Top Accounts Payable Outsourcing Services to Reduce Operational Costs

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Is your accounts payable process eating up more time, money, and resources than it should? You’re not alone. Many small and medium-sized businesses struggle with manual invoice processing, payment delays, and compliance issues leading to rising operational costs. That’s why more finance leaders are turning to accounts payable outsourcing services as a strategic way to streamline operations and reduce expenses. But with so many providers in the market, how do you know which outsourced accounts payable services are right for your business? In this blog, we’ll walk you through what to look for, top features of leading providers, and how outsourcing accounts payable services can help lower costs while boosting efficiency.

Why Businesses Outsource Accounts Payable Services

The need for accuracy, compliance, and speed in accounts payable operations is higher than ever. However, managing AP in-house often leads to:

Manual data entry errors

Late or duplicate payments

Missed early payment discounts

Lack of visibility into cash flow

High overhead for staff and technology

By choosing to outsource accounts payable services, businesses can shift these operational burdens to experienced providers equipped with automation tools, skilled personnel, and streamlined workflows.

So, what’s the result?

✅ Reduced costs

✅ Improved cash flow

✅ Enhanced compliance

✅ Happier vendors

What to Expect from Accounts Payable Outsourcing Services

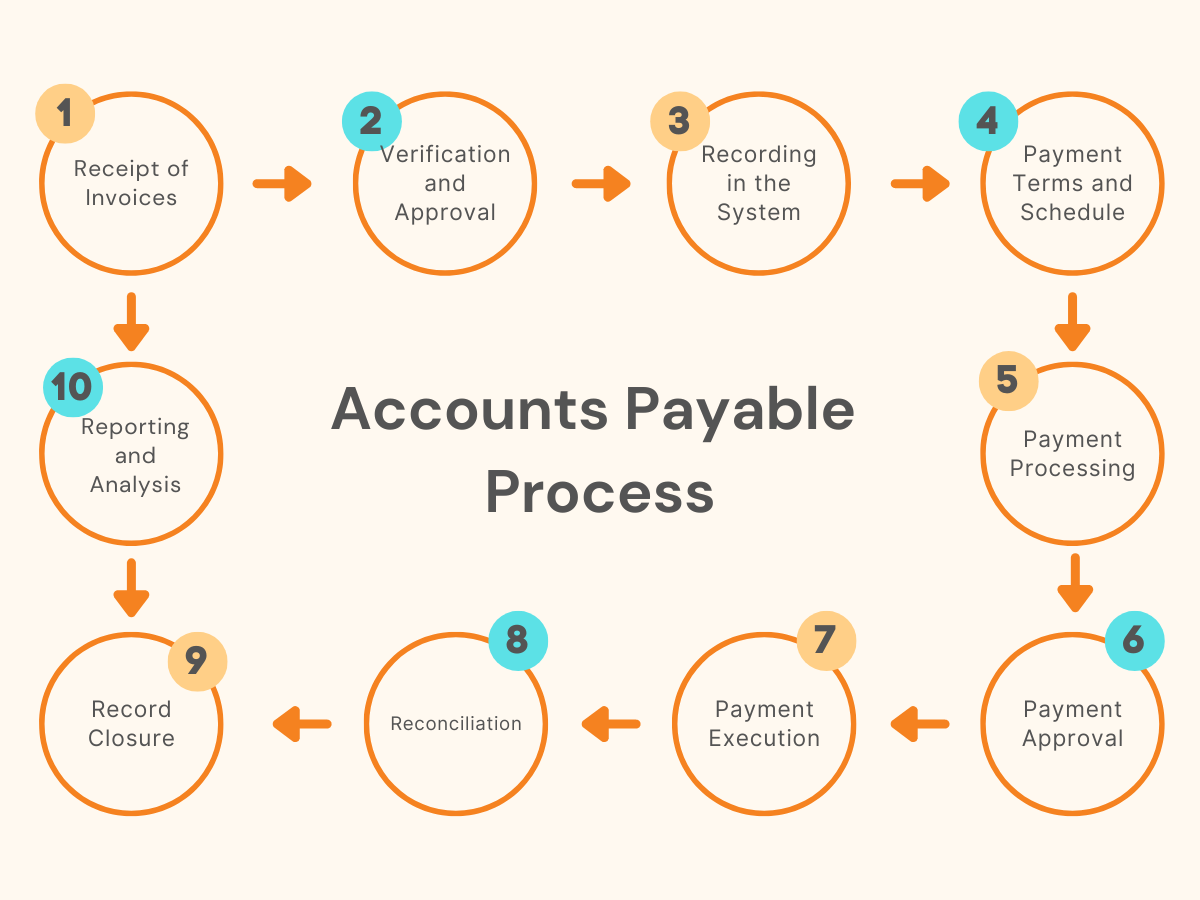

Not all providers are created equal. The best accounts payable outsourcing services go beyond just data entry. They offer a full suite of solutions designed to optimize every stage of the AP process.

Here’s what leading services typically include:

Invoice receipt, scanning & digitization

Two- or three-way matching with POs and receipts

Approval workflow automation

Payment processing (ACH, check, wire transfers)

Vendor management and communication

Real-time reporting and analytics

Regulatory compliance and audit support

These services help eliminate inefficiencies, reduce human error, and ensure you’re in control of your financial operations.

How AP Outsourcing Helps Reduce Operational Costs

Let’s address the big question: How exactly does outsourcing save money?

Here are the most direct ways:

1. Lower Labor Costs

Hiring, training, and retaining in-house AP staff is costly. Outsourcing eliminates these expenses by giving you access to skilled professionals on-demand.

2. Minimized Errors and Penalties

With automation and quality checks, outsourced providers reduce errors that can lead to late fees, duplicate payments, or vendor disputes.

3. Early Payment Discounts

Efficient invoice processing ensures you never miss early payment opportunities that can save 1–3% per invoice.

4. Scalable Infrastructure

Need to scale during peak seasons? Outsourcing providers flex with your needs—no need to invest in additional resources.

5. Reduced Technology Investment

With outsourced accounts payable services, you don’t need to maintain expensive software or hardware. Most providers operate via secure cloud-based platforms.

What to Look for in a Top AP Outsourcing Provider

Before partnering with a service provider, consider the following:

Industry Experience

Choose firms with proven experience in your industry, especially if you deal with complex invoice structures or compliance rules.

End-to-End AP Automation

Ensure the provider supports automation from invoice receipt to final payment, integrated with your ERP system.

Transparent Reporting

You should have access to real-time dashboards, status updates, and detailed reports to track performance and KPIs.

Data Security

Look for providers that adhere to international data protection standards like SOC 2, ISO 27001, or GDPR compliance.

Flexible Service Models

The provider should tailor their offerings—such as full AP outsourcing, hybrid models, or support for specific functions—to match your business needs.

Real-World Use Case: A Mid-Sized Company Saves 30% in AP Costs

A mid-sized logistics company based in the U.S. was handling over 5,000 invoices monthly with a team of four full-time employees. The process involved manual entry, printing checks, and constant vendor calls about payment status.

After switching to outsourced accounts payable services, the company:

Automated 80% of their AP workflow

Reduced invoice cycle time from 12 days to 3 days

Saved 30% in AP processing costs annually

Improved vendor satisfaction by 40%

This is just one example of how outsourcing accounts payable services directly contributes to cost reduction and operational excellence.

Signs It’s Time to Outsource Your Accounts Payable

Still unsure? Ask yourself these questions:

Are we spending too much time on invoice processing and payment approvals?

Are we behind on payments or experiencing frequent vendor issues?

Do we lack visibility into accounts payable performance?

Are we growing faster than our AP team can handle?

Do we need to reduce overhead without sacrificing quality?

If you answered yes to any of the above, it might be time to outsource your accounts payable services.

Conclusion: The Smarter Way to Cut AP Costs

As businesses aim for efficiency and agility, the old way of managing accounts payable just doesn't cut it. From rising costs to compliance risks, managing AP in-house can often slow you down. That’s why choosing the right accounts payable outsourcing services is more than just a financial decision it's a growth strategy. By leveraging expert providers who specialize in AP automation, cloud-based solutions, and regulatory compliance, you not only cut costs but unlock new levels of efficiency and control over your financial operations.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.