Lifetime Link Placements – No Expiry. 100% Index Guarantee!

Lifetime Link Placements – No Expiry. 100% Index Guarantee!

Understanding Fintech: How Technology is Changing Banking

Written by olivia » Updated on: June 17th, 2025

Introduction

The banking industry has undergone significant transformation in recent years, primarily driven by the advent of financial technology, or fintech. This evolution, often referred to as digital transformation in banking, is reshaping how financial institutions operate, interact with customers, and deliver services. Fintech encompasses a broad range of technologies designed to improve and automate the delivery of financial services. From mobile banking and digital wallets to blockchain and artificial intelligence, fintech is revolutionizing the banking sector in unprecedented ways.

The Emergence of Fintech

Fintech, a portmanteau of "financial technology," refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers. The origins of fintech can be traced back to the 1950s with the advent of credit cards, but its rapid growth began in the early 21st century with the proliferation of smartphones and high-speed internet. These advancements created a fertile ground for fintech startups, which began to challenge traditional banking models by offering more efficient, user-friendly, and cost-effective financial services.

Mobile Banking and Digital Wallets

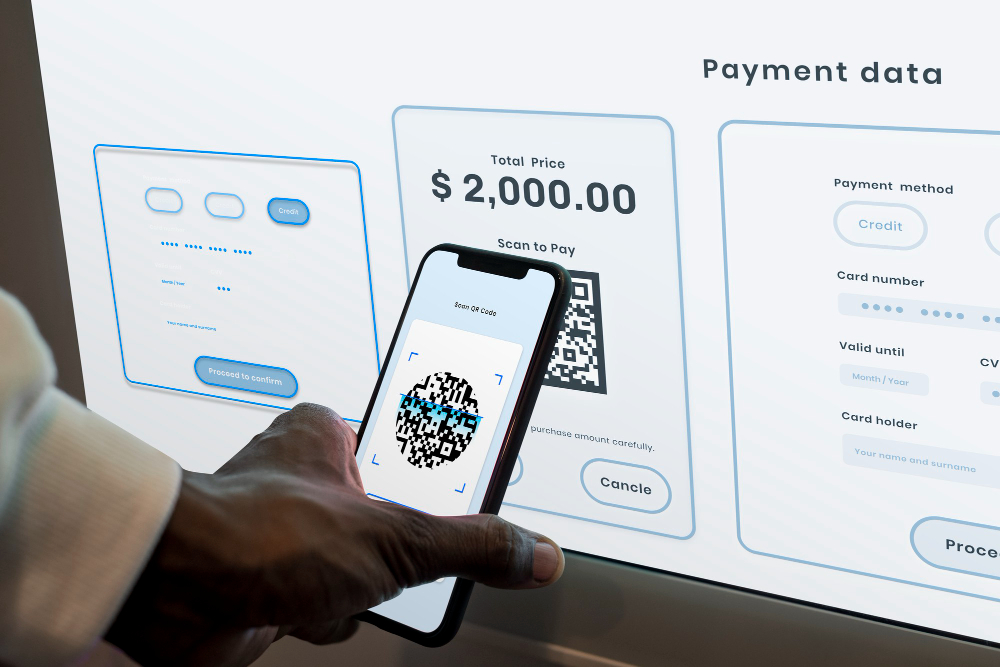

One of the most significant impacts of digital transformation in banking has been the rise of mobile banking. Mobile banking apps have made it possible for customers to perform a wide range of banking activities from their smartphones, including checking account balances, transferring money, paying bills, and even applying for loans. This convenience has led to a significant increase in the adoption of mobile banking services.

Digital wallets, such as Apple Pay, Google Wallet, and PayPal, have also become increasingly popular. These wallets allow users to store their payment information securely and make transactions quickly and easily without the need for physical cards or cash. The integration of digital wallets with mobile banking apps has further streamlined the customer experience, making financial transactions more seamless than ever before.

Blockchain and Cryptocurrencies

Blockchain technology is another major driver of digital transformation in banking. Originally developed as the underlying technology for Bitcoin, blockchain is a decentralized digital ledger that records transactions across multiple computers in a way that ensures the data cannot be altered retroactively. This technology has the potential to revolutionize the banking industry by providing a more secure, transparent, and efficient way to process transactions.

Cryptocurrencies, which are digital or virtual currencies that use cryptography for security, are built on blockchain technology. While Bitcoin is the most well-known cryptocurrency, there are now thousands of different cryptocurrencies available. Banks and financial institutions are exploring ways to integrate cryptocurrencies and blockchain technology into their operations to improve security, reduce costs, and increase efficiency.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are playing an increasingly important role in digital transformation in banking. These technologies are being used to analyze large volumes of data, identify patterns, and make predictions, which can help banks make more informed decisions and offer more personalized services to their customers.

For example, AI-powered chatbots are being used to provide customer support, answer common questions, and assist with transactions. These chatbots can handle a large number of interactions simultaneously, providing quick and efficient service to customers while freeing up human agents to handle more complex issues.

Machine learning algorithms are also being used to detect fraudulent activity by analyzing transaction data and identifying unusual patterns that may indicate fraud. This allows banks to respond to potential threats more quickly and effectively, reducing the risk of financial loss.

Open Banking and API Integration

Open banking is another key aspect of digital transformation in banking. Open banking refers to the practice of banks and financial institutions sharing their data with third-party providers through application programming interfaces (APIs). This allows third-party developers to create new applications and services that can interact with a bank's systems and data.

The goal of open banking is to promote competition and innovation in the financial services industry by enabling customers to share their financial data with multiple service providers. This can lead to the development of new financial products and services that are better tailored to customers' needs, ultimately improving the overall customer experience.

Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is another technology that is driving digital transformation in banking. RPA involves the use of software robots or "bots" to automate repetitive, rule-based tasks that were previously performed by humans. This can include tasks such as data entry, account reconciliation, and compliance reporting.

By automating these tasks, banks can improve efficiency, reduce errors, and lower operational costs. RPA also frees up employees to focus on more strategic and value-added activities, such as customer service and business development.

Enhancing Customer Experience

One of the primary goals of digital transformation in banking is to enhance the customer experience. Fintech innovations are enabling banks to offer more personalized, convenient, and efficient services to their customers. For example, many banks now offer personalized financial advice and product recommendations based on customers' spending habits and financial goals.

Moreover, digital transformation has made banking services more accessible to a broader audience. Mobile banking apps and digital wallets have made it easier for people in remote or underserved areas to access financial services. This increased accessibility is helping to promote financial inclusion and reduce the gap between the banked and unbanked populations.

Challenges and Future Outlook

While digital transformation in banking offers numerous benefits, it also presents several challenges. One of the main challenges is ensuring the security and privacy of customer data. As banks adopt new technologies and open up their systems to third-party providers, they must implement robust security measures to protect against cyber threats and data breaches.

Another challenge is managing the regulatory and compliance requirements associated with digital banking. Banks must navigate a complex and evolving regulatory landscape to ensure they remain compliant with all relevant laws and regulations.

Despite these challenges, the future of digital transformation in banking looks promising. As technology continues to evolve, we can expect to see even more innovative solutions that will further enhance the efficiency, security, and customer experience in the banking industry.

Conclusion

Fintech is at the forefront of digital transformation in banking, driving significant changes in how financial institutions operate and interact with customers. From mobile banking and digital wallets to blockchain and artificial intelligence, fintech is revolutionizing the banking sector and offering numerous benefits to both banks and their customers. As technology continues to advance, the banking industry must adapt and embrace these innovations to remain competitive and meet the evolving needs of their customers.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.