Why Loans Against Mutual Funds Are a Smart Alternative to Personal Loans

Life doesn’t always give you a heads-up. Maybe there’s a medical emergency, your child’s school fees are due, or your business needs a quick infusion of cash. In these moments, a personal loan often seems like the quickest way out.

✍️ Many investors overlook expense ratios, but they directly affect returns. Learn why low-cost mutual funds, especially index funds, are gaining traction among savvy investors worldwide.

It’s easy to understand why. Personal loans are everywhere, and applying for one feels familiar. But what if there’s a better option? One that doesn’t involve paying high interest or touching your long-term investments?

If you’ve been investing in mutual funds, you already have a smarter way to handle short-term financial needs. It’s called a Loan Against Mutual Funds, or LAMF.

What is a Loan Against Mutual Funds?

Here’s the simple idea. You pledge your mutual fund units to a lender. In return, they offer you a loan based on how much your mutual funds are worth at the moment. This value is based on the NAV, or net asset value, of your units.

You don’t have to sell anything. You stay the owner. But your funds are temporarily marked as collateral until the loan is repaid.

Why Not Just Take a Personal Loan?

Personal loans are unsecured, which means the lender has no backup if you default. Because of that risk, interest rates tend to be high. In most cases, it ranges from 15 to 24 percent.

A loan against mutual funds is a secured loan. The lender has something to hold as a guarantee, which usually results in lower interest rates, faster approval, and less dependence on your credit score.

If your credit score isn’t perfect, or if you want to avoid paying high interest for short-term needs, LAMF can be a much better fit.

Why Borrowing Against Mutual Funds Makes Sense

Lower interest - LAMFs typically come with interest rates between 10 and 13 percent. That’s significantly lower than most personal loans.

You don’t have to sell your investments - Selling mutual funds during a market dip can lead to losses. With LAMF, you can access money without disturbing your portfolio.

Quick disbursal - If your mutual funds are in demat form or registered through platforms like CAMS or KFintech, you can apply online and often get the money within hours.

Flexible borrowing - Depending on the value of your mutual funds, you can borrow up to 50 to 75 percent of their NAV. Some lenders offer the loan as an overdraft, so you pay interest only on the amount you use.

Minimal impact from your credit score - Because the loan is backed by your mutual funds, lenders are more flexible even if your credit score isn’t great.

When Should You Consider It?

LAMF is useful when you need funds urgently but don’t want to redeem your mutual fund investments. It works well if you’re self-employed or run a business and prefer a flexible credit option. It’s also ideal if you’re looking to avoid the high interest and formalities of traditional personal loans.

What Kinds of Mutual Funds Are Accepted?

This depends on the lender, but generally:

- Equity mutual funds are accepted, though they may have a slightly lower loan-to-value ratio

- Debt funds are more stable, so lenders often offer a higher LTV

- Hybrid or balanced funds are accepted on a case-by-case basis

Having your mutual funds in demat form or linked with CAMS or KFintech simplifies the process a lot.

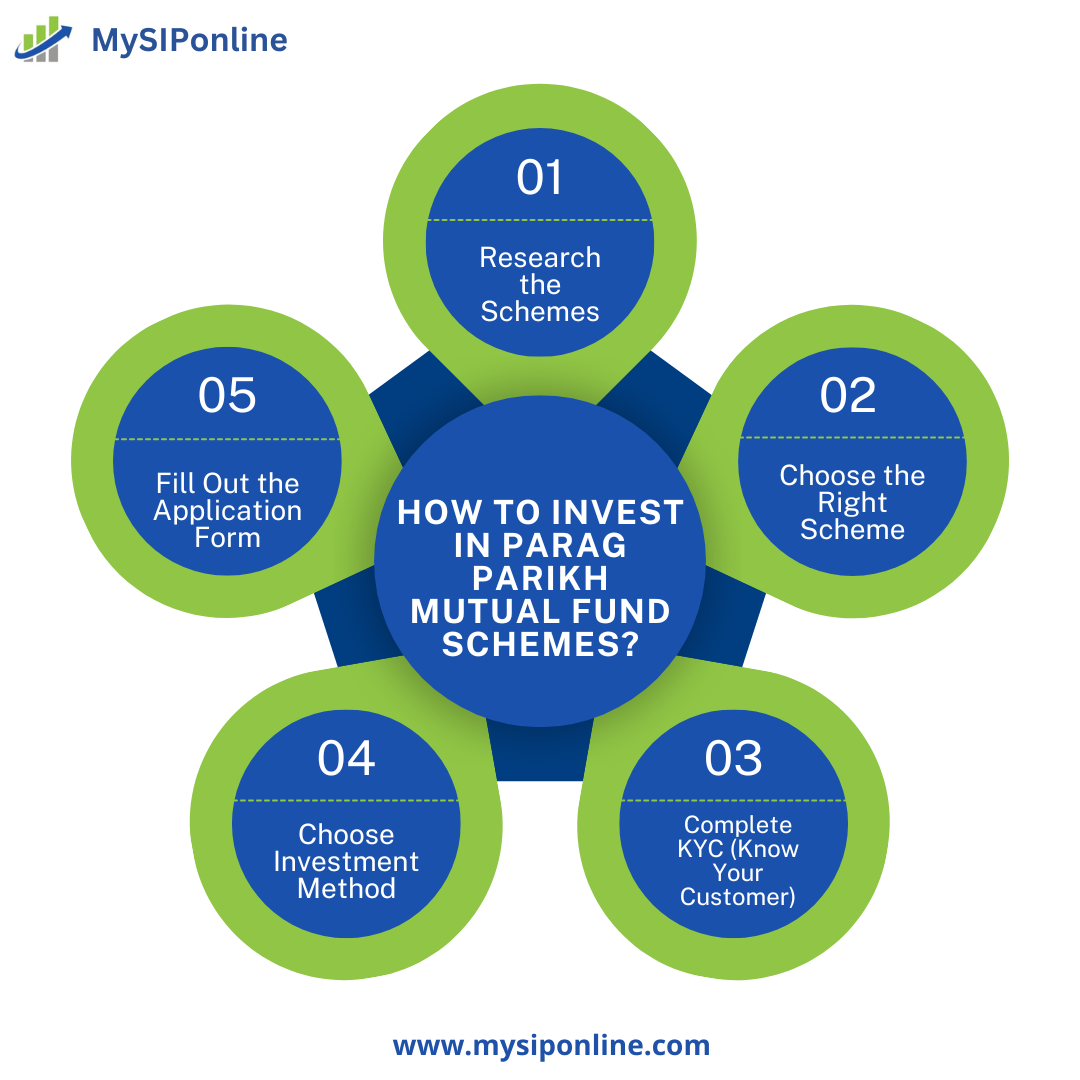

How to Apply

The process is usually simple:

- Choose a lender. This can be a bank, NBFC, or a fintech platform.

- Share your mutual fund folio number or demat account details.

- The lender checks the value of your holdings and offers a loan amount.

- Complete KYC and sign the agreement, often digitally.

- If everything looks good, the money is disbursed, sometimes on the same day.

Once the loan is issued, your mutual fund units are marked as lien, which means you can’t redeem them until the loan is repaid.

Things to Keep in Mind

If the market drops sharply and your mutual fund value falls, the lender might ask for additional security or a partial repayment. Also, if you miss repayments, they may sell the pledged units to recover the money. If your loan is structured as an overdraft, you’ll only pay interest on the amount you’ve actually used, which can help you save even more.

Conclusion

A loan against mutual funds can be a smart way to raise money without disturbing your investment goals. It’s often cheaper, faster, and less stressful than a personal loan. Before rushing into an expensive loan, take a look at your mutual fund portfolio. If it’s doing well and you don’t want to sell, LAMF might just be the financial breathing room you need.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.