India Foreign Exchange Market Trends, Growth Drivers, Size and Future Opportunities By 2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Foreign Exchange Market- India

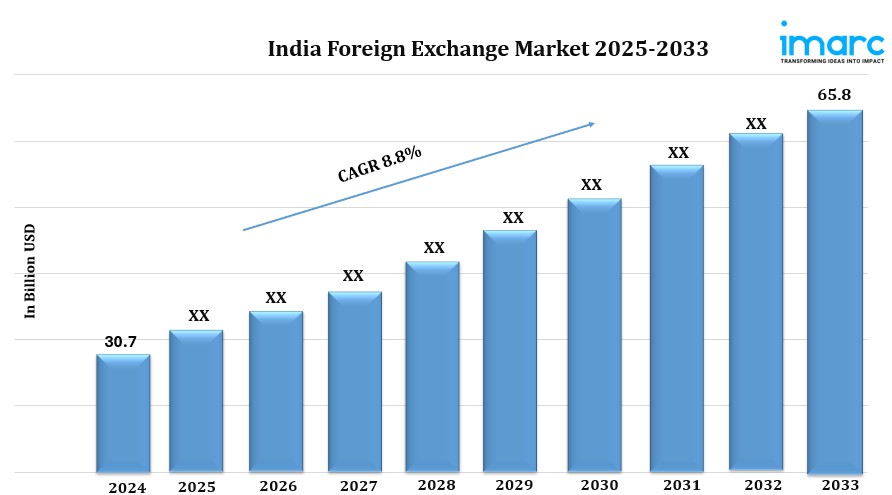

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 8.8% (2025-2033)

Market Size in 2024: USD 30.7 Billion

Market Size in 2033: USD 65.8 Billion

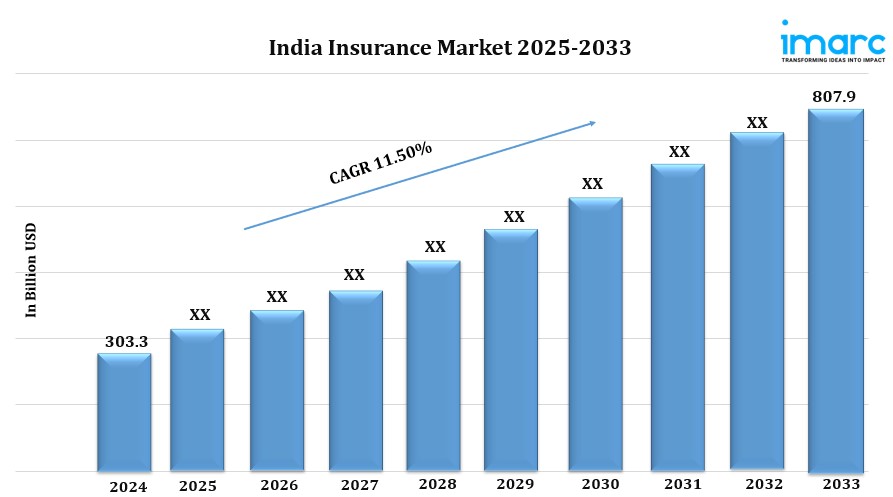

The India foreign exchange market facilitates currency trading, influencing international trade, investments, and monetary policies, driving economic growth. According to the latest report by IMARC Group, the market size reached USD 30.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 65.8 Billion by 2033, exhibiting a growth rate (CAGR) of 8.8% during 2025-2033.

India Foreign Exchange Market Trends and Drivers:

Expansion of International Trade and Investment Activities

- Growth of global trade and investments increases demand for foreign currency transactions.

- Key sectors such as energy, IT services, and pharmaceuticals driving foreign exchange demand.

Rise in Foreign Direct Investment (FDI) and Portfolio Investments

- Growing inflow of FDI and portfolio investments boosts forex market activity.

Global Expansion of Indian Companies

- Increasing number of Indian companies expanding internationally contributes to forex demand.

Increased Demand for Foreign Currencies

- Rising needs for foreign currencies due to travel, education, and remittances.

Favorable Government Policies

- Liberalized norms for foreign investments and trade encourage forex market growth.

Technological Advancements

- Adoption of online trading platforms and digital payment solutions enhances forex trading efficiency.

- Algorithmic trading and AI-driven technologies improving transaction speed and accuracy.

RBI Initiatives to Mitigate Currency Risks

- Promotion of currency hedging tools and derivatives to assist businesses in managing risks.

Emerging Interest in Cryptocurrencies and Blockchain

- Potential for cryptocurrencies and blockchain technology to reduce cross-border payment costs.

Growth of Fintech Solutions

- Increasing role of fintech in providing innovative forex solutions, accelerating market growth.

India Foreign Exchange Market Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India foreign exchange market trends. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Breakup by Counterparty:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

Breakup by Type:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Breakup by Region:

- South India

- North India

- West & Central India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.