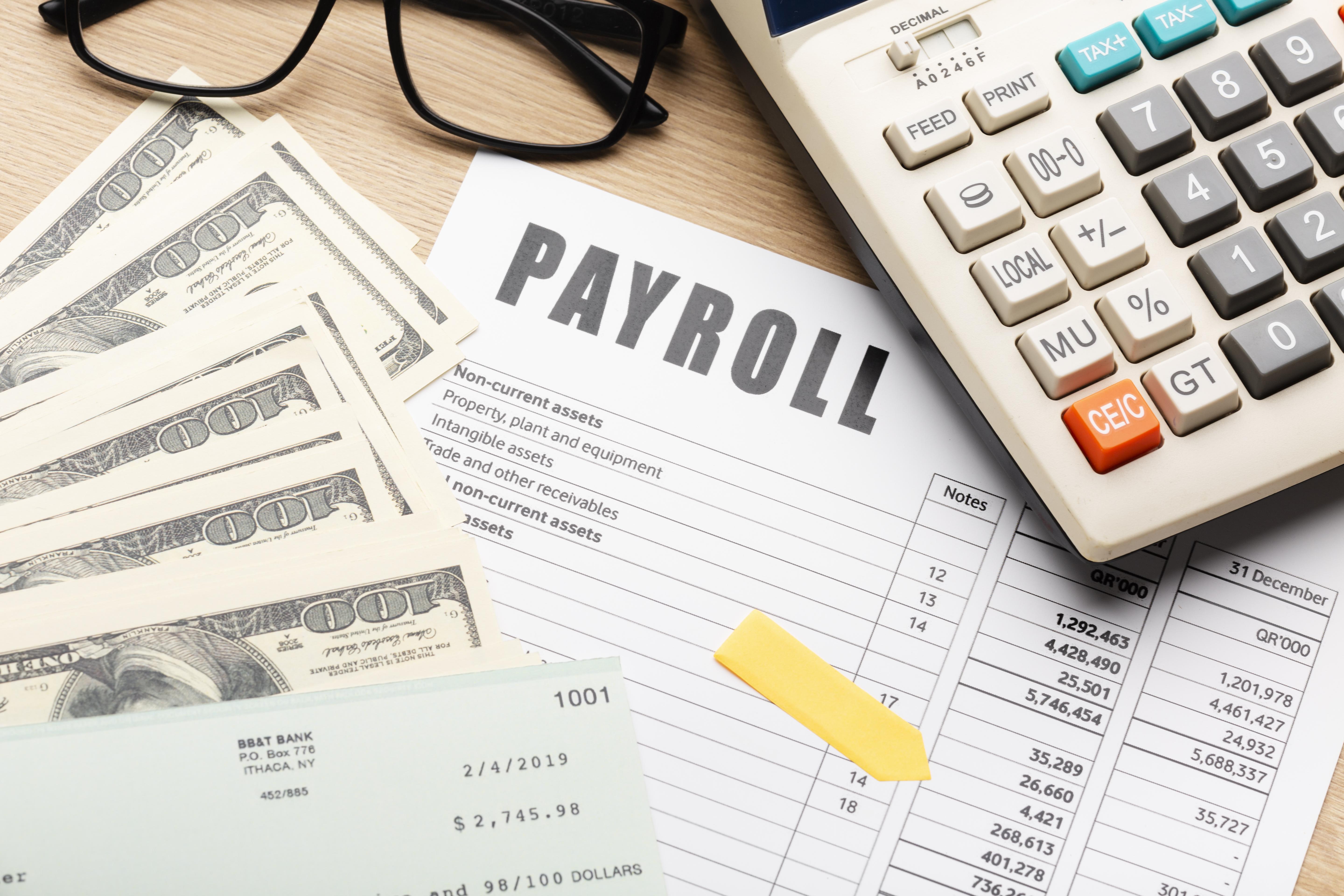

How Professional Payroll Services Can Save You Time & Money

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Managing payroll might seem straightforward calculate hours, pay employees, file taxes. But in reality, it’s time-consuming, detail-heavy, and packed with compliance risks. For small and mid-sized businesses, payroll mistakes can lead to costly penalties and employee dissatisfaction.

That’s why more companies in 2025 are turning to professional payroll services. These services go beyond just writing checks. They streamline operations, reduce compliance risks, and give you back the time to focus on growing your business.

What Are Professional Payroll Services?

Professional payroll services are third-party providers that handle your business's payroll functions. This can include:

- Calculating wages and salaries

- Handling direct deposits

- Withholding and paying payroll taxes

- Filing tax documents (e.g., 941, W-2, 1099)

- Ensuring compliance with state and federal regulations

- Employee self-service portals

- Time tracking integration

How Do Payroll Services Save Time and Money?

1. Automating Time-Consuming Tasks

From calculating hours and tax deductions to processing payments — payroll can eat up hours weekly. A payroll service automates these tasks, saving you time every pay period.

2. Avoiding Penalties and Compliance Issues

Tax regulations are complex and constantly changing. Professional payroll providers stay up to date, reducing your risk of errors, late filings, or incorrect deductions.

3. Streamlining Tax Filing

Payroll providers often file and pay taxes on your behalf, complete with reports and year-end forms like W-2s and 1099s saving you both time and money spent on accountants.

4. Reducing Overhead Costs

Hiring a full-time payroll specialist or HR team costs significantly more than outsourcing. With payroll services, you pay only for what you need.

5. Increasing Employee Satisfaction

Accurate, on-time paychecks, along with access to self-service portals for pay stubs and tax forms, lead to happier employees and fewer HR inquiries.

Pros and Cons of Professional Payroll Services

Pros

- Saves time by automating repetitive tasks

- Reduces tax filing errors and penalties

- Scales with your business size

- Enhances employee satisfaction

- Helps with compliance and reporting

Cons

- May have monthly or per-employee fees

- Less control compared to in-house payroll

- Needs strong data security protocols

- Not all providers offer personalized support

- Can be costly for micro businesses with very few employees

Real-World Example

A 10-person digital agency was spending nearly 8 hours a month on payroll. After switching to a professional service, they cut that time down to under 30 minutes monthly, avoided a $1,200 tax penalty, and improved payroll accuracy — all for less than the cost of one part-time admin assistant.

FAQs About Professional Payroll Services

Q1: Is it worth outsourcing payroll for a small team?

Yes. Even with just a few employees, payroll mistakes can be costly. Outsourcing saves time and ensures compliance, which is crucial for small teams with limited internal resources.

Q2: What’s the typical cost of payroll services?

Most services charge a base fee (e.g., $30–$100/month) plus a per-employee fee ($3–$15). The cost depends on your business size and the features you need.

Q3: Do payroll services handle tax filings automatically?

Many professional payroll providers offer full-service tax filing, including quarterly returns, year-end forms (W-2/1099), and electronic payments to federal and state agencies.

Q4: Can payroll services integrate with time tracking or accounting tools?

Yes. Leading providers integrate with platforms like QuickBooks, Xero, and time-tracking tools, making data flow seamless.

Q5: Is employee data secure with a payroll provider?

Reputable providers use encrypted data transmission, secure portals, and industry-standard compliance practices. Always check their security certifications.

Final Thoughts

Running payroll might not feel like a business growth task — but doing it poorly can hold your business back. Whether you're a startup or an established small business, outsourcing your payroll can free up time, prevent mistakes, and ultimately save you money.

Looking to simplify your payroll process?

Explore Monily’s professional payroll services and discover how we help businesses like yours reduce overhead, stay compliant, and keep employees paid on time.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.