How IBM, Oracle, and SAP are Revolutionizing Fraud Detection with AI, Cloud Solutions, and Automation

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Introduction:

In today’s rapidly evolving digital landscape, fraud detection has become a critical concern for organizations across industries. With the increasing volume and complexity of financial transactions, businesses are under pressure to implement advanced fraud prevention systems. Leading technology giants like IBM, Oracle, and SAP are at the forefront of driving innovation in the fraud detection market, providing solutions that leverage automation, artificial intelligence (AI), and cloud-native technologies. This article explores how these industry leaders are revolutionizing fraud detection, with a particular focus on the shift to cloud-native fraud solutions and the role of robotic process automation (RPA) in fraud prevention within enterprise resource planning (ERP) systems.

The Growing Need for Advanced Fraud Detection

Fraud is one of the most significant threats to the financial stability of businesses, ranging from small enterprises to large corporations. The increasing sophistication of cybercriminals, coupled with the growing number of digital transactions, has made fraud detection more challenging than ever before. Fraud can lead to significant financial losses, damage to a company’s reputation, and legal consequences. As a result, organizations are turning to cutting-edge technologies to safeguard their operations and assets.

The traditional methods of fraud detection, which often relied on static, on-premise systems, have struggled to keep up with the evolving nature of fraud. As fraudsters develop more sophisticated tactics, businesses need more agile, scalable, and intelligent solutions to protect their financial systems and transactions.

The Shift from On-Premise to Cloud-Native Fraud Detection

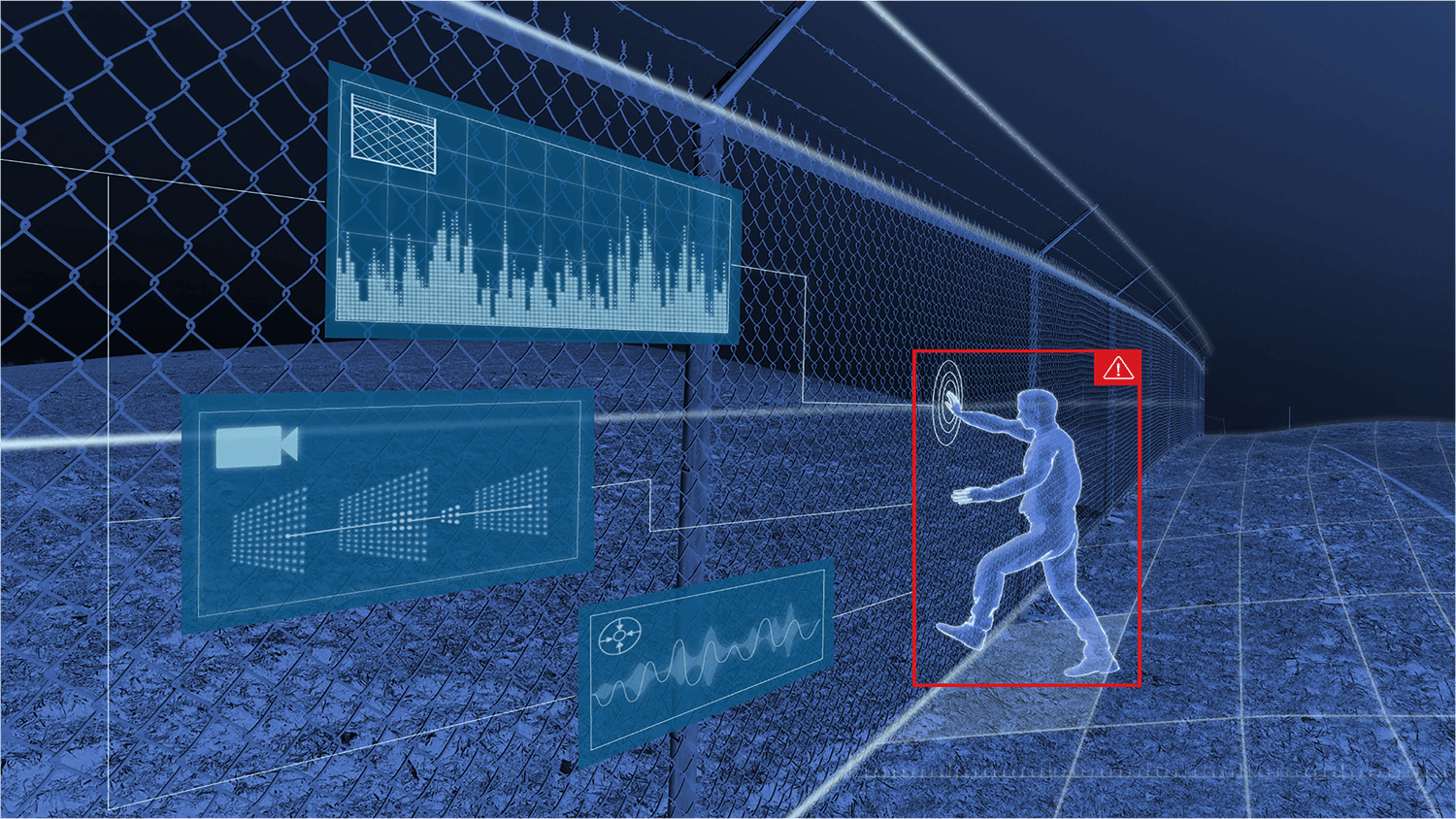

Cloud-native technologies have emerged as a game-changer in the fraud detection market. Unlike traditional on-premise solutions, cloud-native platforms offer scalability, flexibility, and real-time data processing capabilities that are crucial for detecting and preventing fraud. IBM, Oracle, and SAP have been leading the charge in adopting and promoting cloud-native fraud detection solutions.

Cloud-native fraud detection systems are designed to take full advantage of the cloud’s scalability and processing power. These systems can handle large volumes of data and perform complex analytics in real time, enabling businesses to detect fraudulent activities as they occur. The cloud also allows for the seamless integration of advanced AI and Machine Learning algorithms, which are essential for identifying patterns and anomalies that indicate potential fraud.

IBM’s Fraud Detection Solutions

IBM is a key player in the fraud detection market, offering a wide range of AI-driven solutions that help businesses prevent and mitigate fraud. IBM’s cloud-native fraud detection solutions are powered by its Watson AI platform, which uses machine learning algorithms to analyze vast amounts of data and identify potential fraud risks.

IBM’s Fraud Detection Suite offers real-time monitoring of transactions, customer behavior, and network activity. By integrating AI with advanced analytics, IBM’s solution can detect fraudulent patterns and prevent attacks before they cause damage. The platform can also adapt to evolving fraud tactics by continuously learning from new data, ensuring that businesses are always equipped with the latest fraud prevention tools.

Oracle’s Fraud Detection Solutions

Oracle has also made significant strides in the fraud detection market with its cloud-based solutions that leverage AI and machine learning. Oracle’s Fraud Detection and Prevention Platform is designed to protect businesses from various types of fraud, including credit card fraud, identity theft, and financial fraud.

Oracle’s solution uses advanced analytics and AI to detect fraudulent patterns in real time, providing businesses with the ability to respond quickly to threats. The platform integrates with Oracle’s suite of enterprise applications, allowing businesses to manage fraud detection across multiple systems from a centralized platform.

One of the standout features of Oracle’s fraud detection solution is its ability to integrate with ERP systems, making it easier for organizations to monitor and protect their financial transactions. By analyzing transactional data in real time, Oracle’s platform can identify anomalies, flag suspicious activities, and prevent fraudulent transactions before they are processed.

SAP’s Fraud Detection Solutions

SAP is another leader in the fraud detection market, offering cloud-based solutions that help businesses protect their financial systems from fraud. SAP’s Fraud Management solution is designed to integrate with its ERP system, providing a unified approach to fraud detection and prevention.

SAP’s fraud detection platform leverages machine learning algorithms to identify suspicious activities and provide businesses with actionable insights. By analyzing transaction data in real time, SAP’s solution can detect fraudulent behavior, such as unauthorized transactions, financial manipulation, and identity theft. The platform can also be customized to meet the unique needs of different industries, providing businesses with tailored fraud detection capabilities.

The Role of Automation in Fraud Detection: RPA for ERP Systems

Automation is another critical element in the modern fraud detection landscape. Robotic Process Automation (RPA) is increasingly being used in fraud prevention, particularly within ERP systems. RPA involves the use of software robots to automate repetitive tasks, such as data entry, transaction processing, and reporting. By integrating RPA with fraud detection systems, businesses can streamline their fraud prevention processes and reduce the risk of human error.

ERP systems, such as those offered by SAP, Oracle, and IBM, are the backbone of many organizations’ financial operations. These systems handle everything from accounting and procurement to inventory management and payroll. However, ERP systems are also prime targets for fraudsters, who seek to exploit vulnerabilities in these critical business systems.

RPA can help prevent fraud in ERP systems by automating routine tasks and ensuring that they are executed consistently and accurately. For example, RPA can be used to automatically flag suspicious transactions, verify data integrity, and generate alerts when potential fraud is detected. By automating these tasks, businesses can reduce the risk of fraudulent activities going unnoticed and ensure that their ERP systems are protected from malicious attacks.

The Future of Fraud Detection: AI and Machine Learning

As the fraud detection market continues to evolve, AI and machine learning are expected to play an increasingly important role. IBM, Oracle, and SAP are all investing heavily in these technologies to enhance their fraud detection solutions. AI and machine learning algorithms can analyze vast amounts of data and identify patterns that may indicate fraudulent activity, such as unusual spending behavior or abnormal transaction volumes.

These technologies can also adapt to new fraud tactics, ensuring that businesses are always prepared to defend against emerging threats. For example, AI-driven fraud detection systems can learn from historical fraud data to recognize subtle signs of fraud that may have previously gone undetected. This ability to continuously learn and improve makes AI and machine learning essential tools in the fight against fraud.

Conclusion

Fraud detection is a critical priority for businesses today, and IBM, Oracle, and SAP are leading the way in providing innovative solutions that leverage the power of cloud-native technologies, AI, and automation. These industry giants are revolutionizing the fraud detection market by offering scalable, flexible, and real-time solutions that can detect and prevent fraud before it causes significant damage. With the integration of AI, machine learning, and RPA, businesses can enhance their fraud prevention efforts and protect their financial systems from increasingly sophisticated threats.

As fraud continues to evolve, the role of advanced technologies in fraud detection will only grow more important. Cloud-native solutions, AI-driven analytics, and automation will remain at the forefront of the fraud detection market, helping businesses stay one step ahead of fraudsters. By embracing these technologies, organizations can safeguard their financial assets and ensure the integrity of their operations in an increasingly complex digital world.

Read the full blog

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.