Free Paystub Maker vs. Paid Tools: Which One Is Right for You?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Managing payroll and keeping track of earnings is essential for both employees and businesses. Whether you're an employer, freelancer, or self-employed worker, having a clear and professional pay stub is crucial for record-keeping, taxes, and proof of income.

With the rise of digital payroll solutions, many people turn to paystub makers to generate pay stubs quickly. But should you use a free paystub maker or invest in a paid tool?

In this article, we’ll compare free vs. paid paystub generators, their features, benefits, and which one is best suited for your needs.

What Is a Paystub Maker?

A paystub maker (or paycheck stub generator) is an online tool that creates professional pay stubs based on entered salary and deduction details. These tools are widely used by:

✔️ Employers to generate pay stubs for employees

✔️ Freelancers who need proof of income

✔️ Self-employed individuals managing their earnings

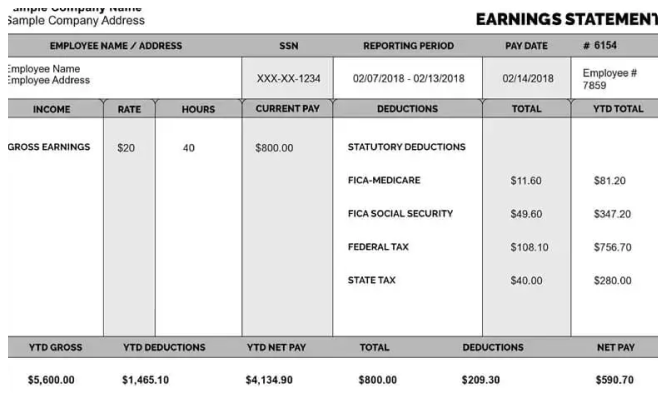

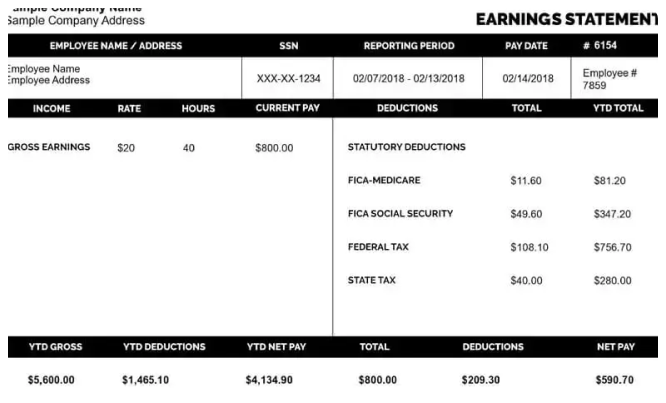

Pay stubs typically include:

✔️ Employee and employer details

✔️ Gross earnings (before deductions)

✔️ Tax withholdings (federal, state, local)

✔️ Deductions (insurance, retirement, etc.)

✔️ Net pay (final take-home pay)

While some paystub makers are free, others charge a one-time fee or subscription for additional features. So, which option is better? Let’s compare!

Free Paystub Maker: Pros and Cons

A free paystub maker allows users to generate basic pay stubs without any cost. These tools are ideal for small businesses, independent contractors, and freelancers who don’t need advanced payroll features.

✅ Pros of Free Paystub Makers:

✔️ Completely Free – No cost, making it ideal for small businesses and individuals.

✔️ Quick and Easy – Generate a pay stub in minutes.

✔️ No Registration Required – Many free tools allow you to create pay stubs instantly without signing up.

❌ Cons of Free Paystub Makers:

⛔ Limited Features – Often lack advanced options like tax calculations and customization.

⛔ No Saved Records – You may need to manually save or print pay stubs since most free versions don’t store data.

⛔ Less Professional Design – Free tools may not offer high-quality templates.

⛔ Ads and Watermarks – Some free paystub makers place watermarks on generated pay stubs.

📌 Best For:

✔️ Freelancers & self-employed workers needing quick proof of income.

✔️ Small businesses looking for an occasional pay stub generator.

✔️ Individuals who need a basic pay stub without detailed tax calculations.

Paid Paystub Maker: Pros and Cons

A paid paystub maker offers more customization, accuracy, and additional features. These tools are often used by businesses, accountants, and self-employed individuals who need detailed and legally compliant pay stubs.

✅ Pros of Paid Paystub Makers:

✔️ Professional and Customizable Templates – High-quality designs that look official.

✔️ Accurate Tax Calculations – Automatically calculates federal, state, and local taxes.

✔️ Saves Payroll Records – Many paid tools allow you to access and store past pay stubs.

✔️ No Ads or Watermarks – Clean and professional pay stubs without branding.

✔️ Compliance with Payroll Laws – Ensures deductions and taxes are calculated correctly.

❌ Cons of Paid Paystub Makers:

⛔ Costs Money – Paid services charge a one-time fee or monthly subscription.

⛔ May Require Registration – Some platforms require signing up before use.

📌 Best For:

✔️ Small and medium-sized businesses that need accurate payroll documents.

✔️ Freelancers and independent contractors who want professional pay stubs for tax purposes.

✔️ Employers who issue pay stubs regularly and need an organized system.

Key Differences: Free vs. Paid Paystub Makers

Feature Free Paystub Maker Paid Paystub Maker

Cost Free One-time fee or subscription

Customization Basic templates Professional, customizable designs

Tax Calculations Manual input required Automatically calculates taxes

Storage & Access No saved records Can store past pay stubs

Watermarks/Ads Often included No watermarks or ads

Ideal For Occasional users, freelancers Businesses, self-employed workers

Which One Should You Choose?

The right choice depends on your needs and how often you generate pay stubs. Here’s a quick guide to help you decide:

Choose a Free Paystub Maker If:

✔️ You need one-time or occasional pay stubs.

✔️ You don’t mind manual tax calculations.

✔️ You’re a freelancer or self-employed worker who just needs basic proof of income.

✔️ You don’t need to store past payroll records.

💡 Recommended Free Paystub Makers:

Check Stub Maker

123PayStubs

FormSwift Pay Stub Generator

Choose a Paid Paystub Maker If:

✔️ You need professional pay stubs with tax calculations.

✔️ You run a small business and issue pay stubs regularly.

✔️ You want a record-keeping system for payroll history.

✔️ You need a customized layout without watermarks or ads.

💡 Recommended Paid Paystub Makers:

PayStubs.net

Pay Stub Direct

OnlinePaystub

How to Choose the Best Paystub Maker

If you’re still unsure which paystub maker to use, consider these factors:

✔️ Frequency of Use – If you generate pay stubs often, a paid tool is worth the investment.

✔️ Customization Needs – If you need professional templates, go for a paid version.

✔️ Tax Accuracy – If tax calculations are important, choose a paid tool with automatic tax deductions.

✔️ Budget – If you’re on a tight budget, a free paystub maker may be enough.

Final Verdict: Free vs. Paid Paystub Maker

Both free and paid paystub makers have their advantages. The best option depends on how often you use them and your payroll needs.

✅ Use a Free Paystub Maker for occasional or personal use.

✅ Use a Paid Paystub Maker if you need accurate, professional pay stubs for business purposes.

No matter which option you choose, having a pay stub is important for financial tracking, taxes, and proof of income.

👉 Do you use a free or paid paystub maker? Share your experience in the comments below! 👇

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.