Why Small Businesses Are Choosing CPA Outsourcing and Virtual CFO Services in 2025?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Introduction: Is Your Small Business Ready for Smarter Financial Management?

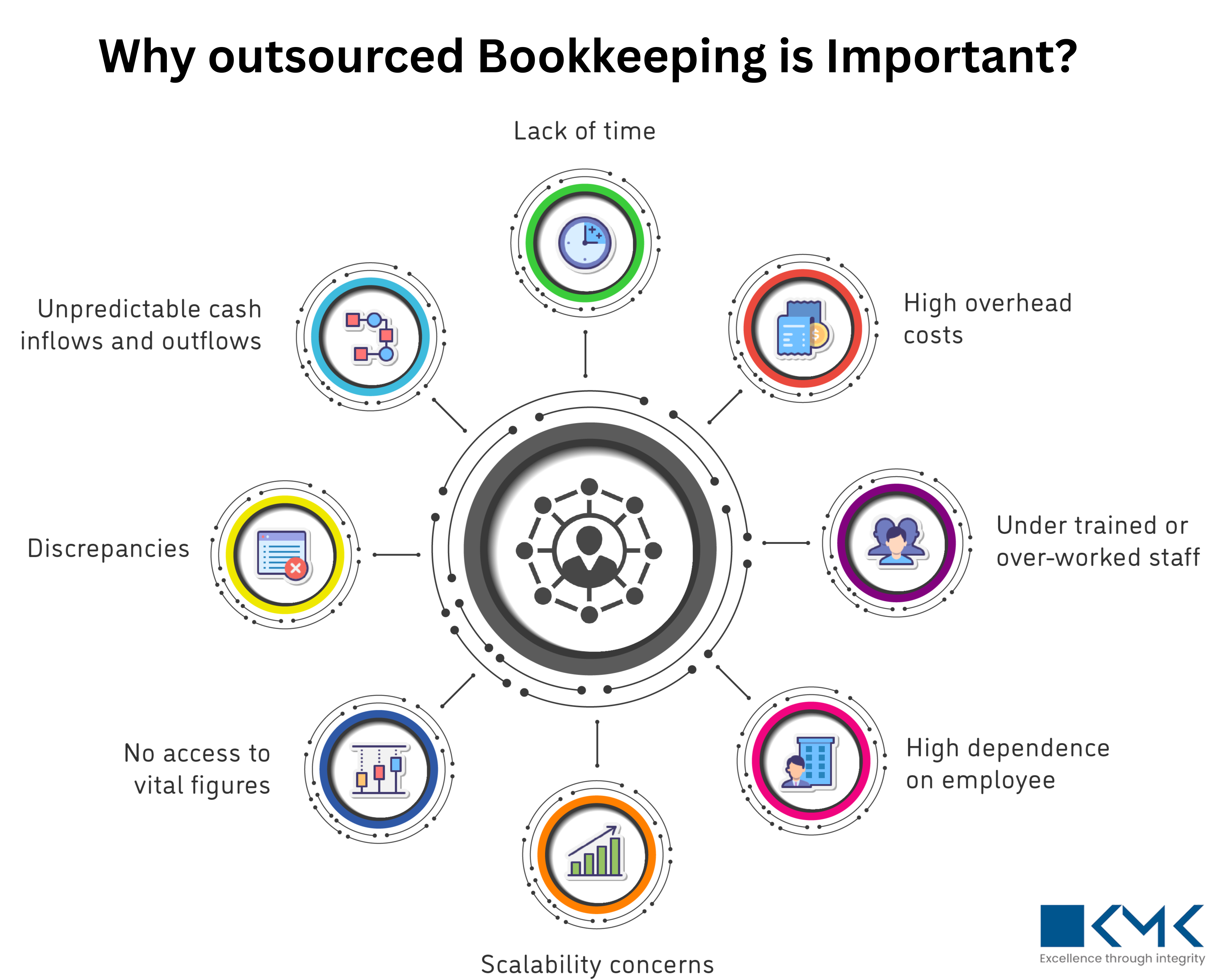

Managing finances isn't just about crunching numbers anymore—it’s about making strategic decisions, staying compliant, and planning for long-term growth. But for small businesses, hiring a full-time CFO or in-house accounting team can be expensive and inefficient.

That’s why in 2025, more and more small businesses are turning to CPA outsourcing services and virtual CFO solutions. But what’s behind this shift? And is it right for your business?

Let’s explore the reasons why this trend is on the rise—and how it could be a game-changer for your business too.

What Is CPA Outsourcing and How Does It Work?

CPA outsourcing services allow businesses to delegate accounting, tax, and compliance tasks to certified professionals outside their company. This can be done through third-party firms or offshore teams, helping you:

1.Reduce overhead costs

2.Access skilled accountants and CPAs

3.Focus on core business activities

4.Ensure compliance with IRS and state regulations

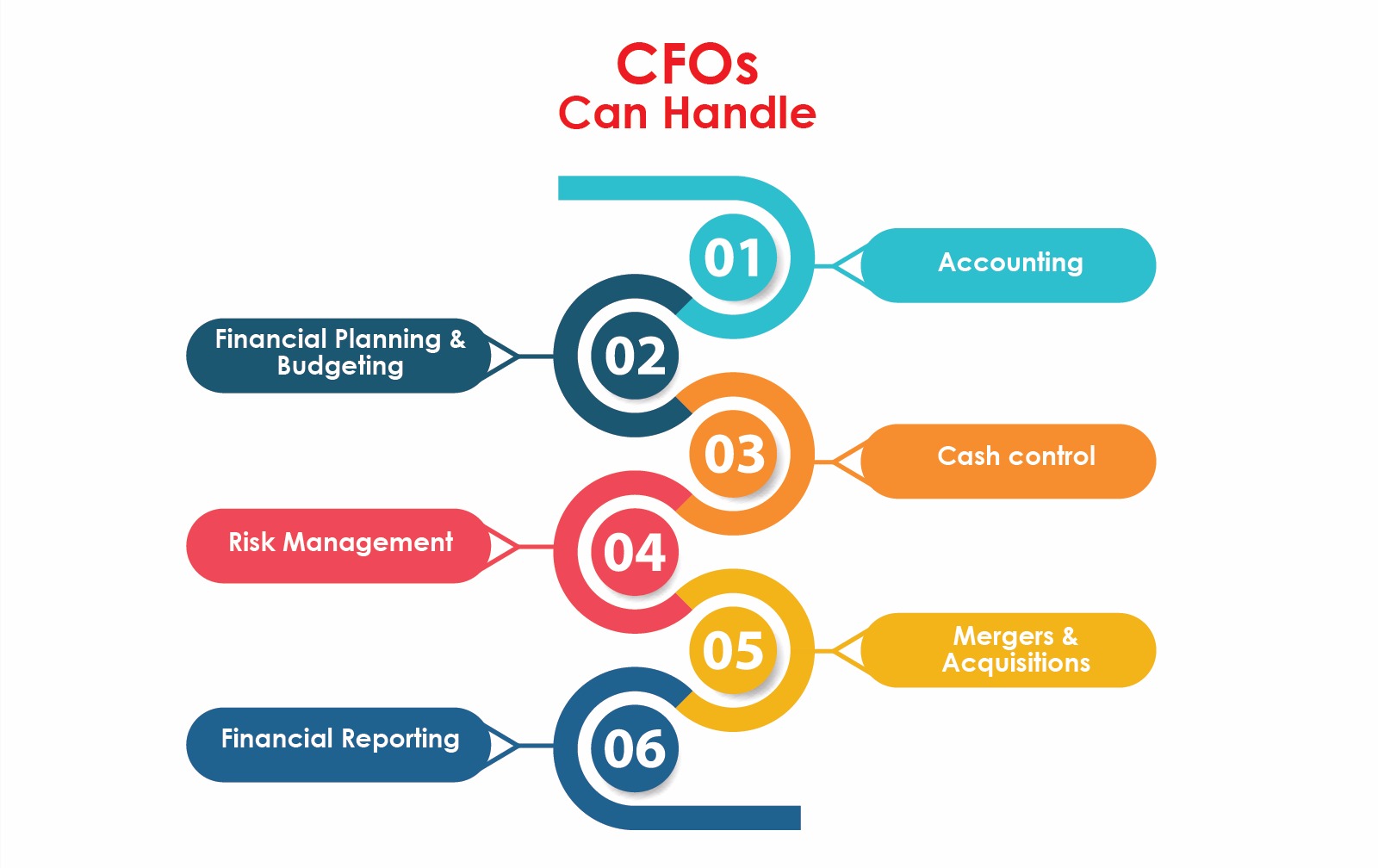

What Are Virtual CFO Services and Why Are They Trending?

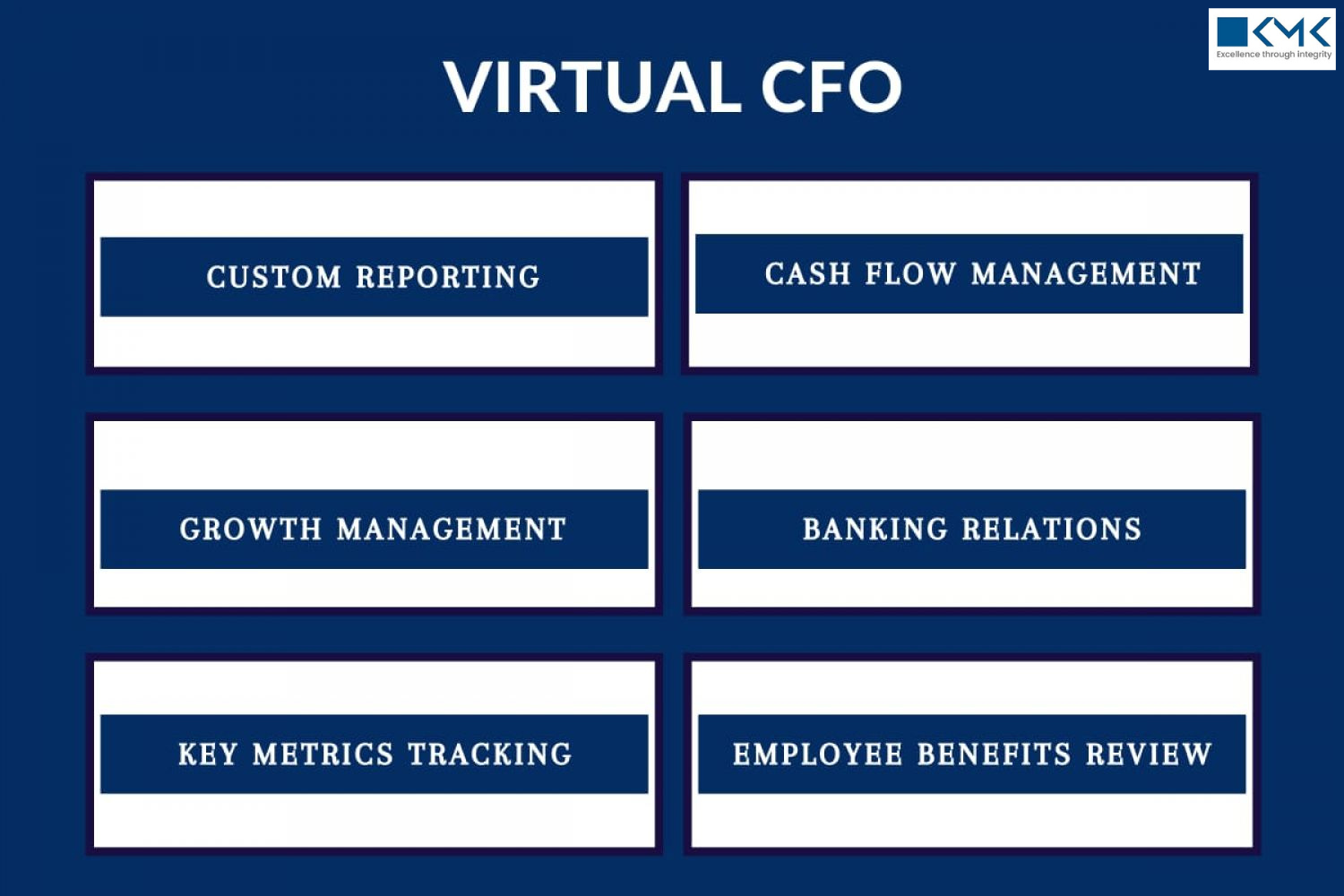

A Virtual CFO provides all the strategic guidance of a Chief Financial Officer—without the high salary or need for full-time employment.

Think of them as your on-demand financial partner, offering:

1.Cash flow forecasting

2.Budgeting and planning

3.Financial risk assessment

4.Strategic decision-making support

5.Fundraising & investor reporting

💬 “Do small businesses really need a virtual CFO?”

Absolutely. Especially when trying to scale or streamline operations, a virtual CFO can help avoid costly mistakes and boost profitability.

Why Are Small Businesses Choosing These Services in 2025?

The reasons are clear—and the advantages are hard to ignore:

1. Cost-Effective Growth

Hiring a full-time finance team is costly. Outsourcing CPA services or using a vCFO gives you the same expertise at a fraction of the cost.

2. Flexibility & Scalability

Need more support during tax season or fundraising? Virtual services scale up or down with your needs.

3. Access to Expertise

Stay updated with tax laws, GAAP standards, and financial regulations without hiring multiple specialists.

4. Technology Integration

Today’s virtual CFOs use the latest cloud-based accounting tools, offering real-time visibility and performance dashboards.

5. Strategic Focus

With someone handling your finances, you can focus on growth, innovation, and client experience.

Still Wondering If It’s the Right Move?

1.Are your finances holding back growth?

2.Are you spending too much time on accounting tasks?

3.Do you need better financial insights without hiring in-house?

If the answer is “yes” to any of these, it’s time to consider CPA outsourcing or hiring a virtual CFO.

FAQ’s:

What is the difference between CPA outsourcing and a virtual CFO?

CPA outsourcing focuses on compliance and bookkeeping, while a virtual CFO provides strategic financial guidance and decision-making support.

How much does a virtual CFO cost?

It varies based on scope and provider. Many small businesses spend 40-60% less compared to a full-time CFO.

Can a virtual CFO help with fundraising?

Yes! They prepare financial models, pitch decks, and investor reports, making your business investor-ready.

Final Thoughts: Outsourcing Isn’t Just a Trend—It’s a Strategy

Whether you're just starting out or scaling fast, CPA outsourcing services and virtual CFO support can optimize your finances, cut costs, and guide smarter decisions.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.