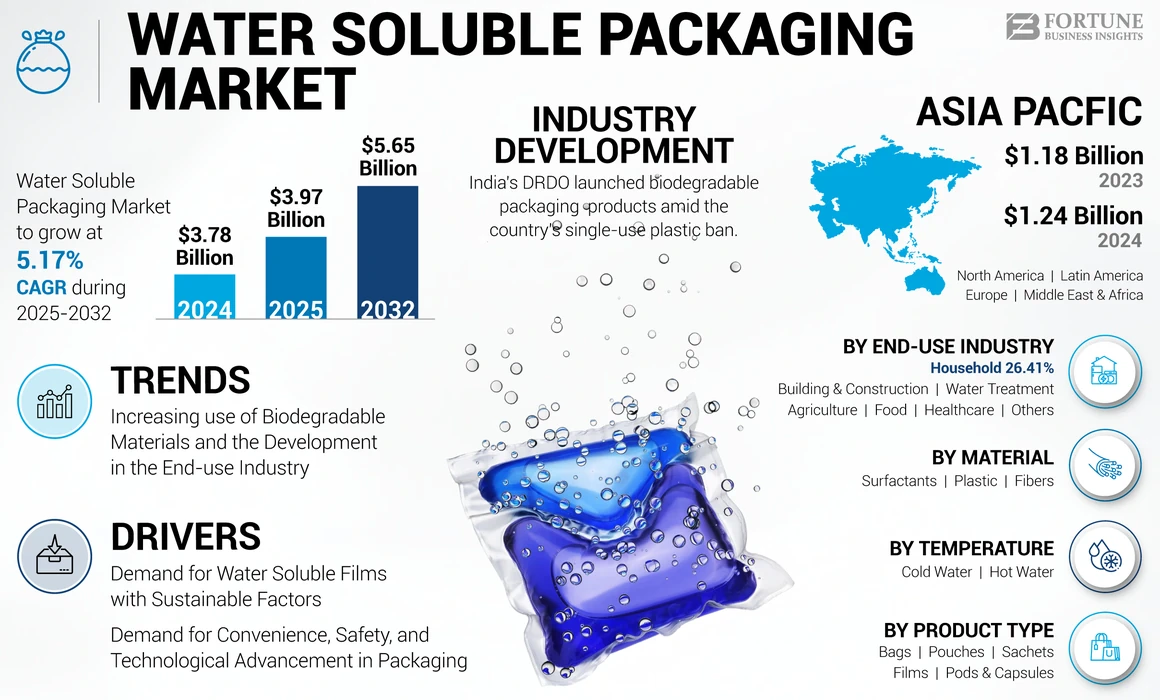

Water Soluble Packaging Market Global Reports, Opportunities, Trends & Forecast 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In 2024, the global water soluble packaging market was valued at USD 3.78 billion. It is expected to rise to USD 3.97 billion in 2025 and reach USD 5.65 billion by 2032, registering a compound annual growth rate (CAGR) of 5.17% during the forecast period. Asia Pacific led the market, accounting for a 38.99% share in 2024. This growth is largely driven by rising environmental concerns, stringent government regulations against plastic use, and shifting consumer preferences toward biodegradable materials.

Market Drivers

One of the primary factors contributing to the growth of the water-soluble packaging market is the global push for environmental sustainability. As environmental awareness spreads among both governments and consumers, the demand for packaging materials that decompose without harming the environment has significantly increased. Water-soluble packaging, made primarily from polyvinyl alcohol (PVA), dissolves easily in water without leaving harmful residues. This makes it a compelling alternative to conventional plastic packaging, especially in regions where single-use plastics are heavily restricted or banned.

Furthermore, the ease of use and convenience associated with water-soluble packaging is another key driver. These packaging solutions are widely used in products like laundry detergents, dishwasher pods, and agricultural chemicals, where users can handle them without direct contact with the contents. This reduces the risk of exposure to potentially harmful substances and enhances consumer safety.

The rise in demand from the agriculture and healthcare sectors has also been instrumental in supporting market growth. In agriculture, water-soluble packaging is used for unit-dose packaging of pesticides and fertilizers, which reduces waste and prevents chemical exposure. In the healthcare industry, it is used for packaging soiled laundry and infectious waste, ensuring hygiene and safety during handling and transport.

List of Key Companies Profiled

Mondi (U.K.)

Sekisui Chemicals (Japan)

Kuraray Co. Ltd. (Japan)

Cortec Corporation (U.S.)

Arrow Greentech Ltd. (India)

Shandong Huazhilin Pharmaceutical Technology Co., Ltd. (China)

MSD Corporation (China)

Green Master Packaging (Australia)

Rovi Packaging (Spain)

Green Cycles (Spain)

Product Segmentation

Among the various product types, film-based water-soluble packaging holds the largest market share. These films, primarily made from polyvinyl alcohol, are known for their high solubility, transparency, and tensile strength. They are especially popular in single-use packaging applications across multiple industries. Other product types include pods, bags, and sachets, each catering to specific end-use applications.

Read More : https://www.fortunebusinessinsights.com/water-soluble-packaging-market-109514

Application Areas

The household and industrial cleaning sectors represent the largest application segments of the market. Laundry detergents, dishwasher pods, and industrial cleaners benefit from the safe, efficient, and user-friendly properties of water-soluble packaging. These applications offer portion-controlled solutions that eliminate product wastage and reduce exposure to concentrated cleaning agents.

The agrochemical industry is also witnessing increased adoption of water-soluble packaging due to its ability to reduce environmental contamination and enhance user safety. Unit-dose packaging for fertilizers, herbicides, and pesticides simplifies application and minimizes direct handling of chemicals.

In the healthcare sector, the packaging is increasingly used for infectious waste and soiled laundry in hospitals and nursing homes. Water-soluble bags offer hygienic handling of contaminated materials, which is especially crucial in maintaining infection control protocols.

Regional Insights

Regionally, Asia Pacific dominated the global water-soluble packaging market in 2024, contributing a significant portion of the overall revenue. The region's growth is attributed to increasing industrial activities, population growth, rising awareness of environmental issues, and government initiatives aimed at reducing plastic consumption. Countries such as China, India, Japan, and South Korea are leading the regional demand due to their strong manufacturing bases and large consumer populations.

North America follows Asia Pacific in terms of market share. The presence of well-established consumer goods and agrochemical industries, along with strict environmental regulations, supports the demand for eco-friendly packaging in the region. Consumers in the U.S. and Canada are highly aware of sustainable products, further fueling market expansion.

Europe also holds a substantial share of the water-soluble packaging market, driven by progressive environmental legislation and sustainability commitments by major brands. European countries have adopted stringent measures to eliminate non-degradable plastics, leading to a shift in packaging practices across sectors like household products, healthcare, and agriculture.

Emerging markets in Latin America and the Middle East & Africa are also expected to witness steady growth. Increasing awareness, rapid urbanization, and expanding agricultural and industrial sectors are opening up new opportunities for water-soluble packaging solutions in these regions.

Key Industry Developments

July 2023 – Notpla partnered with home care and detergent MACK and launched a sustainable clothes detergent sachet, marking Notpla’s first commercial application of its film material in a refill cleaning product line. The product is designed for laundry and homeware products; the packaging solutions dissolve in water and naturally biodegrade without leaving microplastic residue.

July 2022 – Hero Packaging launched the first ever 100% water soluble bags, Aquahero. The Australian company created a transparent reusable garment bag that looks and functions like the plastic version in its strength and transparency but is completely dissolved in boiling water in 30 seconds.

Challenges and Restraints

Despite its promising outlook, the water-soluble packaging market faces certain challenges. One of the primary concerns is the high cost of production. The raw materials and specialized manufacturing equipment required for producing water-soluble films are more expensive compared to traditional plastic packaging. This can act as a barrier, especially for small- and medium-scale manufacturers.

Another challenge is the limited resistance of water-soluble films to humidity and moisture. While the packaging is designed to dissolve in water, it must also maintain integrity during storage and transportation. Ensuring optimal performance under various environmental conditions can be difficult and often requires advanced barrier technologies.

Additionally, the compatibility of water-soluble films with certain chemical substances can be problematic. Some highly concentrated chemicals may prematurely dissolve or degrade the film, reducing its shelf life and effectiveness. Manufacturers must continuously innovate to improve the durability and chemical resistance of these packaging materials.

The global water-soluble packaging market is well-positioned for long-term growth, supported by strong demand from the household, agriculture, and healthcare sectors. Increasing consumer awareness, environmental regulations, and industry innovation are key drivers shaping the market’s future. While challenges related to production costs and material stability persist, ongoing technological advancements and the global shift toward sustainability are expected to sustain market momentum. As more industries adopt eco-friendly practices, water-soluble packaging will continue to emerge as a viable and attractive alternative to conventional plastic.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.