Social Media Content Packs – Stay Active Without Lifting a Finger!

Social Media Content Packs – Stay Active Without Lifting a Finger!

The Evolution of Family Health Insurance: Key Trends and Innovations

Written by Aakash » Updated on: June 17th, 2025

In today's world, healthcare is one of the most crucial considerations for families. The rapid advancements in medical treatments, the rising costs of healthcare, and the increasing awareness about the importance of preventive care have made health insurance a vital part of financial planning. Over the years, the concept of family health insurance has evolved significantly, adapting to meet the growing needs and challenges of modern-day families.

Gone are the days when family insurance for health simply meant covering hospitalisation costs. Today, it encompasses a wide range of services, from preventive care and maternity coverage to wellness programmes and telemedicine consultations. Innovations in health insurance policies for families have made it more accessible, affordable, and flexible, providing families with comprehensive protection against the financial impact of healthcare costs.

If you are wondering what changes the health insurance sector has made in the past few years, don't worry. This article delves into the key trends and innovations in family health insurance that have shaped its evolution and will help you secure the best mediclaim policy for family.

Historical Context of Family Health Insurance

Family health insurance has its roots in traditional models where coverage was often generic and one-size-fits-all. Policies typically included basic hospitalisation benefits without much flexibility or personalisation. However, as healthcare costs soared and medical technology advanced, families began seeking more comprehensive coverage that could address specific needs.

Historically, family floater plans were popular as they allowed families to pool their resources under a single policy. While this model offered convenience, it often lacked the customisation necessary to cater to individual family members' unique health requirements. This limitation sparked a demand for more tailored solutions in the insurance market.

Key Trends in Family Health Insurance

In this digital era, the health insurance sector has also evolved rapidly, offering ease to the policyholders. Here are some of the key trends that have shaped the health insurance sector now:

Shift from Hospitalisation-Centric to Comprehensive Coverage

Traditionally, health insurance policies for families focused primarily on covering hospitalisation expenses. This meant that families were protected against major medical expenses such as surgeries, emergency care, and inpatient treatments. In recent years, however, family insurance plans have expanded to offer more comprehensive coverage. Today’s policies not only cover hospitalisation but also include outpatient treatments, diagnostic tests, health check-ups, vaccinations, and even mental health services.

These modern policies ensure that families have access to a wide array of services, reducing the burden of medical expenses across various aspects of healthcare.

Rise of Preventive Healthcare and Wellness Benefits

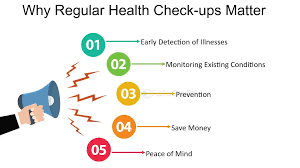

As the focus on health and wellness has grown in recent years, so has the recognition of the importance of preventive care. Many insurers now offer wellness benefits, such as discounts on gym memberships, coverage for annual health check-ups, vaccinations, and screenings for chronic conditions like diabetes and heart disease. These preventive services help families stay healthy and detect potential health issues early, reducing the need for more expensive treatments down the line.

By integrating wellness and preventive healthcare into family insurance plans, insurers are promoting a proactive approach to health that reduces healthcare costs and improves policyholders' quality of life.

Telemedicine: The New Normal for Family Healthcare

Telemedicine or virtual consultations allow patients to consult with doctors and healthcare professionals remotely. This trend has gained massive popularity due to its convenience, accessibility, and cost-effectiveness. This is particularly valuable for families with young children, elderly members, or individuals with mobility issues, who may find it difficult to visit healthcare facilities in person.

Telemedicine also helps reduce the pressure on overcrowded hospitals and clinics, enabling healthcare professionals to prioritise more urgent cases. By integrating telemedicine into the best health insurance plans, insurers ensure that families have access to timely and effective healthcare, even in challenging circumstances.

Customisation and Flexibility in Insurance Plans

The needs of a family can vary greatly depending on its size, age, lifestyle, and health status. Traditionally, family health insurance plans were standardised, offering the same coverage to all family members, regardless of their individual needs. However, today’s family insurance policies are becoming more customisable and flexible.

Insurers now offer plans that allow policyholders to tailor their coverage to suit the unique needs of each family member. Additionally, insurers may offer different levels of coverage for adults and children, ensuring that each member of the family is adequately protected. This flexibility allows families to optimise their coverage and ensure that they have the best mediclaim policy for family needs without paying for unnecessary services or going without the coverage they need.

Digital Health Tools and Mobile Apps

Technology has made healthcare more accessible and easier to manage, and health insurers are now incorporating digital tools and mobile apps into their health insurance plans for families. These tools allow policyholders to track their health, access medical records, schedule appointments, and even submit claims online.

In addition, some insurers offer rewards or incentives for using these digital tools, such as discounts on premiums or wellness benefits. This integration of technology into health insurance plans is helping families manage their healthcare more efficiently and effectively.

Mental Health Coverage

With the increasing prevalence of mental health conditions such as anxiety, depression, and stress, insurers are recognising the importance of including mental health coverage in health insurance plans.

Many modern and best health insurance policies now cover a range of mental health services, including therapy, counselling, psychiatric treatments, and inpatient care for mental health conditions. This is particularly important for families, as mental health issues can affect multiple members, and early intervention is key to managing these conditions effectively.

Final Thoughts

As the health insurance industry continues to evolve, choosing the best health insurance plan for your family is more important than ever. The right policy will provide the comprehensive coverage your family needs, including hospitalisation, preventive care, mental health services, and telemedicine access. By carefully evaluating your family’s health needs and considering the latest innovations in health insurance, you can make an informed decision that ensures your family is protected from unexpected medical expenses.

Niva Bupa is a well-known insurance industry that understands the importance of having the right health insurance coverage for your family. Their family insurance plans are designed to offer flexibility, comprehensive protection, and the peace of mind that comes with knowing your loved ones are covered. With a range of benefits, including wellness programmes, mental health support, and telemedicine services, Niva Bupa provides the best mediclaim policy for family needs.

So, wait no more and explore their health insurance plans for families today and take the first step towards securing your family’s health and financial future.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.