Van Market Insights into Light Commercial Vehicle Segment by 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

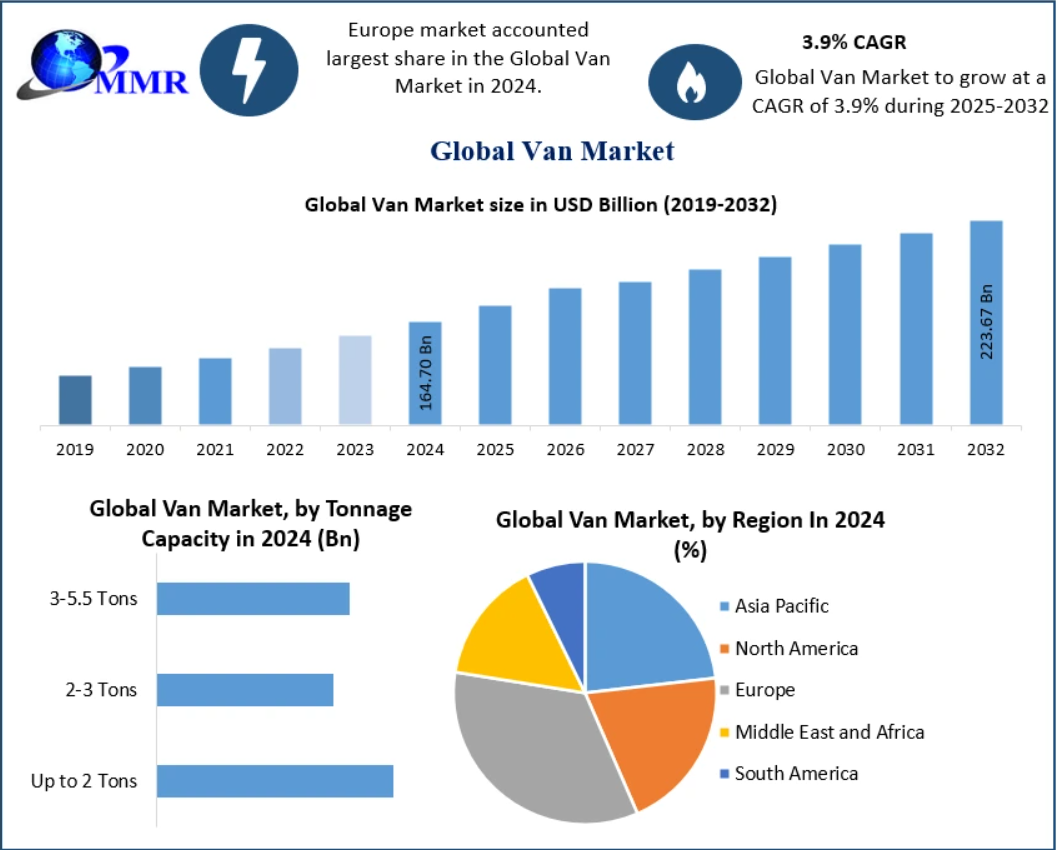

The global Van Market, valued at USD 164.70 billion in 2024, is projected to reach nearly USD 223.67 billion by 2032, growing at a CAGR of 3.9% during the forecast period. Vans, known for their versatile applications from passenger transport to last-mile delivery, are becoming increasingly critical amid booming e-commerce and tightening emission regulations. The market includes a wide variety of vehicle types, including internal combustion engine vans, hybrid, plug-in hybrid, and battery-electric models.

Gain a Competitive Edge – Access Market Insights Through the Sample Link @https://www.maximizemarketresearch.com/request-sample/167094/

Market Dynamics

Stringent CO2 Regulations Driving Electrification

The European legislative proposal to amend Regulation 2019/631 is expected to significantly reshape the van industry. By 2030, CO2 emissions for new vans must be 50% lower than in 2023, with a target of 100% reduction (zero-emission) by 2035. This push is accelerating OEM investments in battery-electric and hybrid van technologies.

Growth in Commercial Van Demand

According to the National Truck Equipment Association (NTEA), commercial van sales have risen consistently, climbing 56.7% from 2013 to 2019. Manufacturers have expanded offerings across various body types, weights, and drivetrains, while equipment providers have developed specialized gear for these vehicles. This trend has unlocked new market opportunities in segments such as mobile air compressors and customized cargo fittings.

Segmentation Analysis

By Propulsion Type

Battery Electric Vehicles (BEVs) are the fastest-growing segment.

In July 2023, BEV registrations rose by 21.2%, with a total of 8,865 units registered in the year, representing a 55.7% Y-o-Y increase. OEMs continue launching electric vans with extended range and quick charging, boosting adoption.

Other propulsion types include Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), Internal Combustion Engine (ICE), and Gasoline vans.

By Application (Tonnage Capacity)

The 2–3 Tons segment dominates, particularly vans between 2.5–3.5 tonnes, which make up 65.8% of registrations.

These vans are crucial for e-commerce logistics, short-haul deliveries, and construction activities.

The 3–5.5 Tons and Up to 2 Tons segments cater to smaller commercial operations and school transportation needs.

By End-Use

Commercial use accounts for the lion’s share, driven by rising logistics demand, mobile services, and fleet upgrades.

Personal use is gradually rising, especially with luxury and camper van trends in North America and Europe.

Unlock more insights—request a free sample report now :https://www.maximizemarketresearch.com/request-sample/167094/

Regional Insights

Europe – Leading the Market with 56% Share in 2024

Europe's van market is robust, driven by e-commerce, logistics, and eco-friendly mobility.

In 2022, European e-commerce revenue grew by 10% compared to 2020, demanding higher van utilization for last-mile delivery.

Road transport dominates freight movement in Europe, accounting for 75% of inland freight—rising to 90% in some countries.

Key OEMs like Mercedes Benz, Volkswagen Group, Ford, and new players like Arrival Electric are fueling innovation and adoption of electric vans.

North America

The U.S. sees strong van demand in utilities, construction, and e-commerce, with Ford and GM playing major roles.

European-designed commercial vans have found renewed interest in the American market post-recession, driven by versatility and fuel economy.

Asia Pacific

Fast growth is expected due to expanding infrastructure, urbanization, and automotive electrification policies in China, India, and Southeast Asia.

Key Market Players

Leading OEMs in the Van Market include:

Toyota

Volkswagen Group

Hyundai / Kia

General Motors (GM)

Ford Motor Company

Nissan

Honda

FCA (Fiat Chrysler Automobiles)

Renault

Groupe PSA

Suzuki

SAIC Motor

Daimler

BMW

Geely

Changan

Mazda

Dongfeng Motor

BAIC

Mitsubishi

Competitive Strategies

Renault launched the new Kangoo Van in 2022 and opened bookings for Traffic Van in March 2022, targeting high functionality and ADAS (Advanced Driver Assistance Systems).

Volkswagen-Ford Alliance (est. 2020) focuses on shared R&D for light commercial vehicles, electric vans, and autonomous driving.

FedEx-BrightDrop Partnership underscores the growing trend of logistics providers turning to OEMs for customized EV delivery fleets.

Outlook

The Van Market is on a transformational journey—from combustion to electrification, and from basic cargo movers to smart, tech-integrated, multifunctional vehicles. Government mandates, consumer demand for green transport, and the growth of e-commerce are aligning to create a fertile environment for innovation and expansion.

By 2032, vans will not only remain crucial for urban freight and passenger transport but will also represent a significant piece in the broader decarbonization puzzle of global mobility.

Report Scope:

Feature Details

Base Year 2024

Forecast Period 2025–2032

Market Size (2024) USD 164.70 Billion

Market Size (2032) USD 223.67 Billion

CAGR (2025–2032) 3.9%

Segmentation Tonnage Capacity, Propulsion Type, End Use

Regions Covered North America, Europe, Asia Pacific, ME&A, South America

More Trending Reports:

Headlight Market https://www.maximizemarketresearch.com/market-report/headlight-market/166868/

Electric Drive Mining Truck Market https://www.maximizemarketresearch.com/market-report/electric-drive-mining-truck-market/183384/

Final Thought

With increasing investments in electric mobility, rising commercial applications, and government regulations supporting zero-emission vehicles, the global van market is shifting gears—and fast. Manufacturers who adapt to this evolution with electrified, connected, and customized offerings will steer ahead in the competitive race toward 2032.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.