Australia Biosimilar Market Projected to Reach USD 5.51 Billion by 2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

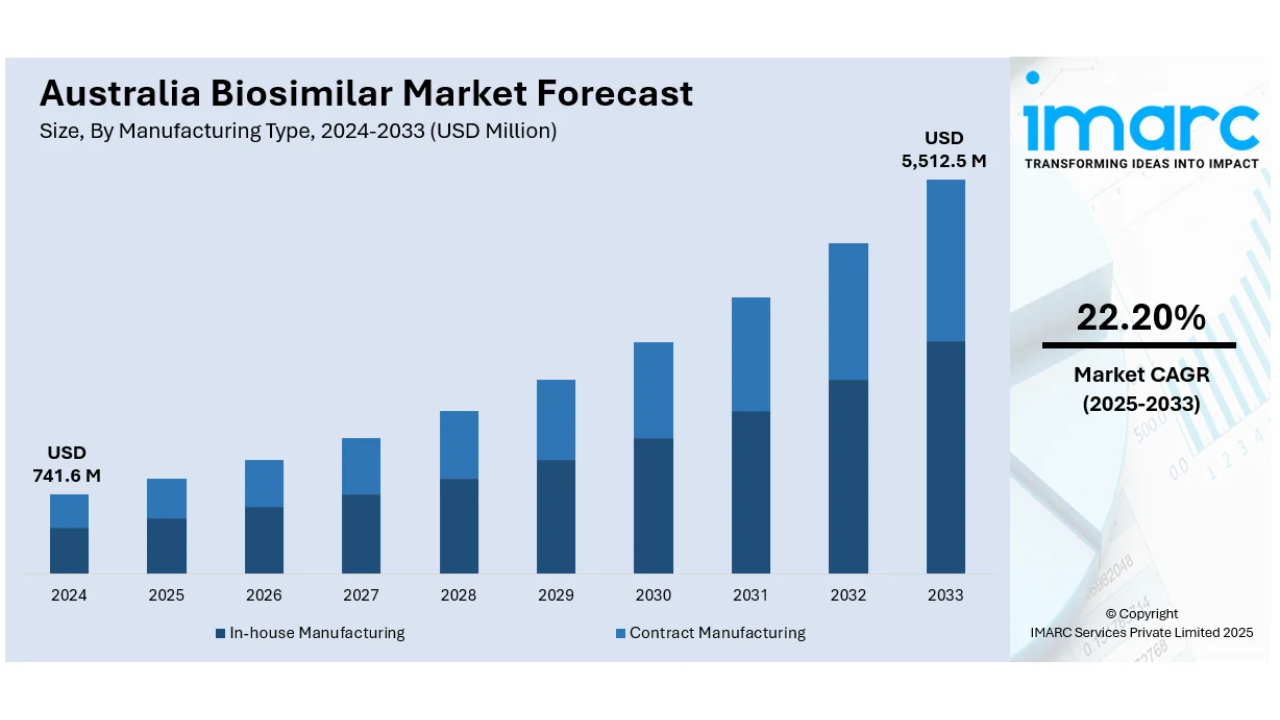

The latest report by IMARC Group, titled “Australia Biosimilar Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033”, offers a comprehensive analysis of the biosimilar market's growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia biosimilar market size reached USD 741.6 million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,512.5 million by 2033, exhibiting a growth rate (CAGR) of 22.20% during 2025–2033.

Base Year: 2024

Market Size in 2024: USD 741.6 Million

Forecast Years: 2025–2033

Market Forecast for 2033: USD 5,512.5 Million

CAGR: 22.20% (2025–2033)

Historical Period: 2019–2024

Australia Biosimilar Market Overview

The biosimilar market in Australia is witnessing robust growth, fueled by favorable government initiatives, inclusion of biosimilars under the Pharmaceutical Benefits Scheme (PBS), and rising demand for affordable biologic alternatives. Government efforts to promote cost-effective treatments have expanded access to high-quality biologics and stimulated market competition. This supportive landscape is accelerating the adoption of biosimilars among healthcare professionals and patients, contributing to improved treatment accessibility and reduced healthcare expenditure nationwide.

Request For Sample Report:

https://www.imarcgroup.com/australia-biosimilar-market/requestsample

Australia Biosimilar Market Trends and Drivers

The Australian biosimilar market is evolving rapidly, driven by strong regulatory backing and strategic reimbursement policies. Central to this growth is the government’s commitment to affordable biologic therapies, which has paved the way for increased competition and expanded access through the Pharmaceutical Benefits Scheme (PBS). The Pharmaceutical Benefits Advisory Committee (PBAC) plays a pivotal role by assessing biosimilars for subsidization, ensuring cost-effectiveness without compromising quality. A notable development occurred in May 2024, when PBAC recommended Amgen’s Wezlana—the first ustekinumab biosimilar—for PBS listing, following its approval by the Therapeutic Goods Administration (TGA) in January 2024. Approved for multiple inflammatory conditions such as Crohn’s disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis, Wezlana’s listing marked a significant shift from reliance on expensive originator biologics to more accessible biosimilar options. This milestone has catalyzed wider biosimilar adoption, increased confidence among healthcare providers, and encouraged new market entrants. Ongoing PBAC support and more streamlined PBS pathways are expected to further strengthen the market, enhancing availability, affordability, and competition across Australia’s healthcare landscape.

Why Biosimilars Matter in the Australian Healthcare Landscape

Biosimilars are biological medicines that are highly similar to an already approved reference biologic product. They offer the same therapeutic benefits but at significantly lower costs. Given the rising burden of chronic diseases—such as cancer, diabetes, and autoimmune disorders—the affordability of biosimilars makes them critical to expanding healthcare access.

Australia’s public healthcare system, especially through the Pharmaceutical Benefits Scheme (PBS), plays a key role in enabling the uptake of such treatments. Biosimilars offer the potential to save millions in public spending, while increasing availability of therapies to a wider population.

What’s Fueling This Growth?

1. Strong Government Support & PBS Integration

A major driver for biosimilar adoption in Australia is its national reimbursement strategy. Through the PBS, the government subsidizes a wide range of medications, including biosimilars. One notable regulatory body, the Pharmaceutical Benefits Advisory Committee (PBAC), evaluates the cost-effectiveness of drugs before they are listed.

A recent example includes Amgen’s Wezlana, the first biosimilar to ustekinumab. In January 2024, it was approved by the Therapeutic Goods Administration (TGA), and by May 2024, it was recommended for PBS listing by PBAC. Indicated for Crohn’s disease, plaque psoriasis, and psoriatic arthritis, Wezlana now provides a lower-cost alternative to its originator product—marking a milestone in expanding access to essential biologics.

This successful pathway not only encourages more developers to enter the Australian market but also reinforces confidence in the quality and safety of biosimilars.

2. Growing Awareness and Acceptance

Healthcare providers and patients are increasingly aware of biosimilars as safe, effective, and economically sensible alternatives to expensive biologic treatments. Education campaigns and medical training initiatives have helped reduce skepticism around switching to biosimilars. As familiarity grows, prescription rates are expected to rise across both public and private healthcare sectors.

Australia Biosimilar Market Segmentation:

1. By Molecule:

• Infliximab

• Insulin Glargine

• Epoetin Alfa

• Etanercept

• Filgrastim

• Somatropin

• Rituximab

• Follitropin Alfa

• Adalimumab

• Pegfilgrastim

• Trastuzumab

• Bevacizumab

• Others

2. By Indication:

• Auto-Immune Diseases

• Blood Disorders

• Diabetes

• Oncology

• Growth Deficiency

• Female Infertility

• Others

3. By Manufacturing Type:

• In-house Manufacturing

• Contract Manufacturing

4. By Region:

• New South Wales

• Victoria

• Queensland

• South Australia

• Western Australia

• Tasmania

• Northern Territory

• Australian Capital Territory

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-biosimilar-market

Australia Biosimilar Market News:

• May 2024: Amgen’s Wezlana, the first ustekinumab biosimilar, was recommended by the Pharmaceutical Benefits Advisory Committee for listing under the Pharmaceutical Benefits Scheme.

• January 2024: The Therapeutic Goods Administration approved Wezlana for multiple indications, including Crohn’s disease and plaque psoriasis.

Key Highlights of the Report:

1. Market Performance (2019–2024)

2. Market Outlook (2025–2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current, and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=31900&flag=E

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients across all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91-120-433-0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.