Tiered Link Strategy – Multiply Your SEO Impact Today!

Tiered Link Strategy – Multiply Your SEO Impact Today!

Free Paystub Maker for Employers: How to Manage Payroll Easily

Written by Free Paycheck Creator » Updated on: June 17th, 2025

Managing payroll can be a challenging task for employers, especially small business owners who want to ensure their employees are paid accurately and on time. Creating paystubs is a crucial part of payroll management, as they serve as proof of income for employees and help businesses keep accurate financial records.

Fortunately, with a free paystub maker, employers can streamline the payroll process without the need for expensive payroll software. In this guide, we’ll explore how to create paystubs easily, why they are essential, and the best free tools available to help you manage payroll efficiently.

Why Paystubs Are Important for Employers and Employees

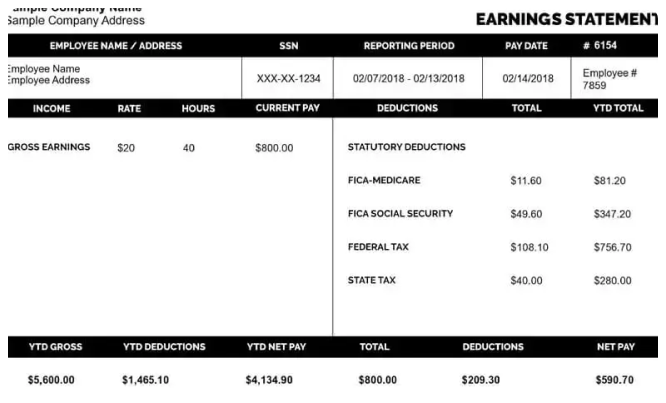

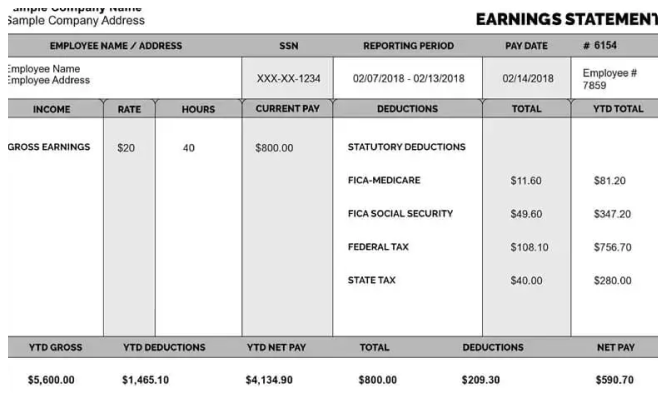

A paystub is a document that outlines an employee’s earnings and deductions for a specific pay period. It typically includes details such as gross pay, taxes withheld, deductions, and net pay. Paystubs are important for both employers and employees for several reasons:

For Employers:

Provides proof of payment to employees.

Ensures compliance with labor laws and tax regulations.

Helps with record-keeping for tax filing and audits.

Reduces disputes regarding payment discrepancies.

For Employees:

Serves as proof of income for loans, rental applications, and financial planning.

Helps track earnings, tax withholdings, and deductions.

Assists with budgeting and financial management.

How to Create Paystubs with a Free Paystub Maker

Creating paystubs manually can be time-consuming and prone to errors. Instead, using a free paystub maker can simplify the process. Here’s how you can generate paystubs quickly and accurately:

1. Choose a Free Paystub Maker

Several online platforms offer free paystub creation services. Some of the most popular free paystub makers include:

Check Stub Maker

PayStubs.net

123PayStubs

Online Paystub

FormPros (Limited Free Options)

2. Enter Employer and Employee Information

To create a paystub, you will need to provide basic details such as:

Business name and address.

Employee name and contact details.

Employee’s job title and payment frequency (weekly, biweekly, monthly).

3. Input Payment Details

The next step is entering payment information, including:

Gross Earnings – The total amount earned before deductions.

Hourly Rate or Salary – Depending on whether the employee is hourly or salaried.

Hours Worked – For hourly employees, enter the number of hours worked.

Overtime Pay – If applicable, include overtime hours and pay rate.

4. Add Deductions and Taxes

Paystubs should reflect deductions and withholdings, such as:

Federal and State Income Tax – Based on tax brackets and employee’s W-4 information.

Social Security and Medicare (FICA Taxes) – Standard deductions for all employees.

Health Insurance Premiums – If the employee is enrolled in company benefits.

Retirement Contributions (401k, IRA) – If the employee contributes to a retirement plan.

Other Deductions – Any other voluntary or mandatory deductions.

5. Review and Download the Paystub

Once all the information is entered, review the paystub for accuracy. Most free paystub makers allow you to download the document as a PDF or print it for record-keeping.

Benefits of Using a Free Paystub Maker

Using a free paystub maker comes with several advantages for employers:

1. Saves Time and Effort

Manually creating paystubs can be time-consuming, especially for businesses with multiple employees. A paystub generator automates calculations, reducing the risk of errors and saving valuable time.

2. Ensures Accuracy

Paystub makers automatically calculate deductions, taxes, and net pay, ensuring that employees receive accurate and consistent payments.

3. Provides a Professional Format

Most free paystub makers generate professional-looking paystubs with a clear breakdown of earnings and deductions, making it easier for employees to understand their payment details.

4. Helps with Compliance

Employers are required to provide accurate pay records to employees. A free paystub maker helps ensure compliance with labor laws and tax regulations.

5. No Additional Costs

Many small businesses operate on tight budgets, and investing in payroll software can be costly. A free paystub maker provides an affordable alternative without compromising on accuracy and efficiency.

Potential Limitations of Free Paystub Makers

While free paystub makers are beneficial, they may have some limitations:

Limited Features – Some platforms offer basic features for free but require payment for advanced options like automatic tax calculations or custom branding.

Watermarked Documents – Some free versions may include watermarks on the paystubs.

Limited Storage – Free tools may not store past paystubs, requiring you to save them manually.

Best Practices for Managing Payroll Efficiently

In addition to using a free paystub maker, here are some best practices for managing payroll smoothly:

1. Maintain Accurate Employee Records

Keep updated records of employee wages, tax forms, and payment details to ensure accurate payroll processing.

2. Stay Compliant with Tax Laws

Understand federal and state payroll tax requirements to avoid penalties. Use IRS guidelines or consult a tax professional if needed.

3. Set a Consistent Payroll Schedule

Pay employees on a regular schedule (weekly, biweekly, or monthly) to ensure financial stability for your workforce.

4. Keep Payroll Records Organized

Store paystubs, tax documents, and payroll reports in a secure system to comply with record-keeping requirements.

5. Use Accounting Software if Needed

For businesses with multiple employees, integrating a payroll system like QuickBooks or Wave can help automate payroll processing.

Final Thoughts

A free paystub maker is a valuable tool for employers looking to simplify payroll management. It allows businesses to generate professional paystubs quickly and accurately, ensuring compliance and reducing administrative burdens. Whether you run a small business, a startup, or manage a few employees, using a free paystub generator can save time, improve accuracy, and help maintain financial transparency.

By choosing the right paystub maker and following best payroll practices, employers can streamline payroll processes and focus on growing their business. Start using a free paystub maker today and make payroll management easier than ever!

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.