Is Outsourcing Bookkeeping More Cost‑Effective Than Automation?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Bookkeeping is the backbone of every business. But as businesses grow, so does the complexity of managing financial records. This raises a common question for startups and small businesses:

Is it better to outsource bookkeeping or automate it?

Let’s explore both options to help you decide which is more cost-effective—and more importantly, which works best for your business in the long run.

What Is Bookkeeping Automation?

Bookkeeping automation involves using software to record and manage your financial transactions. Tools like QuickBooks, Xero, or Zoho Books offer features such as:

• Automated invoicing and billing

• Bank reconciliation

• Real-time financial dashboards

• Expense categorization using AI

Sounds great, right? But automation has limits.

Can Automation Replace a Bookkeeper?

Not entirely. Software still needs human oversight. Automated tools can handle data, but they can’t provide insights, catch context-specific errors, or handle complex compliance.

That’s where outsourced bookkeeping services come in.

What Is Outsourced Bookkeeping?

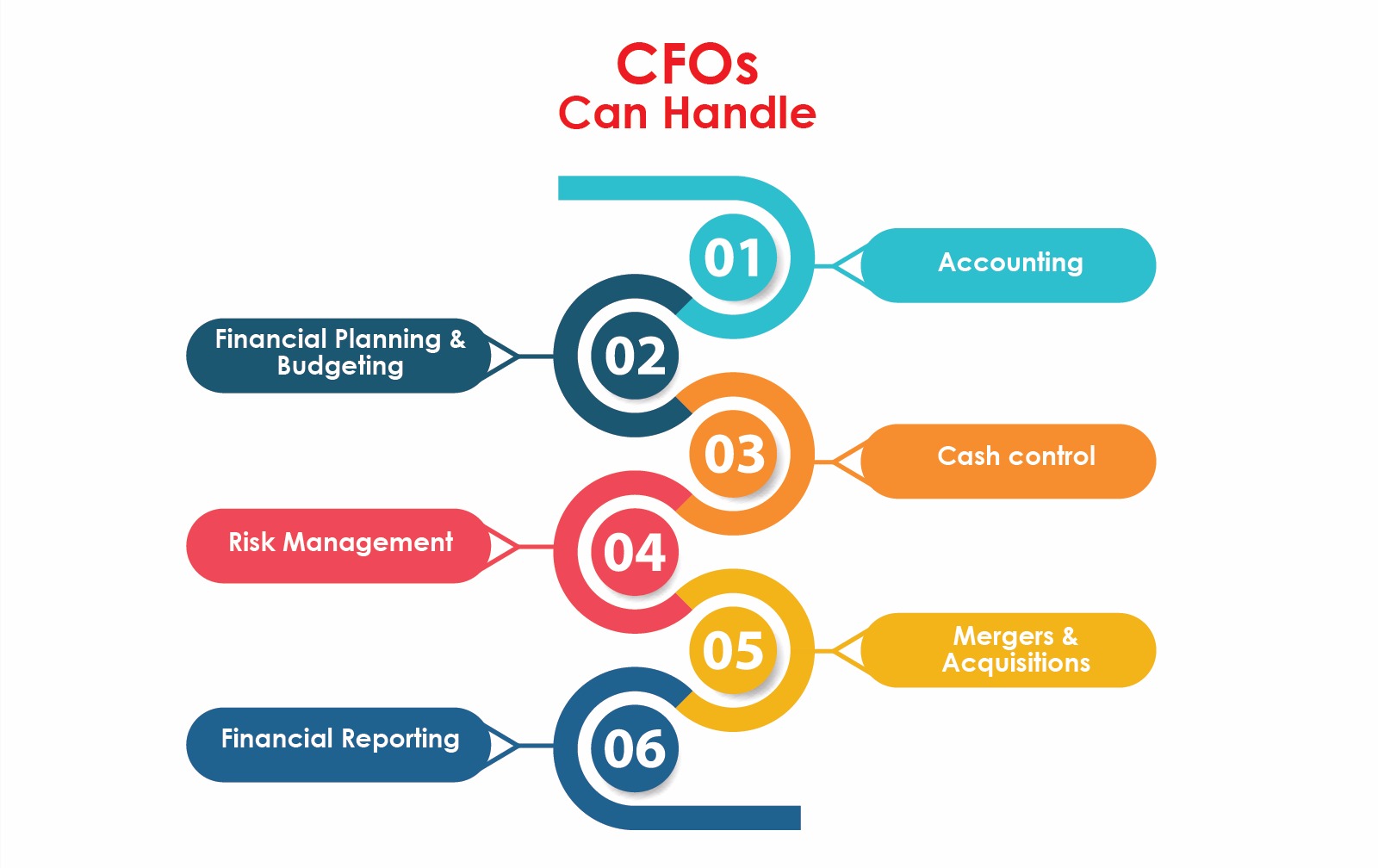

Outsourced bookkeeping is when you hire an external expert or firm (often offshore) to manage your books. These professionals handle everything from:

• Data entry and bank reconciliation

• Payroll and accounts payable/receivable

• Monthly financial reporting

• Tax-ready financials and compliance

And the best part? It’s often more affordable than hiring in-house staff.

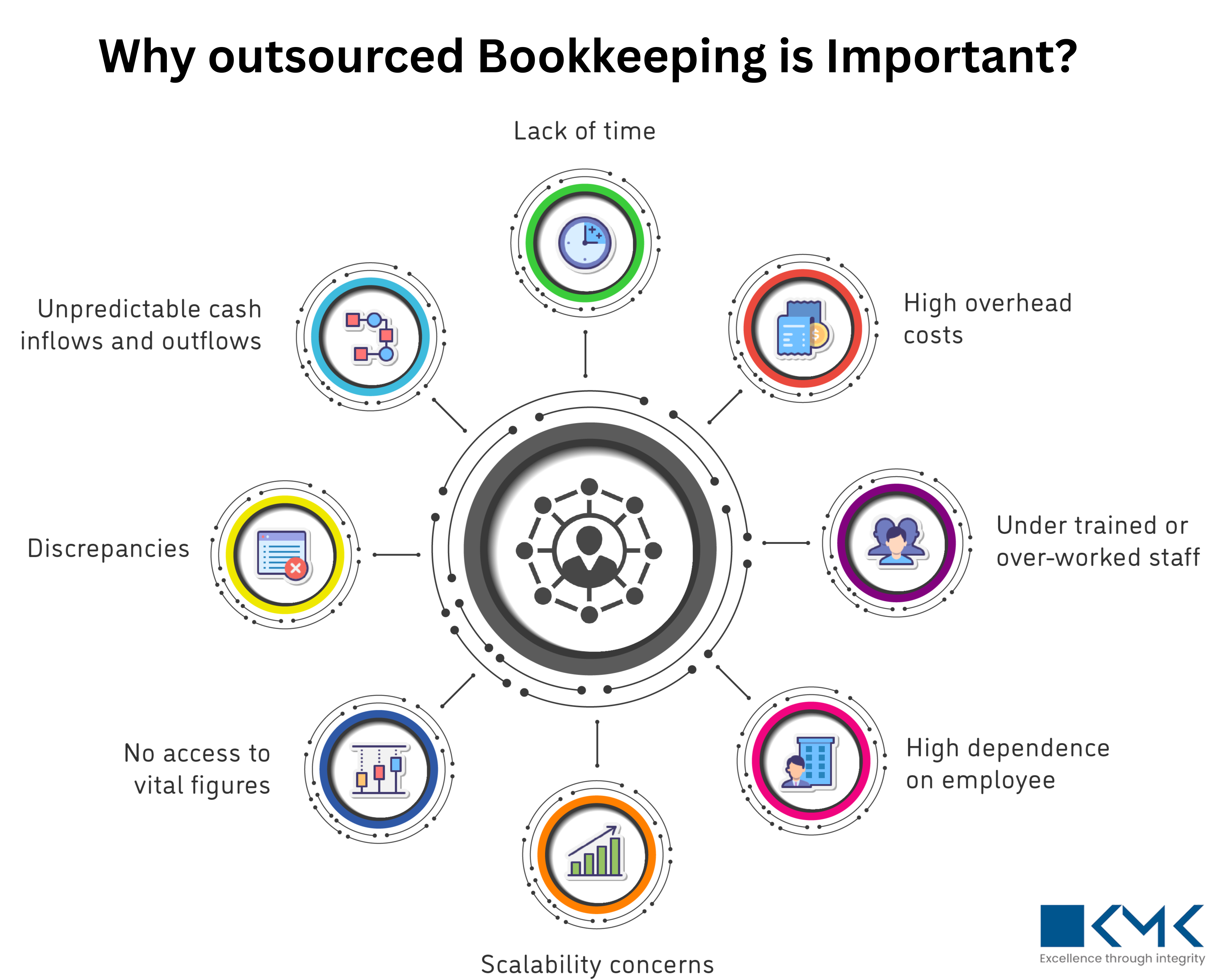

Why Small Businesses Prefer to Outsource Bookkeeping?

If you’re a small business or startup, you know every penny counts. Let’s look at the advantages of outsourcing bookkeeping for small businesses:

Cost Efficiency

• Pay only for what you need (hourly or project-based)

• Save on employee benefits, software subscriptions, and training

• Offshore bookkeeping services can reduce costs by up to 60%

Expertise on Demand

• Access to a team of trained professionals

• Stay compliant with local tax laws and global standards

• Receive financial insights and advice tailored to your industry

Time-Saving

• Focus on growing your business while your books are handled

• Avoid late filings and financial mismanagement

• Outsourced Bookkeeping vs. Automation: A Quick Comparison:

The Offshore Advantage: Why Businesses Go Global for Bookkeeping?

Many startups and small firms are turning to offshore bookkeeping services in countries like India, the Philippines, or Eastern Europe.

Benefits:

• Lower labor costs without compromising quality

• Flexible time zone coverage

• Expertise in global accounting platforms

• Faster turnaround and scalability

Offshore firms often have robust data security practices, too, making them a safe option for financial services.

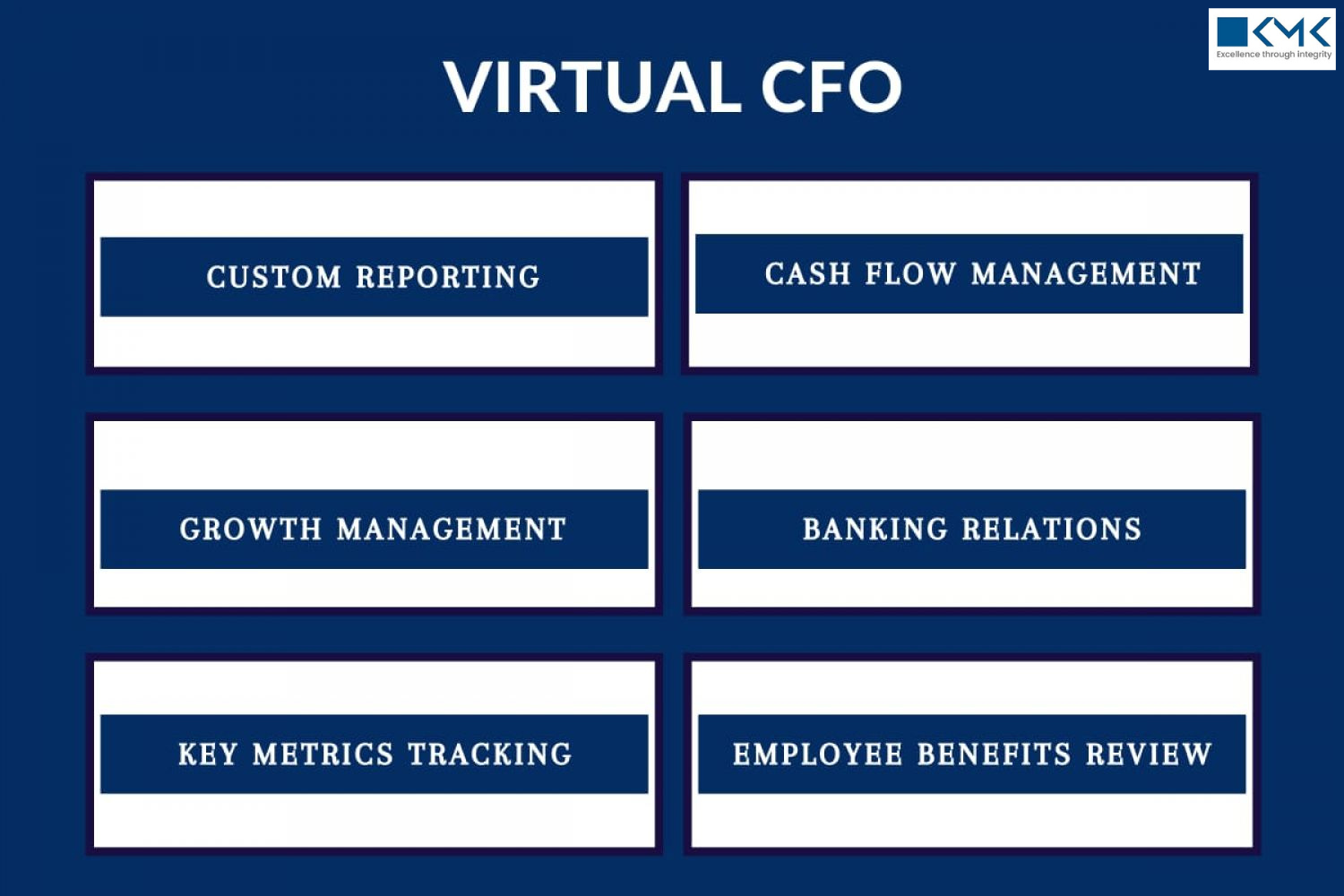

Why Choose KMK Ventures?

We understand that choosing the right partner is crucial. Here’s why U.S. businesses trust KMK Ventures:

U.S.-Focused Compliance and Accounting Standards

💼 Experienced Team with Industry-Specific Expertise

🔐 Secure Systems and Confidentiality Protocols

🌐 Cloud-Based Real-Time Access

📈 Scalable Services for Startups, Small Businesses, and CPA Firms

Explore how KMK Ventures can help simplify your Outsourced Services:

To learn more or discuss a customized solution for your business, connect with the KMK team today. Our experts are ready to answer your questions and guide you toward a seamless payroll experience.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.