How Do Virtual CFO Services Help Small Businesses Save Costs and Grow?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In today’s fast-moving business world, small businesses need to be smart with their money and strategic with their growth plans. But not every business can afford a full-time CFO or finance team. That’s where virtual CFO services come in. With the rise of CPA outsourcing services and remote finance professionals, even startups and small companies can access top-tier financial expertise—without the hefty cost.

But how exactly do virtual CFO services help small businesses save costs and grow? Let’s break it down.

What Is a Virtual CFO?

A Virtual CFO (Chief Financial Officer) is an outsourced financial expert who provides high-level financial strategy, planning, and analysis—just like a traditional CFO, but remotely and at a fraction of the cost.

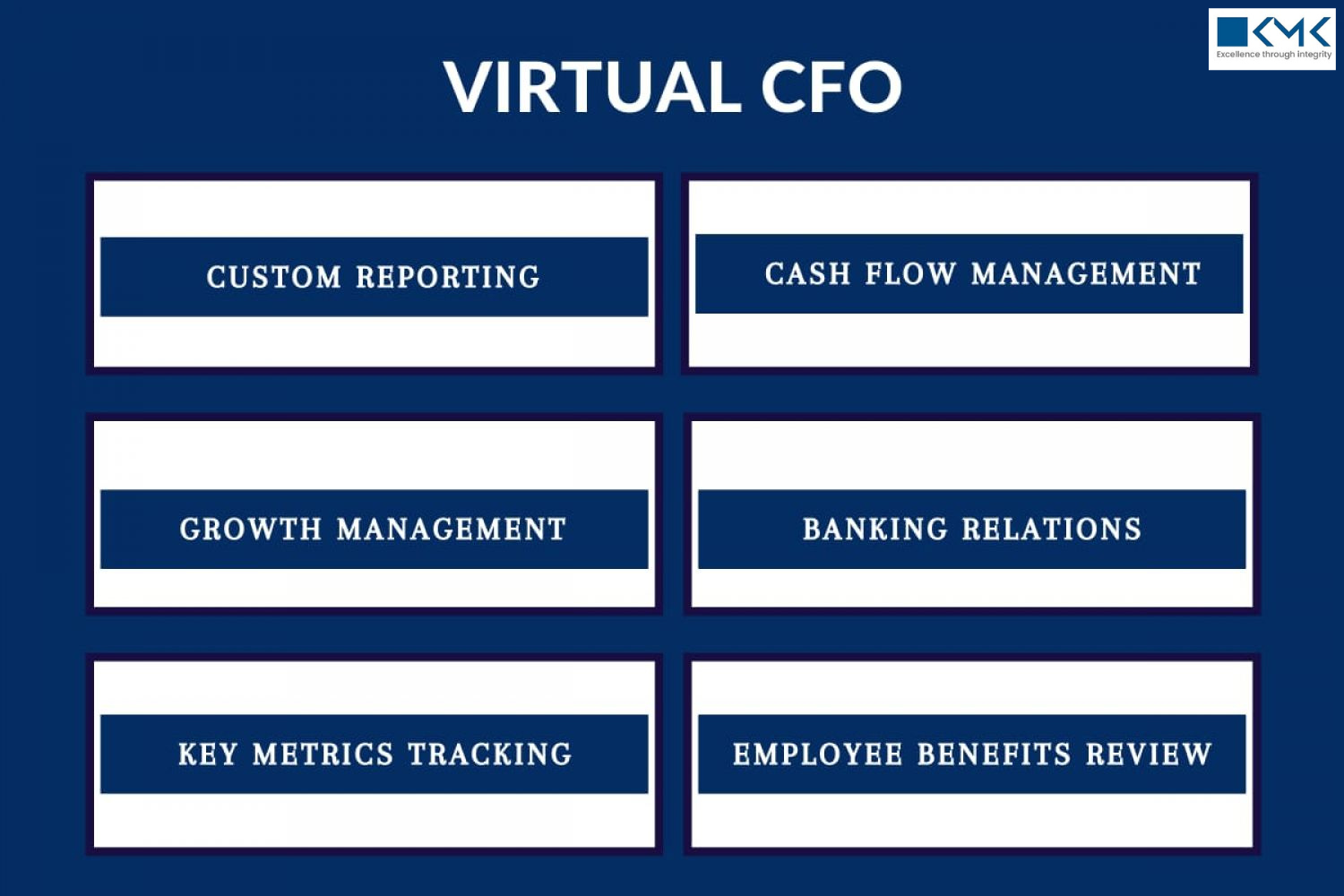

Virtual CFOs typically handle:

1.Financial forecasting and budgeting

2.Cash flow management

3.Profitability analysis

4.Tax planning and compliance

5.Strategic financial decision-making

These services are tailored for small businesses and startups that don’t need or can’t afford a full-time CFO.

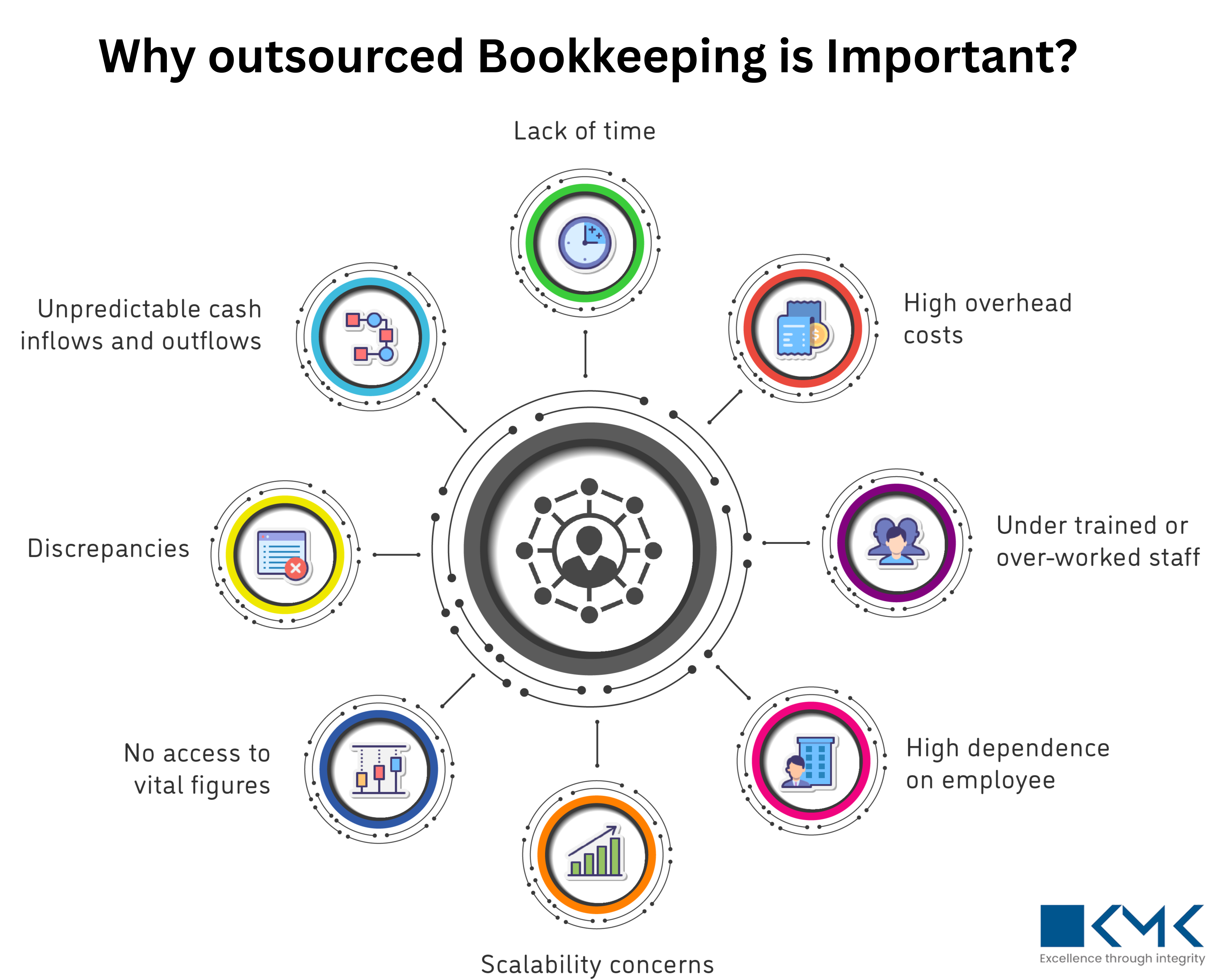

Why Are Small Businesses Turning to Virtual CFO Services?

Here are a few important questions you might be asking:

Is a virtual CFO worth it for a small business?

Yes—especially if you:

1.Need expert financial guidance but can’t hire in-house

2.Want to scale but need help planning

3.Are facing cash flow issues or inconsistent revenue

4.Need support with investor reporting or fundraising

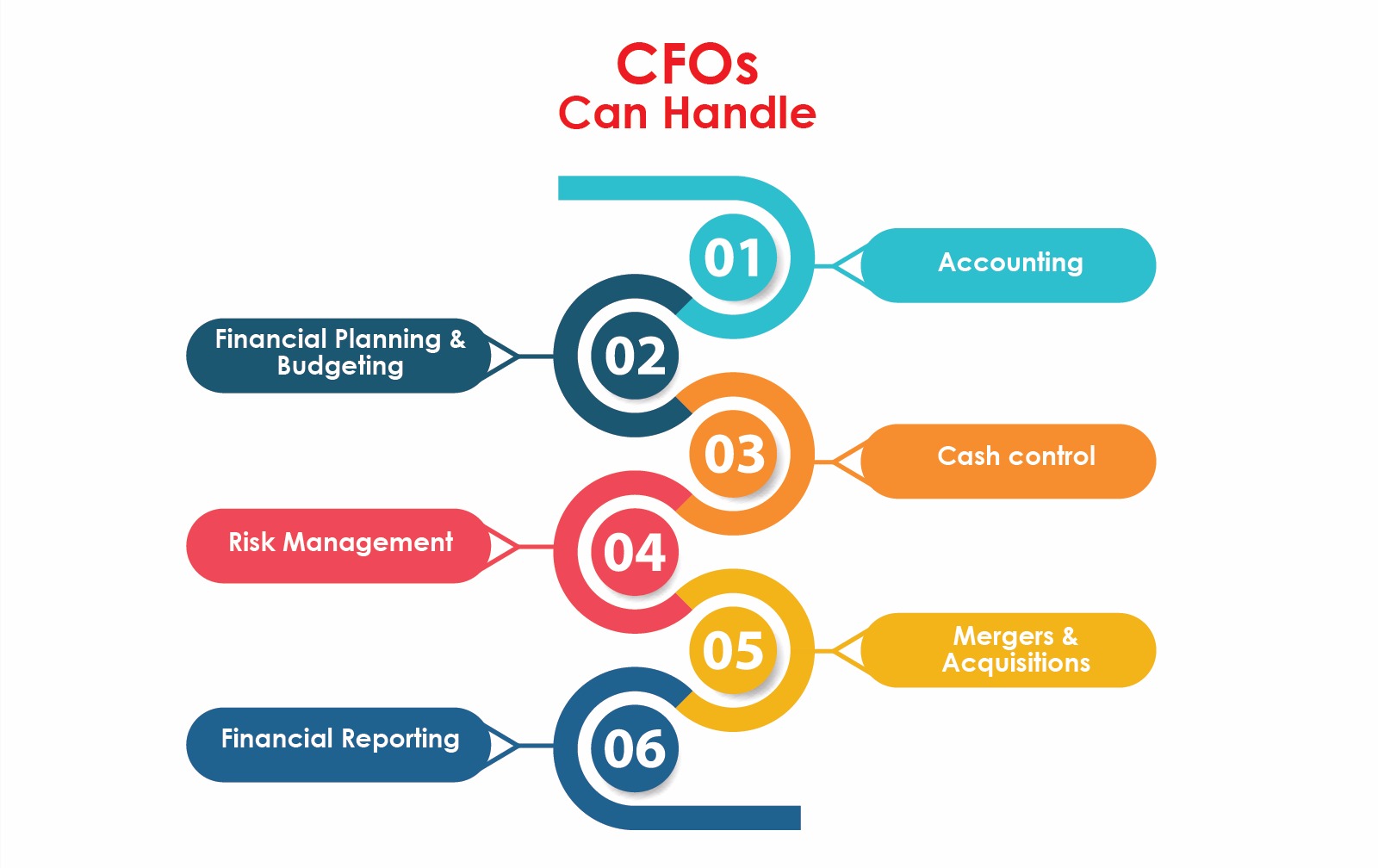

How Do Virtual CFOs Help Businesses Grow?

1. Strategic Planning

Virtual CFOs help you plan long-term business goals, assess market risks, and build sustainable models. They give you a big-picture roadmap for profitability.

2. Real-Time Reporting & Insights

They deliver up-to-date financial reports, dashboards, and KPIs so you always know where your business stands—empowering smarter decisions.

3. Better Fundraising and Investor Relations

Need funding? A virtual CFO can help prepare financial projections, pitch decks, and speak with investors in a language they understand.

4. Tax Efficiency and Compliance

With a deep understanding of federal and state tax laws, they help reduce your tax liabilities and keep you compliant.

CPA Outsourcing Services vs. Virtual CFO: What’s the Difference?

1.CPA Outsourcing Services usually handle compliance tasks: bookkeeping, payroll, tax filing, audits.

2.Virtual CFOs focus more on strategy and analysis: financial health, future planning, and decision-making support.

Tip: Many small businesses benefit from combining both—using outsourced CPAs for day-to-day tasks and a virtual CFO for big-picture strategy.

Can Virtual CFO Services Be Used Anywhere?

Yes! Thanks to cloud-based accounting tools and video conferencing, remote CFO services are accessible no matter where you're based. Whether you're in New York or a small town in Ohio, you can connect with expert finance professionals across the globe.

Who Should Consider Virtual CFO Services?

You should consider hiring a virtual CFO if you:

1.Run a startup or early-stage business

2.Have inconsistent cash flow

3.Are preparing to scale or expand

4.Need to impress investors or lenders

5.Want to improve profitability

Final Thoughts: Is a Virtual CFO Right for You?

If you're a small business owner looking for financial clarity, cost control, and sustainable growth, virtual CFO services can be a game-changer. Paired with CPA outsourcing services, they offer a powerful combo—ensuring both your books are in order and your growth strategy is sharp.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.