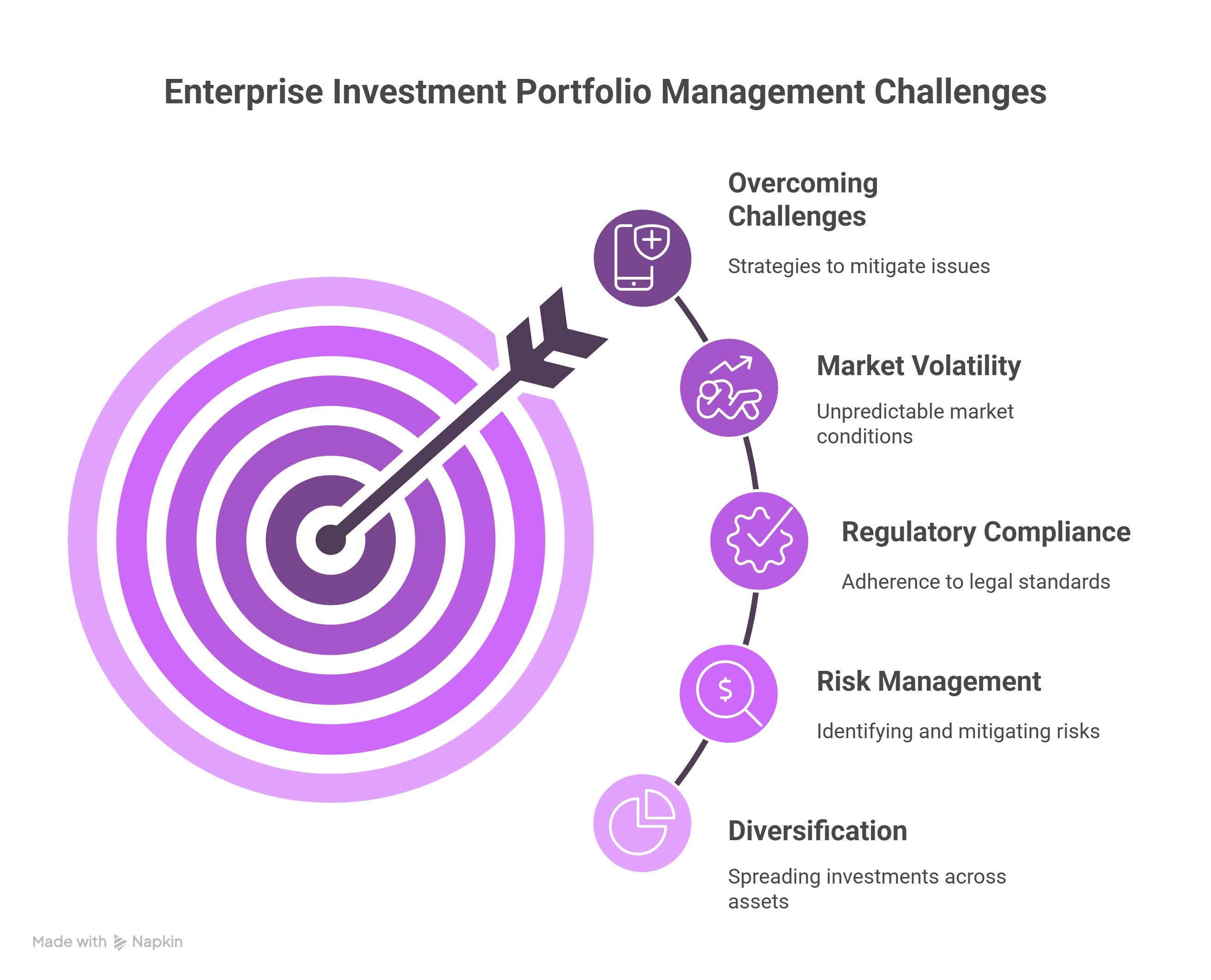

The Top 7 Difficulties in Managing an Enterprise Investment Portfolio and How to Solve Them

Enterprise investment portfolio management has evolved from a back-office task to a strategic objective in the increasingly intricate and dynamic financial sector. Today's businesses oversee enormous, varied portfolios that comprise fixed income, alternative assets, equity investments, and real estate. Organizations encounter several difficulties that might impede performance, transparency, and expansion, including increasing regulatory requirements, increasing data complexity, and the requirement for real-time decision-making.

The top seven obstacles to managing a corporate investment portfolio are examined in this article, along with workable remedies, such as utilizing cutting-edge platforms like Dynamics 365 Investment Solution.

1. Lack of Visibility and Data Fragmentation

Fragmented data is one of the largest obstacles to enterprise-level investment management. Investment data is frequently dispersed over several departments, systems, and even spreadsheets, resulting in data silos that hinder a cohesive portfolio view.

Why it's an issue: Organizations suffer from missed opportunities, inaccurate forecasts, and reporting delays when they lack centralized access to investment data.

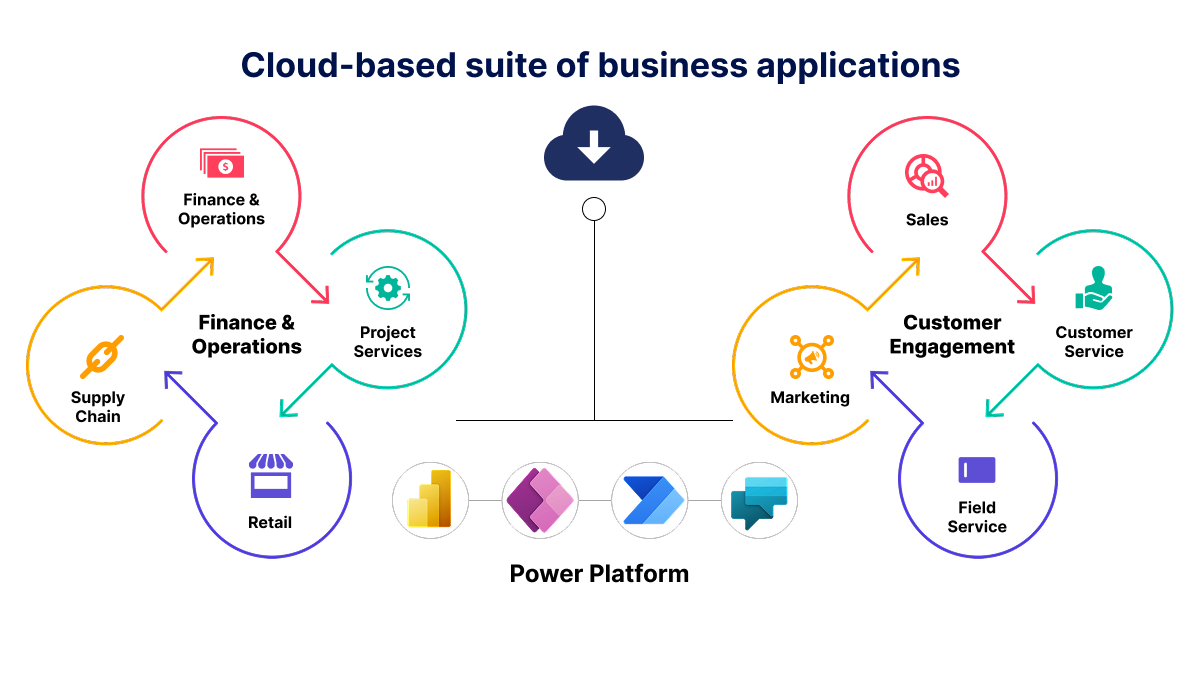

The solution is to put in place a single platform for investment management that aggregates data from various asset classes and departments. A single source of truth is provided by programs like Dynamics 365 Investment, which facilitates smooth data integration throughout the company and real-time visibility.

2. Ineffective Risk Control

Effective risk management gets harder as portfolios get more global and diverse. Businesses must keep an eye on operational, credit, market, and geopolitical risks, frequently in real time.

Why it's an issue: Inadequate knowledge of portfolio risk in real time can result in bad choices, monetary losses, and harm to one's reputation.

How to get around it: Make use of tools that provide automated alerts, scenario modeling, and real-time risk dashboards. Organizations may reduce possible dangers before they become more serious by using sophisticated technologies like Dynamics 365, which enable risk exposure to be evaluated instantaneously.

3. Outdated Systems and Manual Procedures

To manage investments, a lot of businesses still use outdated systems or Excel spreadsheets. These approaches take a lot of effort, are prone to mistakes, and can't keep up with expanding portfolios.

Why it's an issue: Manual input reduces agility, slows down procedures, and raises the possibility of errors.

The solution is to switch to cloud-based, automated technologies that automate repetitive processes and optimize workflows. By digitizing crucial procedures like data collection and reporting, the Dynamics 365 Investment solution frees up teams to concentrate on strategic research.

4. Complex Multi-Entity & Multi-Currency Accounting

For global enterprises managing investments across jurisdictions, handling multiple legal entities and currencies can become overwhelming.

Why it’s a problem:

Inconsistent accounting methods, currency fluctuations, and a lack of consolidation tools make financial reporting highly complex and error-prone.

How to overcome it:

Adopt an investment management system that supports multi-entity, multi-currency, and multi-GAAP reporting. Dynamics 365 is built to accommodate enterprise-scale operations, simplifying international compliance and financial consolidation.

5. Regulatory Compliance & Audit Pressure

As regulatory bodies tighten oversight, enterprises must ensure investment activities comply with multiple frameworks — including GAAP, IFRS, SOX, and ESG mandates.

Why it’s a problem:

Non-compliance can result in hefty fines, audit failures, and stakeholder distrust.

How to overcome it:

Utilize platforms with built-in compliance features, audit trails, and customizable reporting. The Dynamics 365 Investment solution enables proactive compliance management with real-time documentation and regulatory alignment.

6. Lack of Real-Time Performance Insights

Traditional systems often deliver performance reports in batches, leading to reactive rather than proactive investment decisions.

Why it’s a problem:

Delayed insights hinder timely actions that could improve returns or reduce risk.

How to overcome it:

Invest in real-time performance monitoring tools that deliver interactive dashboards, KPIs, and analytics. With Dynamics 365, decision-makers can access up-to-the-minute investment data, ensuring informed, agile portfolio adjustments.

7. Scaling Portfolio Management Across Asset Classes

Managing multiple asset classes, including real estate, fixed income, equities, and private equity across different platforms, creates inefficiencies and blind spots.

Why it’s a problem:

Fragmented asset tracking leads to duplicated efforts, poor visibility, and a lack of strategic cohesion.

How to overcome it:

Leverage enterprise-grade solutions that support end-to-end asset class management. Dynamics 365 Investment solution offers scalability to manage diverse investments in a unified framework, supporting both operational efficiency and strategic oversight.

In conclusion

In 2025, enterprise investment portfolio management will be about more than just asset tracking; it will be about facilitating large-scale, data-driven, and intelligent decision-making. To remain competitive, organizations need to tackle data fragmentation, gaps in risk visibility, compliance issues, and antiquated procedures.

Businesses may increase portfolio performance, guarantee compliance, improve operations, and obtain real-time insights by implementing contemporary technologies like the Dynamics 365 Investment solution.

The correct technology is the first step toward better investment management, and the moment to take action is now.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

![What’s New in Dynamics 365 Implementation? [2025 Update Overview]](https://indibloghub.com/public/images/courses/686d1a9112af2552_1751980689.jpg)