Enhancing Your Business with Offshore CPA Back Office and Staffing

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Offshore Staffing for CPA Firms

In today's globalized economy, offshore staffing has emerged as a crucial strategy for CPA firms looking to optimize operations, reduce costs, and enhance service delivery. Leveraging talent from around the world enables firms to maintain competitive advantages and deliver superior client service. This article explores the benefits, implementation strategies, and best practices for integrating offshore staffing into a CPA firm's workflow.

What is Offshore Staffing?

Offshore staffing refers to the practice of hiring employees in foreign countries to perform tasks that are traditionally handled domestically. For CPA firms, this often includes roles in accounting, tax preparation, bookkeeping, and other back-office functions. The primary motivations for offshore staffing include cost savings, access to a broader talent pool, and the ability to scale operations quickly.

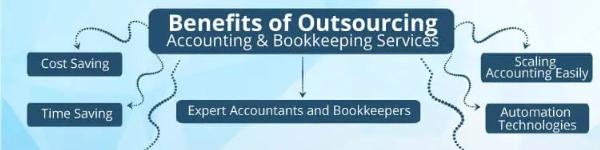

Benefits of Offshore Staffing for CPA Firms

Cost Efficiency

One of the most compelling advantages of offshore staffing is the significant cost savings. Labor costs in countries like India, the Philippines, and Vietnam are substantially lower than in Western countries. By outsourcing routine tasks to offshore teams, CPA firms can reduce overhead expenses and allocate resources more efficiently.

Access to Skilled Talent

Offshore staffing provides access to a vast pool of skilled professionals. Countries with robust educational systems and strong emphasis on accounting and finance education produce highly qualified candidates who can contribute to the firm's success. This access allows CPA firms to tap into specialized expertise that may be scarce or expensive domestically.

Scalability and Flexibility

Offshore staffing offers unparalleled scalability. CPA firms can quickly adjust their workforce size to match seasonal demands, such as tax season, without the long-term commitments associated with hiring full-time domestic employees. This flexibility enables firms to remain agile and responsive to client needs.

Enhanced Focus on Core Activities

By delegating routine and time-consuming tasks to offshore teams, CPA firms can free up their domestic staff to focus on high-value activities. This includes client relationship management, strategic planning, and advisory services, which are crucial for driving growth and client satisfaction.

Implementing Offshore Staffing in Your CPA Firm

Identify Key Functions for Outsourcing

The first step in implementing offshore staffing is to identify which functions are suitable for outsourcing. Commonly outsourced roles in CPA firms include:

Tax Preparation

Bookkeeping

Accounts Payable/Receivable

Payroll Processing

Financial Analysis

Assessing the complexity and volume of these tasks will help determine the best approach for offshore staffing.

Choose the Right Offshore Partner

Selecting the right offshore staffing partner is critical to the success of your outsourcing strategy. Consider factors such as the partner's industry experience, reputation, and the quality of their workforce. Conduct thorough due diligence by reviewing client testimonials, case studies, and industry certifications.

Establish Clear Communication Channels

Effective communication is vital for managing offshore teams. Establish robust communication protocols, including regular video conferences, progress reports, and collaboration tools. Clear communication ensures alignment on project goals, timelines, and quality standards.

Implement Robust Training Programs

To ensure offshore teams meet your firm's standards, implement comprehensive training programs. This includes onboarding sessions, ongoing training, and regular performance reviews. Providing offshore employees with the necessary resources and support will enhance their productivity and integration into your firm.

Ensure Data Security and Compliance

Data security and compliance are paramount when outsourcing financial tasks. Implement stringent security measures, such as encryption, secure file transfer protocols, and access controls. Additionally, ensure your offshore partner complies with relevant regulations, such as GDPR and SOC 2, to protect client data and maintain trust.

Overcoming Challenges in Offshore Staffing

Cultural and Time Zone Differences

Cultural and time zone differences can pose challenges in offshore staffing. To mitigate these, invest in cultural sensitivity training for both your domestic and offshore teams. Additionally, establish overlapping work hours to facilitate real-time communication and collaboration.

Quality Control

Maintaining high-quality standards is essential when outsourcing. Implement rigorous quality control processes, including regular audits, performance metrics, and feedback mechanisms. These measures will help ensure the offshore team's output meets your firm's expectations.

Managing Expectations

Clear and realistic expectations are crucial for a successful offshore staffing arrangement. Set defined goals, deliverables, and timelines from the outset. Regularly review progress and address any issues promptly to maintain alignment and satisfaction.

Offshore Tax Preparation

Streamlining Tax Processes

Offshore tax preparation services enable CPA firms to streamline their tax processes. Offshore teams can handle various aspects of tax preparation, including data entry, tax return preparation, and compliance checks. This allows domestic staff to focus on more complex tax issues and client consultations.

Reducing Turnaround Times

By leveraging offshore teams, CPA firms can significantly reduce tax preparation turnaround times. Offshore staff can work on tax returns during the firm's off-hours, ensuring a continuous workflow and faster delivery of completed returns.

Cost Savings and Efficiency

Outsourcing tax preparation to offshore teams can lead to substantial cost savings. The lower labor costs combined with increased efficiency result in a more cost-effective tax preparation process. These savings can be passed on to clients or reinvested in the firm.

Offshore CPA Back Office

Comprehensive Back-Office Support

Offshore staffing can extend to various back-office functions, providing comprehensive support for CPA firms. This includes accounts payable/receivable management, payroll processing, financial reporting, and other administrative tasks. Offshore teams can handle these functions efficiently, allowing domestic staff to focus on client-facing activities.

Enhancing Productivity

By offloading routine back-office tasks to offshore teams, CPA firms can enhance overall productivity. Domestic staff can dedicate more time to strategic initiatives, client engagement, and business development, driving growth and profitability.

Scalable Solutions

Offshore back-office support offers scalable solutions that can grow with your firm. Whether you need additional support during peak periods or ongoing assistance, offshore teams provide the flexibility to meet your firm's evolving needs.

Conclusion

Incorporating offshore staffing into your CPA firm's operations can deliver significant benefits, including cost savings, access to skilled talent, and enhanced operational efficiency. By carefully selecting the right offshore partner and implementing robust communication and training programs, CPA firms can successfully integrate offshore teams into their workflow. Embracing offshore staffing allows firms to focus on core activities, drive growth, and deliver superior client service.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.