How to Verify Paystubs Generated for Free: A Guide for Employers & Landlords

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Paystubs are essential documents for verifying income, whether for employment, rental applications, or loan approvals. Employers use them to confirm salary payments, while landlords and lenders rely on them to assess financial stability. However, with the rise of free paystub generators, it has become easier for applicants to create fake or altered paystubs.

As an employer, landlord, or financial institution, it’s crucial to verify the authenticity of paystubs to prevent fraud and ensure that applicants meet financial requirements. In this guide, we’ll discuss how to verify paystubs, spot red flags, and take steps to confirm a person's income accurately.

Why Verifying Paystubs is Important

1. Prevents Fraudulent Applications

Some applicants manipulate or create fake paystubs to inflate their income, making them appear more financially stable than they actually are. This can lead to:

✔️ Employers hiring unqualified candidates

✔️ Landlords renting to tenants who can’t afford rent

✔️ Banks lending to people who may default on loans

2. Ensures Financial Stability

✔️ Employers need to verify paystubs when hiring to ensure a candidate has stable previous employment and earnings.

✔️ Landlords use paystubs to confirm if a tenant meets the income-to-rent ratio (usually three times the monthly rent).

✔️ Lenders rely on accurate income records to determine if an applicant can afford a loan.

3. Protects Against Legal and Financial Risks

If an employer hires someone based on false financial information, it can lead to salary disputes or legal issues. Landlords who rent to tenants with fake income documents may face evictions and lost rental income.

How Fake Paystubs Are Created Using Free Paystub Generators

A paystub generator free tool is designed to create real and accurate paystubs for freelancers, small business owners, and employees who need proof of income. However, some people misuse these tools to generate fraudulent paystubs by:

✔️ Entering false salary details to appear as if they earn more.

✔️ Altering employer information to claim employment at a non-existent company.

✔️ Modifying tax withholdings to make deductions look legitimate.

Because fake paystubs can look professional, employers and landlords must know how to spot them.

Steps to Verify Paystubs for Authenticity

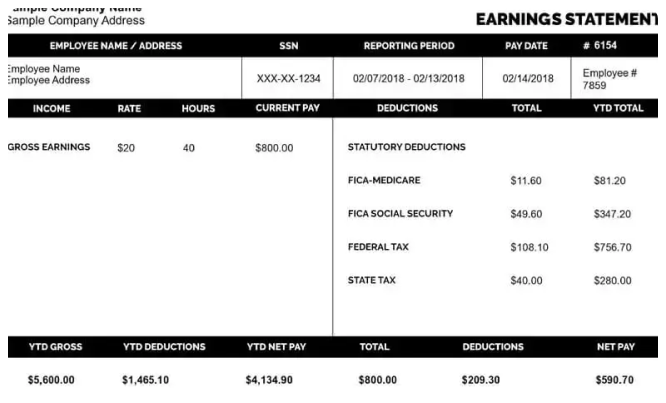

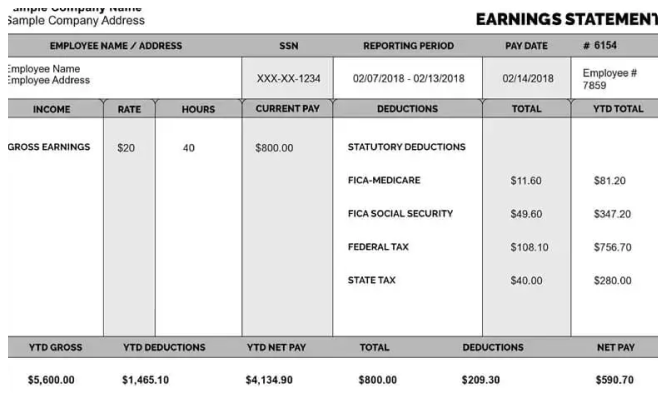

1. Examine the Paystub Format Carefully

Legitimate paystubs typically have a professional and structured layout with the following details:

✔️ Employee’s full name and address

✔️ Employer’s name, address, and contact information

✔️ Pay period and payment date

✔️ Gross pay, deductions, and net pay

✔️ Tax withholdings (federal, state, Social Security, Medicare, etc.)

🔹 Red Flags:

❌ Missing employer details or incorrect address

❌ Unusual fonts, misaligned text, or unprofessional design

❌ Formatting inconsistencies between multiple paystubs

2. Verify the Employer’s Information

Fake paystubs often include made-up company names and addresses. Employers and landlords should verify that the listed employer is legitimate.

✔️ Search for the company online – Check the company’s website, Google Maps, or business directories.

✔️ Call the employer directly – Use a verified company phone number, not the number provided on the paystub.

✔️ Check business registration records – Many states have online business registries where you can confirm a company’s existence.

🔹 Red Flags:

❌ Employer name doesn’t match online records

❌ The phone number leads to an individual, not a business

❌ No online presence for the company

3. Cross-check paystubs with Bank Statements

A paystub alone is not enough to verify income. Employers and landlords should ask for:

✔️ Bank statements showing deposits matching the paystub amounts

✔️ Tax returns (W-2s or 1099s) to confirm yearly earnings

✔️ Employment verification letters from the company

🔹 Red Flags:

❌ Paystub shows a direct deposit, but there’s no matching deposit in the bank statement

❌ Inconsistencies between reported income on the paystub and tax returns

4. Look for Consistency in Pay Periods and Amounts

Legitimate paystubs follow a consistent pay schedule, such as:

✔️ Weekly – 52 paychecks per year

✔️ Bi-weekly – 26 paychecks per year

✔️ Semi-monthly – 24 paychecks per year

✔️ Monthly – 12 paychecks per year

🔹 Red Flags:

❌ Pay period dates are random or inconsistent

❌ Sudden, unexplained jumps in income over different pay periods

❌ The same paystub template is used, but pay periods don’t match common schedules

5. Verify Tax Deductions & Withholdings

Paystubs should reflect realistic tax deductions, including:

✔️ Federal and state income tax

✔️ Social Security (6.2% of gross income)

✔️ Medicare (1.45% of gross income)

🔹 Red Flags:

❌ Rounded tax deduction numbers (e.g., exactly $500 instead of a precise amount like $512.47)

❌ Missing standard deductions such as Social Security or Medicare

❌ Unusual tax rates that don’t align with federal or state guidelines

6. Contact Previous Employers for Verification

If an applicant provides previous employer paystubs, landlords and lenders should:

✔️ Call the company’s HR department to confirm employment.

✔️ Request an official employment verification letter from the company.

✔️ Ask for W-2 forms to cross-check earnings.

🔹 Red Flags:

❌ Employer refuses to verify details

❌ The applicant provides a personal phone number for verification instead of a company number

7. Use Online Paystub Verification Tools

Several online services can help verify paystubs:

✔️ Plaid – Connects bank accounts to verify income directly.

✔️ The Work Number – A third-party employment verification service.

✔️ Truework – Helps lenders and landlords verify income data.

🔹 Red Flags:

❌ Paystub information doesn’t match verified financial records.

❌ The applicant refuses to provide additional documentation.

What to Do If You Suspect a Fake Paystub

If you believe a paystub is fraudulent, take the following steps:

✔️ Request additional proof of income – Ask for tax returns, W-2s, or 1099 forms.

✔️ Speak directly with the employer – Confirm employment details.

✔️ Compare with bank deposits – Verify that deposits match earnings.

✔️ Deny the application if fraud is confirmed – Do not proceed with hiring, rental, or loan approval.

🚨 If fraud is detected, you may report it to local authorities or credit bureaus to prevent further misuse.

Final Thoughts

With the increasing use of paystub generator free tools, it’s more important than ever for employers, landlords, and lenders to verify paystubs carefully. By following these steps, you can:

✔️ Spot fake or altered paystubs.

✔️ Ensure financial stability before approving loans or rentals.

✔️ Protect yourself from fraud and financial loss.

If you’re reviewing a paystub for a job, rental, or loan, take time to verify all details before making a decision. Accuracy matters when it comes to financial trustworthiness!

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.