USA Company Formation - Answer to Your Queries

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

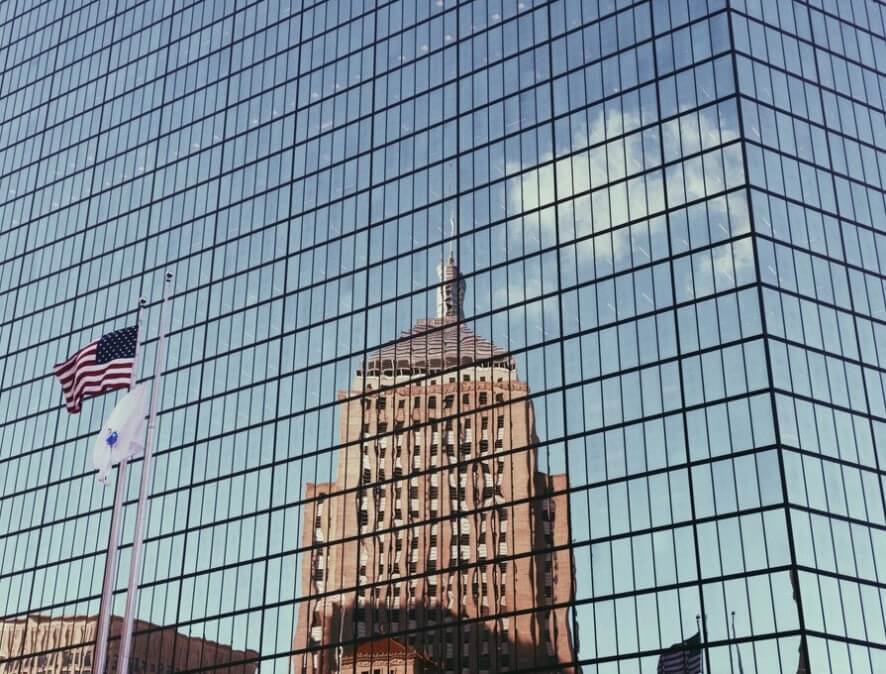

Are you ready to tap into one of the world’s largest and most lucrative markets? Forming a company in the USA is not only feasible but can also be incredibly rewarding with the right guidance. In this comprehensive guide, we will answer your most pressing questions about USA company formation, empowering you to make informed decisions and seize opportunities that wait in this vibrant economy.

Why Choose to Register a Company in the USA?

The U.S. offers several key advantages for businesses:

Access to a Large Market: The U.S. is home to millions of consumers, providing significant potential to boost sales and grow your business. The vast domestic market and its position as a global economic leader make it a prime location for expanding your operations.

Favorable Business Environment: The U.S. legal framework protects businesses and encourages entrepreneurship. With strong intellectual property laws and a transparent regulatory system, the U.S. provides a stable environment for businesses to thrive. This makes it easier to operate and ensure long-term success.

Tax Benefits: Certain states provide tax incentives and business-friendly policies, making the U.S. an attractive destination for new companies. States like Delaware, Nevada, and Wyoming offer favorable tax structures and minimal state-level taxes, enhancing your bottom line.

Types of Business Entities You Can Form

When registering a company in the USA, you have several entity types to choose from, each offering distinct benefits depending on your business goals:

Limited Liability Company (LLC): Combines flexibility in management with liability protection. An LLC offers personal liability protection for its owners (members) and avoids double taxation, making it a popular choice for small to mid-sized businesses.

Corporation (C-Corp or S-Corp): Ideal for businesses looking to attract investors or issue shares. A C-Corp is suited for businesses planning to scale, issue stock, or seek venture capital. An S-Corp, on the other hand, allows profits and losses to pass through directly to shareholders' tax returns, avoiding double taxation.

Partnership: Best for businesses with multiple owners who share responsibilities. Partnerships can be a general partnership (where all partners share liability) or a limited partnership (where some partners have limited liability).

Sole Proprietorship: Suitable for individuals who want to run a business without formal incorporation. This structure is simple and inexpensive to establish, but it does not provide liability protection for the owner.

Selecting the right structure is crucial, as each entity has its own unique advantages, tax implications, and legal requirements. Understanding which structure aligns with your goals is an essential first step in the formation process.

Steps to Register Your Company in the USA

Here’s a step-by-step breakdown of the process:

1. Decide on Your Business Structure: Choose the entity type that aligns with your business goals and future vision.

2. Select a State of Incorporation: States like Delaware, Nevada, and Wyoming are popular for their business-friendly regulations and favorable tax policies. You will need to choose one based on your business needs and the benefits offered by the state.

3. File Formation Documents: Submit the necessary paperwork, such as Articles of Incorporation or Certificates of Formation, with the Secretary of State. This document outlines key information about your business, including its name, address, and purpose.

4. Appoint a Registered Agent: A registered agent is responsible for receiving legal documents on behalf of your company. Many states require businesses to designate a registered agent with a physical address in the state of incorporation.

5. Obtain an Employer Identification Number (EIN): This is required for tax purposes and to open a U.S. business bank account. You can apply for an EIN through the Internal Revenue Service (IRS) website.

Comply with Ongoing Requirements: After formation, you will need to stay compliant with state and federal requirements, including annual filings, renewals, and reports, to keep your company in good standing.

How Long Does Company Registration Take?

The timeframe for registering a company in the USA varies by state but typically takes anywhere from a few days to several weeks, depending on the complexity of the business structure and the state’s processing times. Some states offer expedited services if you need faster processing.

Do You Need to Be a U.S. Resident to Register a Company?

No, non-residents can form a company in the USA. Many states allow foreign nationals to register businesses without U.S. citizenship or residency. However, a U.S. business address and registered agent are generally required for legal and regulatory purposes.

How We Can Help

Forming a company in the USA can seem like a complex process, but with the right guidance, it becomes a straightforward and rewarding experience. Our team of experts is here to provide personalized assistance tailored to your specific needs. We will guide you through the registration process, help you choose the right business structure, and ensure that all your legal and tax requirements are met.

Contact us today for expert advice and start your journey to success in the U.S. market!

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.