Free Payroll Check Generator – Create Paychecks & Stubs Online for Free

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Managing payroll—calculating wages, taxes, deductions, and creating professional documentation—can be daunting for small business owners, freelancers, and contractors. Traditional payroll software can be expensive and overly complex. That’s why a free payroll check generator like FreePaycheckCreator.com is such a valuable tool. It empowers you to create polished, legally compliant paychecks and stubs in minutes, at no cost.

In this guide, you'll discover how this tool works, why it’s so useful, and why FreePaycheckCreator.com stands out as the best choice for hassle-free payroll.

Why Payroll Checks Matter

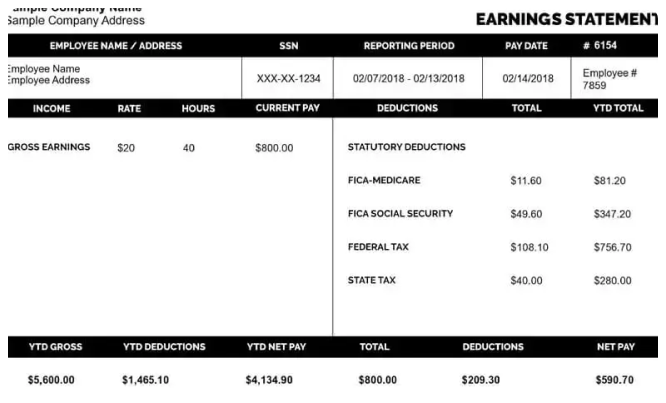

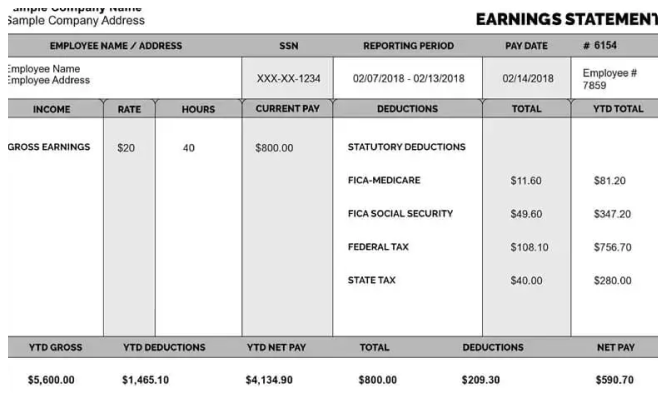

A payroll check accompanied by a stub provides a transparent breakdown of wages and deductions:

- Gross pay (total earnings before deductions)

- Tax withholdings (federal, state, and local)

- Other deductions (such as insurance or retirement contributions)

- Net pay (the final amount received)

These documents serve multiple purposes:

Employees rely on paychecks and stubs as proof of income for loan applications, tax filings, and rental agreements.

Employers use them to demonstrate professionalism, ensure compliance, and maintain accurate payroll records.

According to the U.S. Department of Labor, employers are required to retain detailed payroll records and, in many states, provide employees with clear pay statements.

What Is a Free Payroll Check Generator?

A free payroll check generator is an intuitive online tool that simplifies the payroll process. With FreePaycheckCreator.com, the process is:

Enter company and employee information

(including names, addresses, and pay period dates)

Provide wage and deduction details

(hourly rate or salary, hours worked, taxes, and benefits)

Let the tool compute

It calculates gross pay, withholdings, deductions, and net pay automatically.

Download or print

You receive a professionally formatted paycheck and stub in PDF format

This eliminates the need for spreadsheets, manual math, or costly payroll software.

Who Should Use a Free Payroll Check Generator?

Small Business Owners

Save time and money while producing professional pay stubs and checks for your team.

Freelancers & Contractors

Generate official-looking paychecks and stubs you can use to show income to clients, lenders, or landlords.

Startups & Nonprofits

Operate lean without sacrificing payroll professionalism or compliance.

Employees

Need proof of income? Generate your paycheck stubs for renting, loan applications, or personal records.

Benefits of Using FreePaycheckCreator.com

Time-saving – What used to take hours is now done in minutes.

Accuracy – Automated calculations reduce the risk of errors.

Cost-free – No monthly fees, no trial subscriptions—just free, reliable service.

Professional output – Documents are clean, polished, and suitable for official use.

Anywhere, anytime – Web-based access means you can use it on any device with internet.

Choosing the Right Free Payroll Check Generator

When evaluating tools, consider these factors:

Ease of Use – A clear and intuitive layout, even for beginners

Accurate Calculations – Must correctly compute taxes and deductions

Customization – Allows for notes, year-to-date totals, or extra pay lines

Security – Ensure the site uses HTTPS to protect sensitive data

Download Options – Offers easy PDF downloads or printable formats

FreePaycheckCreator.com checks all these boxes, making it a dependable solution for anyone needing professional paychecks and stubs.

Is It Legal to Use a Free Payroll Check Generator?

Yes—as long as the information you enter is accurate and honest. It remains your responsibility to comply with federal and state wage laws. Fabricating payroll data—like inflating earnings or altering withholding—can lead to serious consequences. Always make sure your entries reflect actual payments and deductions.

FAQ: Free Payroll Check Generator

1. Who can use FreePaycheckCreator.com?

Anyone—business owners, freelancers, contractors, or employees needing pay documentation.

2. Are the generated checks accepted as proof of income?

Yes—when formatted accurately, banks, landlords, and tax authorities accept online-generated paychecks and stubs.

3. Is my data safe on the site?

Yes—FreePaycheckCreator.com uses HTTPS and encryption to secure your data.

4. Do I still need an accountant if I use it?

For straightforward payroll, no. But complex tax or compliance scenarios may benefit from professional advice.

Tips for Getting the Most from a Free Payroll Check Generator

Keep yearly records – Save all generated PDFs for tax and compliance purposes.

Verify data accuracy – Especially names, dates, wages, and deductions.

Stay updated – Adjust for tax changes at the start of each year.

Use for documentation – Provide employees with copies if required by law.

Final Thoughts

A free payroll check generator offers a compelling solution to streamline your payroll. With FreePaycheckCreator.com, you get speed, accuracy, and professionalism—all without the expense or complexity of traditional payroll systems.

Whether you’re managing a fledgling startup, working as a freelancer, or providing employee paychecks, this tool can simplify payroll, boost credibility, and ease compliance concerns.

Looking for more guidance? Visit the U.S. Department of Labor for detailed payroll and wage recordkeeping guidelines.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.