How Outsourced Accounts Payable Boosts Efficiency for SMEs

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

For small and medium-sized enterprises (SMEs), managing growth while keeping costs under control is a constant balancing act. One often-overlooked area that consumes valuable time and resources is accounts payable (AP). From handling invoices to managing vendor relationships and ensuring timely payments, AP can quickly become a drain on lean teams. That's why more SMEs are turning to outsourced accounts payable solutions to streamline operations, reduce costs, and improve financial visibility. Outsourcing AP isn’t just for large corporations anymore—it’s a smart, scalable strategy for growing businesses looking to boost efficiency without compromising on quality. In this blog, we’ll explore how outsourced AP drives efficiency for SMEs, the benefits it offers, and how to choose the right solution for your business.

Understanding the AP Burden for SMEs

Accounts payable might seem like a straightforward back-office function, but it comes with a lot of complexity—especially as your business scales. Consider these common challenges SMEs face:

- Manual invoice entry and filing

- Missed or delayed payments

- Poor cash flow visibility

- High risk of errors and duplicate payments

- Time-consuming vendor communication

- Lack of internal controls and audit trails

Most SMEs don’t have large finance teams or access to expensive software. As a result, AP management often becomes a time sink for staff who could be focusing on core business functions like customer service, sales, or operations.

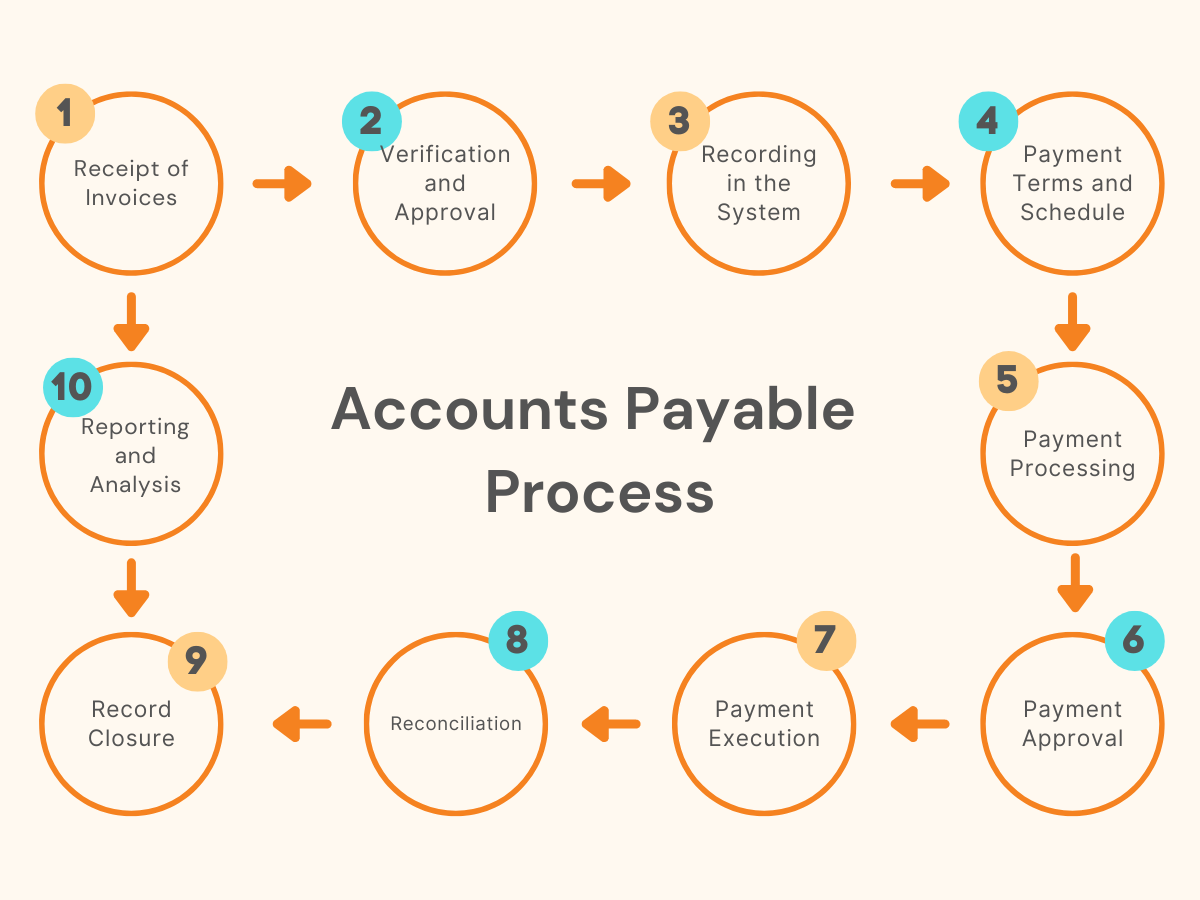

What Is Accounts Payable Outsourcing?

Outsourced accounts payable involves handing over all or part of your AP processes to a third-party provider. This can include:

- Receiving and digitizing invoices

- Matching purchase orders with invoices

- Routing invoices for approval

- Processing payments to vendors

- Handling vendor queries

- Ensuring tax and regulatory compliance

- Generating AP reports and analytics

The goal is to automate and optimize your payables process while reducing the administrative burden on your internal team.

How Outsourcing AP Improves Efficiency for SMEs

Here are the key ways outsourcing accounts payable helps SMEs operate more efficiently:

1. Faster Invoice Processing

Outsourced AP partners use automation tools like OCR (Optical Character Recognition) and AI-driven platforms to capture and process invoices quickly and accurately. This significantly cuts down the time it takes to move an invoice from receipt to payment.

Benefit: Reduce average invoice processing time from days to hours.

2. Reduced Manual Errors

Manual data entry often leads to costly errors—like overpayments, double payments, or missing invoices. Outsourced providers standardize and automate AP processes, which drastically reduces human error.

Benefit: Improve accuracy and reduce rework or reconciliations.

3. On-Time Vendor Payments

Late payments can hurt your vendor relationships and sometimes even lead to penalties or lost early payment discounts. With outsourced AP, payments are scheduled and processed systematically, ensuring vendors are paid on time.

Benefit: Strengthen vendor trust and take advantage of early payment discounts.

4. Improved Cash Flow Visibility

AP outsourcing partners provide real-time dashboards and reports that give SMEs a clearer picture of upcoming liabilities and available cash. This helps business owners plan better and make informed financial decisions.

Benefit: Make better budgeting and forecasting decisions.

5. Scalability Without Overhead

As your business grows, so does the volume of invoices and vendors. Instead of hiring more staff or investing in expensive software, outsourced AP gives you access to enterprise-grade solutions that scale with your needs.

Benefit: Grow without growing your internal finance team.

6. Better Compliance and Controls

Most AP outsourcing providers are experts in local tax regulations, compliance standards, and financial controls. They ensure your payables process aligns with best practices and audit requirements.

Benefit: Reduce risk and stay compliant with tax laws and financial regulations.

7. More Time for Core Business Activities

One of the biggest benefits of outsourcing AP is freeing up your internal team. Instead of spending hours chasing invoices or manually reconciling payments, your staff can focus on strategy, growth, and customer success.

Benefit: Increase productivity and business agility.

Real-Life Example: SME Cuts Invoice Processing Time in Half

A mid-sized IT services company with 60 employees was struggling with slow, error-prone AP processes. Their finance manager was overwhelmed with manual data entry and invoice approvals. By partnering with an AP outsourcing firm:

- Invoice processing time dropped by 50%

- Overpayments were eliminated

- Vendor satisfaction improved

The finance manager could focus on budgeting and forecasting

The company now handles twice the invoice volume without adding any new staff.

How to Choose the Right AP Outsourcing Partner

Not all AP outsourcing providers are created equal. Here’s what SMEs should look for:

SME Experience

Choose a provider that understands the unique needs of small and mid-sized businesses.

Automation Tools

Ensure the provider uses AI, OCR, and cloud-based platforms for faster processing and reporting.

ERP/Accounting Software Integration

Make sure they integrate seamlessly with your existing systems like QuickBooks, Xero, or NetSuite.

Transparent Pricing

Look for a cost-effective pricing model with no hidden fees.

Security and Compliance

Your provider should follow strict data protection policies and be compliant with relevant financial regulations.

When Should SMEs Consider Outsourcing AP?

If any of the following sounds familiar, now is a good time to consider AP outsourcing:

You’re spending too much time on invoice management

Your AP team is overwhelmed

You’ve missed payments or made duplicate payments

You want better cash flow visibility

You're growing quickly and need to scale operations

Final Thoughts: Make Efficiency a Competitive Advantage

For SMEs, every minute and every dollar counts. Outsourced accounts payable is not just a financial decision it’s a strategic one. It allows you to run leaner, smarter operations while improving accuracy, vendor relationships, and compliance. In an increasingly competitive marketplace, efficiency isn’t optional—it’s your edge. And outsourcing your AP function might just be the next big step in powering your growth.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.