Investment Portfolio Management Software: Features, Benefits & Enterprise Impact

Investment Portfolio Management Software: Features, Benefits & Enterprise Impact

In the ever-evolving financial landscape, enterprises managing diverse and large-scale investments can no longer rely on spreadsheets or manual tracking. Investment Portfolio Management Software has become essential for CFOs, asset managers, and finance leaders to maintain visibility, ensure compliance, and drive stronger investment returns across multiple regions, currencies, and legal entities.

What Is Investment Portfolio Management Software?

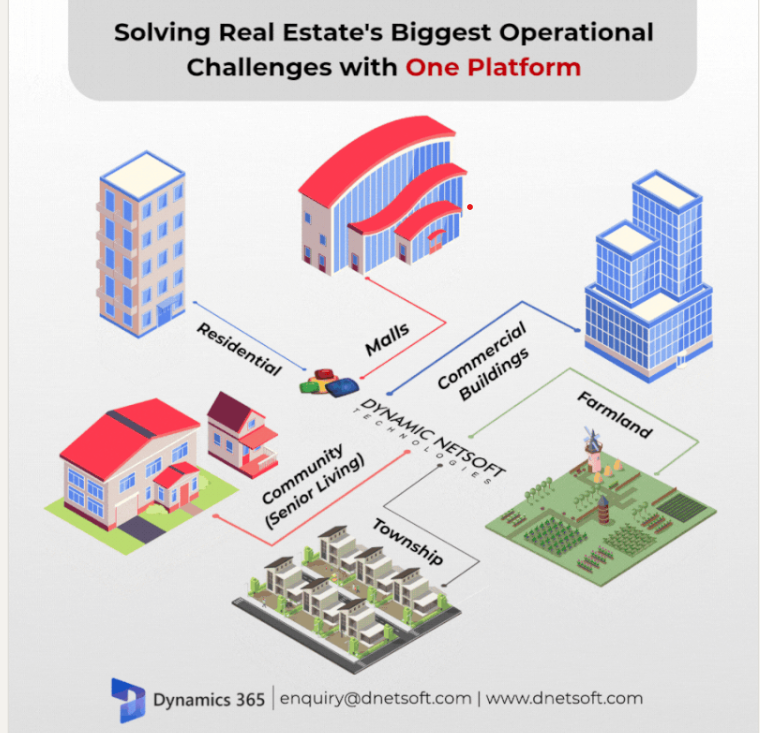

This specialized software helps organizations manage financial assets with real-time tracking, risk analysis, and performance optimization. Unlike tools built for personal finance, enterprise-grade platforms are designed to handle multi-company structures, multi-currency transactions, and regulatory compliance on a global scale.

It goes beyond tracking, enabling automated rebalancing, seamless reporting, and integration with ERP systems for complete financial visibility.

Who Benefits from This Software?

Investment Firms & Asset Managers

Manage client portfolios with accuracy and transparency, reducing overhead and human error.

Corporate Finance Teams

Oversee internal investments, long-term reserves, and strategic assets.

Banks & Financial Institutions

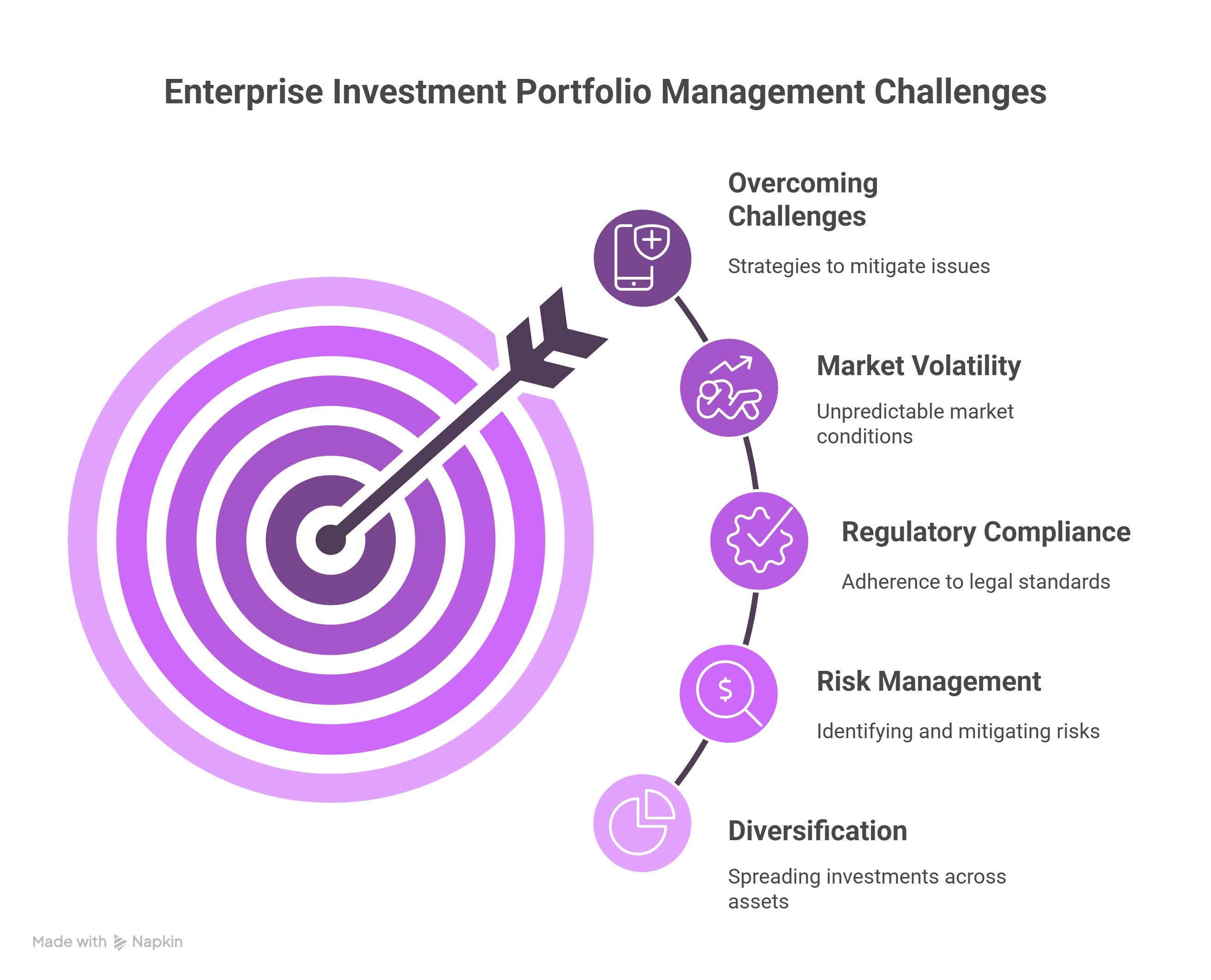

Optimize asset allocation, diversification, and ensure compliance with evolving regulations.

Public Sector & Government Bodies

Manage long-term investments like pension funds and education trusts with complete auditability.

Must-Have Features in Enterprise Portfolio Management

Asset Allocation & Auto-Rebalancing

Automatically distribute and rebalance funds across equities, fixed income, real estate, and alternative assets as markets fluctuate.

Risk Management & Compliance

Built-in rules and alerts help identify exposure, reduce risk, and stay compliant with standards like IFRS 9 and Basel III.

Real-Time Tracking & Dashboards

Visualize performance, gains/losses, and asset weightings live to support faster, data-driven decisions.

Multi-Entity & Multi-Currency Handling

Essential for firms operating across geographies, supporting local regulations and currency conversions.

Automated Reporting

Generate investor reports, audit logs, and board summaries in a single click, saving time and effort.

Seamless ERP & BI Tool Integration

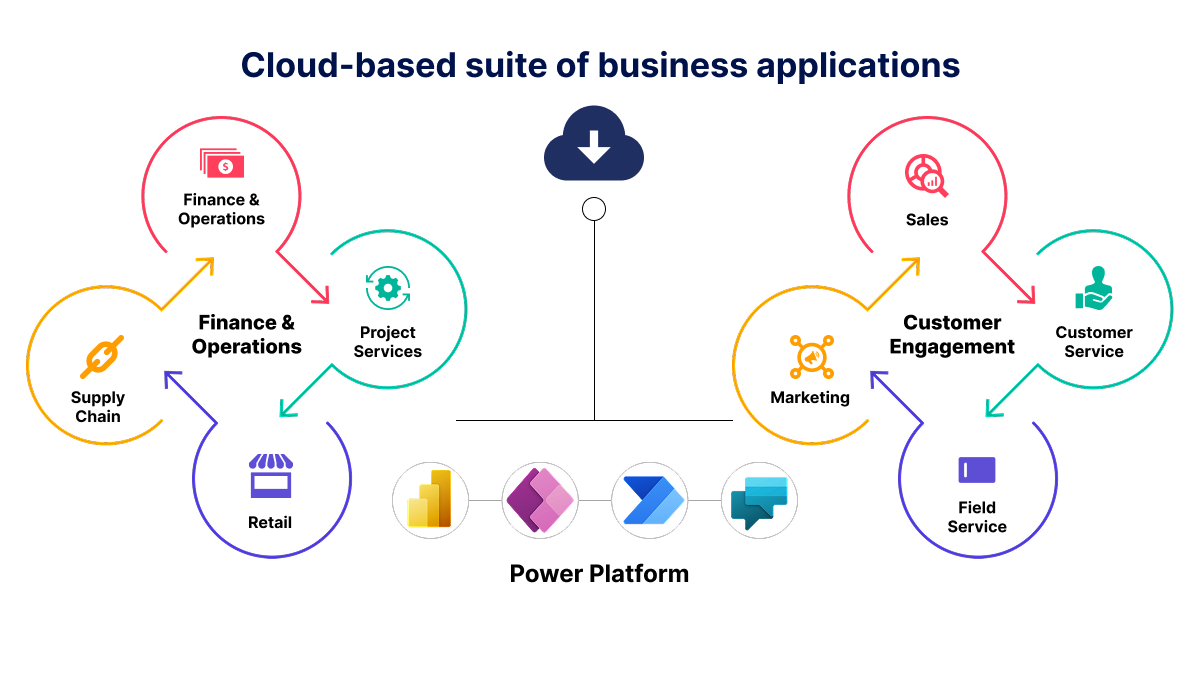

Sync data with Microsoft Dynamics 365, Excel, and Power BI for a unified financial view.

Why Integrate with Microsoft Dynamics 365?

Most enterprises already use Microsoft Dynamics 365 Finance & Operations for core financial management. Integrating it with investment portfolio software offers:

Real-Time Investment Data inside your ERP

Automated Journal Entries and reconciliations

Streamlined Compliance with centralized data

Elimination of Data Silos, improving team collaboration

🔍 Example: A multinational group with 15 subsidiaries across 6 countries used our integrated solution to cut reporting time by 80% and reduce portfolio risk by 30%.

Benefits for Enterprise Finance Teams

Smarter investment decisions with accurate insights

Less manual work through automation

Improved internal collaboration

Risk reduction through real-time alerts

Higher ROI through better asset distribution

Future Trends to Watch

As AI and machine learning continue to evolve, expect portfolio software to offer predictive investment modeling, automated compliance audits, and even scenario simulations for high-stakes decision-making.

Ready to Upgrade?

If you're overseeing complex investments and looking to streamline operations, enhance transparency, and improve returns, our enterprise-grade solution is built for you.

Conclusion

Investment Portfolio Management Software is no longer a luxury; it's a strategic necessity for modern enterprises handling complex, multi-entity investments. With real-time visibility, automation, and integration with tools like Microsoft Dynamics 365, organizations can reduce risk, boost performance, and ensure financial compliance at scale. For finance teams aiming to modernize their operations and maximize ROI, adopting a robust portfolio management solution is a clear step toward long-term growth and stability.

Explore your options today, streamline, scale, and stay ahead

📞 Book a Free Demo

📩 Download the Full Product Brochure

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.