Choosing the Right Automated Accounts Payable Solution

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

If you're still relying on spreadsheets and manual processes to manage vendor invoices and payments, it might be time for a change. Businesses today are shifting to automated accounts payable solutions to save time, reduce human error, and boost cash flow visibility. But with so many platforms out there, how do you know which one is right for your business? This blog will guide you through choosing the best accounts payable automation system based on your company’s size, goals, and technology needs—whether you're integrating with NetSuite, looking to outsource accounts payable, or planning to streamline the end-to-end process of accounts payable.

Why Automation Is No Longer Optional

Let’s face it—accounts payable (AP) is often seen as a back-office task, but it directly impacts your vendor relationships, compliance, and financial health. Manual AP processes can lead to:

Missed or duplicate payments

Invoice approval delays

Poor audit trails

High labor costs

Cash flow blind spots

With the right accounts payable automation process, businesses can achieve:

60–80% faster invoice processing

Real-time visibility into liabilities

Improved vendor satisfaction

Better fraud prevention

Scalability for growth

Key Features of an Ideal AP Automation Solution

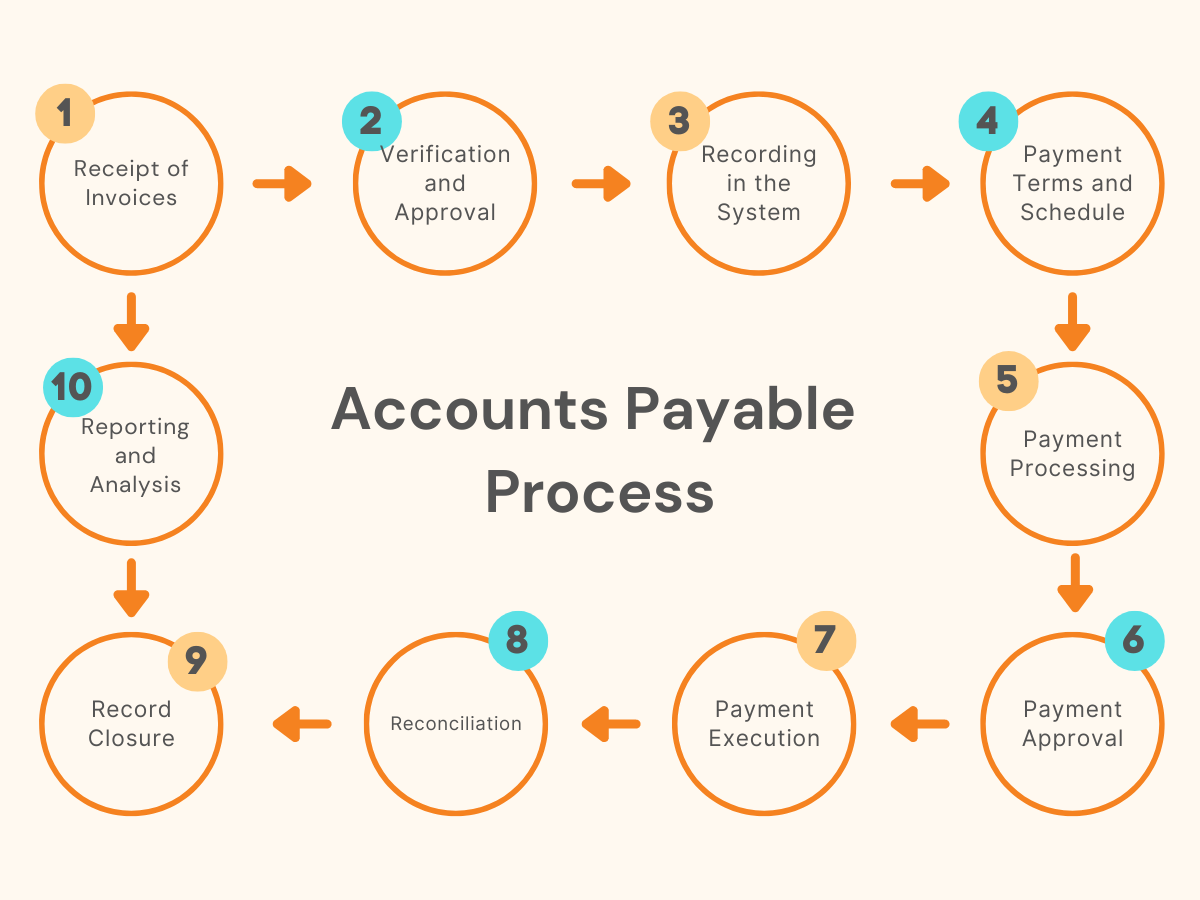

When selecting from various automated accounts payable solutions, you’ll want a platform that covers the end-to-end process of accounts payable, which includes:

Invoice Capture and Digitization

Scan paper invoices or ingest e-invoices via email

Use OCR (optical character recognition) to extract data

Invoice Matching and Validation

Match invoices against purchase orders (POs) and receipts

Flag discrepancies automatically

Approval Workflow

Route invoices to the right stakeholders

Automate escalations and alerts

Payment Execution

Integrate with banks or use built-in payment options

Handle ACH, wire transfers, virtual cards, and checks

Reconciliation and Reporting

Sync with ERP for accounting entries

Generate audit-ready reports and dashboards

Considering NetSuite? Look for Certified Integrations

If your business already uses NetSuite ERP, choosing a solution with NetSuite accounts payable automation capabilities is a smart move. Certified integrations ensure seamless data flow and eliminate double entries.

Features to expect:

Real-time sync of vendor records, GL codes, and payment statuses

Automatic syncing of invoice approvals and payment records

NetSuite-native dashboards for AP aging, due payments, and budget controls

Platforms like Tipalti, Bill.com, and Stampli are well-known for their robust NetSuite integrations.

When to Outsource Accounts Payable

If your business lacks internal bandwidth or wants to reduce operational costs, outsource accounts payable services may be the right fit. Outsourcing combines the benefits of automation with human expertise for error-checking, customer service, and strategic advice.

Benefits of AP outsourcing:

Access to skilled financial professionals

Lower overhead costs

24/7 invoice processing and vendor support

Enhanced fraud detection and compliance

Scalable services for seasonal or rapid-growth companies

Providers like AvidXchange offer end-to-end AP outsourcing, including data entry, payment scheduling, and reporting.

Questions to Ask Before Choosing a Solution

To narrow down your options, ask yourself:

What’s my invoice volume?

High volumes demand more robust automation with bulk upload and multi-layer approval capabilities.

Do I need NetSuite or ERP integration?

If yes, prioritize platforms with certified connectors and real-time sync.

Do I operate internationally?

Look for multi-currency support, tax compliance (GST, VAT), and language localization.

Do I want to keep AP in-house or outsource?

Some businesses prefer to control AP internally, while others benefit from outsourcing.

What’s my budget?

Automation solutions vary widely in pricing. Consider cost per invoice, user licenses, and implementation fees.

Top AP Automation Platforms in 2025

Here are a few trusted names to explore, based on your business type and needs:

🔹 Tipalti

Best for global payments and scaling finance teams

NetSuite integration

Tax compliance tools

Supplier portal

🔹 Bill.com

Ideal for small to mid-sized businesses

Simple interface

Approval workflows

Mobile access

🔹 Stampli

Great for collaboration-heavy teams

AI assistant “Billy” for invoice capture

Real-time comments and audit trails

🔹 AvidXchange

Best for AP outsourcing

Handles invoice receipt, approval, and payment

Scales with growing organizations

🔹 Yooz

Excellent for advanced automation

Smart OCR

Custom workflows

Over 250 ERP integrations

Local Compliance & Vendor Relations

Your AP platform should support:

Local tax compliance (e.g., GST in India, VAT in the UK, Form 1099 in the US)

Multi-currency transactions

Region-specific invoice formats

Local language interfaces for vendor portals

A solution that accounts for geo-specific needs helps you reduce payment delays, stay compliant, and build trust with vendors globally.

Implementation Tips for a Smooth Transition

Switching to an automated solution can feel overwhelming—but with the right approach, it can be smooth and rewarding.

Step-by-Step Guide:

Audit your current AP process

Identify where delays or bottlenecks happen

Define your goals

Reduce DSO? Improve approval speed? Cut costs?

Involve stakeholders early

Get input from finance, procurement, and IT

Choose your provider carefully

Look for strong references, integration support, and customer success teams

Test with a pilot group

Start with one department or vendor type before full rollout

Train and go live

Provide onboarding sessions for users and assign internal champions

Final Thoughts: AP Automation Is a Growth Enabler

Choosing the right accounts payable solution isn’t just about eliminating paper or speeding up approvals—it’s about unlocking the time, data, and control you need to grow. Whether you're seeking full accounts payable automation, ERP integration, or to outsource accounts payable, 2025 is the year to modernize.

With the right system in place, your finance team becomes more agile, your vendors get paid faster, and your cash flow becomes easier to manage. In short, AP automation transforms a cost center into a strategic advantage.

Ready to Automate?

At KMK Ventures, we specialize in helping businesses streamline their AP operations through automated accounts payable solutions tailored to your needs. Whether you want to integrate with NetSuite, improve visibility, or fully outsource, our team can guide you through the right strategy.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.