What is Copy Trading and How Does It Work?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

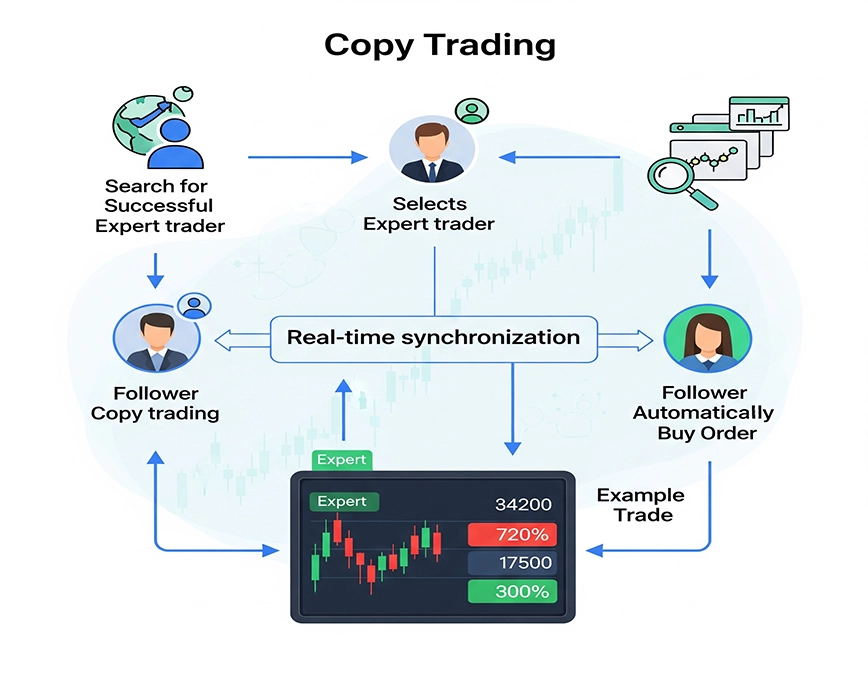

If you've ever wanted to participate in the stock market but have felt intimidated by all of the technical charts, analysis, and jargon that come with market participation, copy trading may be for you. Copy trading is a way for you to automatically copy the trades of professional traders. Or simply put, whenever the expert trader makes a trade, your account will simply copy the same trade, without you doing anything manually.

Copy trading is becoming more popular in India and globally, particularly for novice investors, working professionals, and people that don't have the time to actively monitor the market on a day-to-day basis. In the copy trading method, it reduces the pressure of having to participate in stock trading without needing to devote time and effort to extensive research or continuous implementations of decision-making processes.

Let's look at how copy trading works, as well as why it may be the best thing for new traders to do.

What is copy trading?

Copy trading is a type of automated trading whereby a trader (also referred to as the follower or investor) copies the trades of an experienced trader (also referred to as the signal provider or master trader). The concept is simple: when the expert profits, you profit from the same trade in real time.

Copy trading is often used when trading in forex, stock trading, crypto trading, and even commodity trading.

Let’s say you have a successful trader who is buying shares of Infosys. If you are connected on a copy trading platform, you will instantly have the same trade (the buying of shares of Infosys) made in your account—no monitoring the charts, no placing an order yourself!

How Copy Trading Works?

Copy trading works using copy trading software or a platform, which connects your trading account to a professional trader's account, and then the process generally goes as follows:

1. Pick a Copy Trading Platform

First, you will need to register for a copy trading platform in India that you can trust. You can (for copy trading purposes) use the copy trading platform of brokers like Angel One or Zerodha (it is preferable to use a third party for the copy trading), or you can use a copy trading platform run by Combiz Services Pvt Ltd.

2. Connect Your Trading Account

You will have to connect your trading (demat) account to the copy trading software, and typically, this connection is through broker APIs (application programming interfaces).

3. Select a Signal Provider

You will have a range of traders (signal providers) displayed in a list to you so that you can see their performance, strategy, risk, and history and compare them.

4. Define Investment Size

You will define an amount of money to copy trade from a trader of your choice. Your trade size will be proportional to your investment.

5. Automatic trading will commence.

Once you have set everything up, the copy trading provider will automatically copy trades from the signal provider account into your trading account as new trades occur when the signal provider accounts for the trades in their account.

Advantages of Copy Trading

✅ Simple for Beginners

There is no need to be a genius or learn complicated trading strategies. It is excellent for people who are new to the market.

✅ Time Efficient

No sitting in front of a screen and following the market. The system does all the work for you automatically.

✅ Real-Time Execution

You trade in real-time, which means your trades will mirror the thoughts of traders in real-time.

✅ Transparency

Most platforms will have the performance history of expert traders, which will help you make an informed decision.

✅ Diversification

You can copy several traders from different assets such as stocks, forex, and crypto, which means you can diversify your risk.

Is Copy Trading Legal in India?

Yes. Copy trading is legal in India on approved Indian platforms with Indian-registered brokers. The copy trading software should be using only broker-approved APIs and following SEBI regulations. For example, Combiz Services Pvt Ltd offers legal copy trading software in India that offers options with brokers like Alice Blue, Zerodha, etc.

Best Copy Trading Platform in India

Here are some popular and most reputed copy trading platforms in India...

- Combiz Copy Trading Software—Popular for features like master-child auto copy, broker integration, and real-time sync.

- MetaConnector—for TradingView to MT4/MT5 automatic trade signal processing.

- Third-party APIs for brokers like Angel One, Alice Blue, Kotak Securities, etc.

Whenever you choose a platform, make sure it has reporting, override, and connection to multiple accounts.

Copy Trading Risks Involved

Although copy trading is simpler than manual trading, it is not risk-free. A few considerations:

You can still lose money if the strategy of the expert trader fails.

There’s no proven correlation between success and history; past performance does not guarantee future success.

When used without due diligence and vigilance, the reliance on automation can be a dangerous thing.

Start out small, invest in several different traders, and use copy trading software that has risk management features.

How to Choose a Copy Trading Provider

Here are a couple tips before you select a provider/platform:

- Make sure they are SEBI compliant or work with registered brokers.

- Seek out transparent performance records on their traders.

- Make sure the platform has broker integrations like Angel One, Zerodha, Alice Blue, etc.

- Use platforms like Combiz Services Pvt Ltd, which offer custom copy trading and have complete automation and flexibility.

- Don't be afraid to ask for a free demo or trial to utilize their platform.

Conclusion

Copy trading can be a game changer for new and busy traders in India. The hardest part of trading is trying to get a good setup; copy trading makes it easy to learn and earn at the same time. By using the appropriate copy trading platform, trustworthy signal providers, and a little due diligence, you can create a passive income flow from the stock market.

If you are serious about making your wealth grow in the stock market but are wasting time or do not have the experience, give copy trading a try. It might just end up being the fast-track route you have been looking for in your trading journey.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.