Can I Deduct a Reverse Osmosis System for My Business?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Introduction

Water quality is crucial for businesses, especially those in the food, beverage, and healthcare industries. Many companies invest in reverse osmosis (RO) systems to ensure clean and safe water. But can I deduct a reverse osmosis system for my business? Understanding tax deductions for business expenses can help you maximize savings while ensuring high water quality.

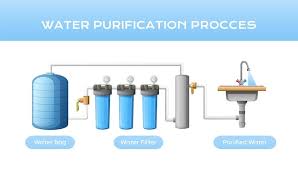

What Is a Reverse Osmosis System?

A reverse osmosis system is an advanced water filtration system that removes contaminants, improving water purity. Many businesses use RO systems for various applications, such as:

- Providing high-quality drinking water for employees and customers

- Maintaining water purity in manufacturing processes

- Enhancing equipment longevity by preventing mineral buildup

Are Reverse Osmosis Systems Tax Deductible?

Yes, in many cases, businesses can deduct the cost of a reverse osmosis system as a business expense. The IRS allows deductions for necessary business expenses that contribute to operational efficiency.

Qualifying Criteria for Deduction

To qualify for a tax deduction, an RO system must meet the following criteria:

- Ordinary and Necessary – The expense must be common and appropriate for your industry.

- Business-Exclusive Use – The system should primarily benefit business operations.

- Capital or Operating Expense – It may be a deductible operating cost or a depreciable asset.

How to Deduct a Reverse Osmosis System for Your Business

Depending on your business structure and accounting methods, you may deduct an RO system in different ways:

1. Section 179 Deduction

Under Section 179 of the IRS tax code, businesses can deduct the full cost of qualifying equipment purchases, including water filtration systems, in the year of purchase rather than depreciating over time.

Eligibility for Section 179 Deduction:

- The system must be used for business purposes more than 50% of the time.

- The total cost of qualifying purchases must be within the IRS annual limit.

2. Depreciation Deduction

- If the RO system does not qualify for a full Section 179 deduction, businesses can depreciate the cost over time using the Modified Accelerated Cost Recovery System (MACRS).

- Generally, water filtration systems fall under five- or seven-year property classifications.

- Depreciation spreads the cost across multiple tax years, reducing taxable income annually.

3. Operating Expense Deduction

If the RO system is leased or regularly maintained, related costs may qualify as operating expenses and be deductible under business utility expenses.

Industries That Benefit from Reverse Osmosis System Deductions

Certain industries commonly rely on high-quality water and can benefit from tax deductions for reverse osmosis systems:

Restaurants and Food Service

- Ensures clean water for cooking, beverage preparation, and ice machines.

- Protects equipment from mineral buildup, reducing maintenance costs.

Healthcare and Pharmaceuticals

- Provides purified water for medical applications, laboratories, and dialysis centers.

- Meets compliance standards for water purity in healthcare facilities.

Manufacturing and Industrial Operations

- Prevents contamination in product manufacturing.

- Enhances longevity of machinery by reducing scale buildup.

Hospitality and Office Spaces

- Improves drinking water quality for guests and employees.

- Reduces reliance on bottled water, leading to cost savings.

- Steps to Claim a Tax Deduction for Your Reverse Osmosis System

To ensure a smooth tax deduction process, follow these steps:

1. Determine Eligibility

Confirm that the system qualifies as a business expense and is used primarily for business purposes.

2. Choose the Right Deduction Method

Decide whether to claim the expense under Section 179, depreciation, or operating expenses.

3. Keep Detailed Records

Maintain receipts, installation invoices, and maintenance agreements to support your deduction claim.

4. Consult a Tax Professional

Tax laws frequently change, and consulting an accountant ensures compliance and maximized deductions.

Common Questions About RO System Deductions

Can I Deduct Installation Costs?

Yes, installation costs are typically deductible when considered part of the business expense.

What If My Business Uses a Home Office?

For home-based businesses, the deduction may be limited to the percentage of space used exclusively for business operations.

Are Maintenance and Repairs Deductible?

Yes, ongoing maintenance and filter replacements are considered ordinary business expenses and can be deducted.

Benefits of Investing in a Reverse Osmosis System for Your Business

Beyond tax deductions, investing in a high-quality RO system offers several advantages:

Cost Savings – Reduces expenses on bottled water and equipment maintenance.

Health and Safety Compliance – Meets industry-specific water purity standards.

Improved Equipment Lifespan – Prevents scale and mineral buildup in machinery.

Eco-Friendly Solution – Reduces plastic waste by minimizing bottled water consumption.

Conclusion

So, can I deduct a reverse osmosis system for my business? In many cases, yes. Businesses that rely on high-quality water can benefit from tax deductions through Section 179, depreciation, or operating expense deductions. By maintaining proper documentation and consulting a tax professional, businesses can maximize their tax benefits while ensuring superior water quality for operations.

By making a strategic investment in a reverse osmosis system, businesses can improve efficiency, meet industry standards, and enjoy long-term cost savings.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.