What is Financial Management Software? A Beginner’s Guide

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

A Simple Guide to Financial Management Software for Beginners

In today’s fast-paced digital world, managing your company’s finances manually isn’t just inefficient; it can be risky. As businesses grow, so do their financial complexities. This is where financial management software comes in.

Whether you're a startup founder, small business owner, or finance manager, understanding what financial management software is and how it can streamline your operations is essential. In this beginner-friendly guide, we’ll walk you through the basics, benefits, and how to choose the right solution for your business.

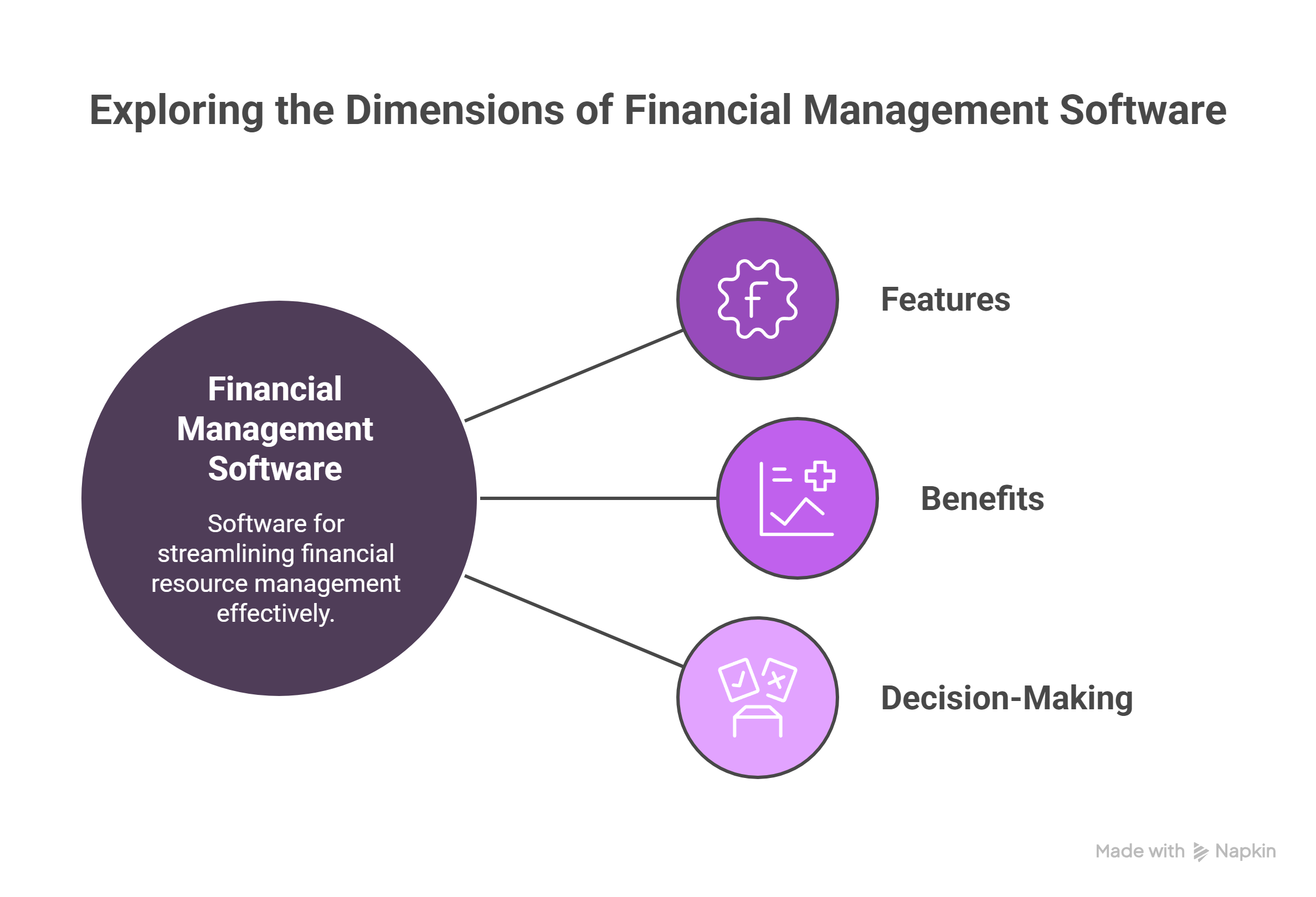

What is Financial Management Software?

Financial management software is a digital tool designed to help businesses track, manage, and analyze their financial operations. It automates and simplifies core financial tasks such as budgeting, invoicing, expense tracking, reporting, and forecasting.

At its core, this software provides real-time visibility into a company’s financial health, enabling better decision-making, improved accuracy, and reduced manual errors.

Key Features of Financial Management Software

Not all financial tools are created equal, but most high-quality platforms share the following core features:

🔹 Budgeting and Forecasting

Plan your finances based on historical data, predict future cash flows, and allocate resources more effectively.

🔹 Expense Tracking

Monitor where your money goes in real time. Automatically categorize and analyze expenses to keep budgets in check.

🔹 Invoicing and Billing

Generate, send, and manage invoices. Set up recurring billing and track payment statuses to improve cash flow.

🔹 Financial Reporting and Dashboards

Access visual dashboards and generate reports on profits, losses, and cash flow—making it easier to present insights to stakeholders.

🔹 Integration with Bank Feeds and Other Systems

Seamlessly connect with bank accounts, payroll software, or even enterprise resource planning (ERP) systems for end-to-end financial visibility.

Benefits of Using Financial Management Software

Implementing the right software can transform the way your business handles finances. Here’s how:

✅ Increased Accuracy: Reduce manual errors and discrepancies through automation.

✅ Time Savings: Automate recurring tasks like invoice generation, reconciliations, and reporting.

✅ Real-Time Insights: Make smarter decisions using live financial data and performance metrics.

✅ Improved Compliance: Ensure your processes align with financial regulations and audit requirements.

✅ Scalability: Easily adapt the system to support business growth or expansion into new markets.

Types of Financial Management Software

There are several categories of financial management software based on functionality, deployment, and target industry:

🔸 Cloud-Based vs. On-Premise

Cloud-Based: Accessible anywhere, automatically updated, and ideal for remote teams.

On-Premise: Installed locally with full control, but requires more IT resources.

🔸 Standalone vs. Integrated

Standalone: Focused solely on finance functions.

Integrated (ERP): Combines finance with other business processes like HR, supply chain, or CRM.

🔸 Industry-Specific Solutions

Some software is tailored for particular industries such as healthcare, manufacturing, or nonprofits, offering features specific to those sectors.

Who Should Use Financial Management Software?

This kind of software is not just for big corporations. It’s valuable across a wide spectrum:

Small Business Owners: Gain control over expenses, invoicing, and compliance without hiring a full-time accountant.

Finance Teams: Manage complex reporting, budgeting, and forecasting efficiently.

Freelancers and Consultants: Track income, manage client billing, and prepare for tax season with ease.

Choosing the Right Software for Your Needs

Here are a few factors to consider when selecting the right solution:

Your business size and complexity

Budget and cost of ownership

Required integrations (e.g., payroll, CRM, banking)

User-friendliness and learning curve

Vendor reputation and customer support

🔍 Popular Financial Management Tools

QuickBooks Online – Great for small businesses and freelancers

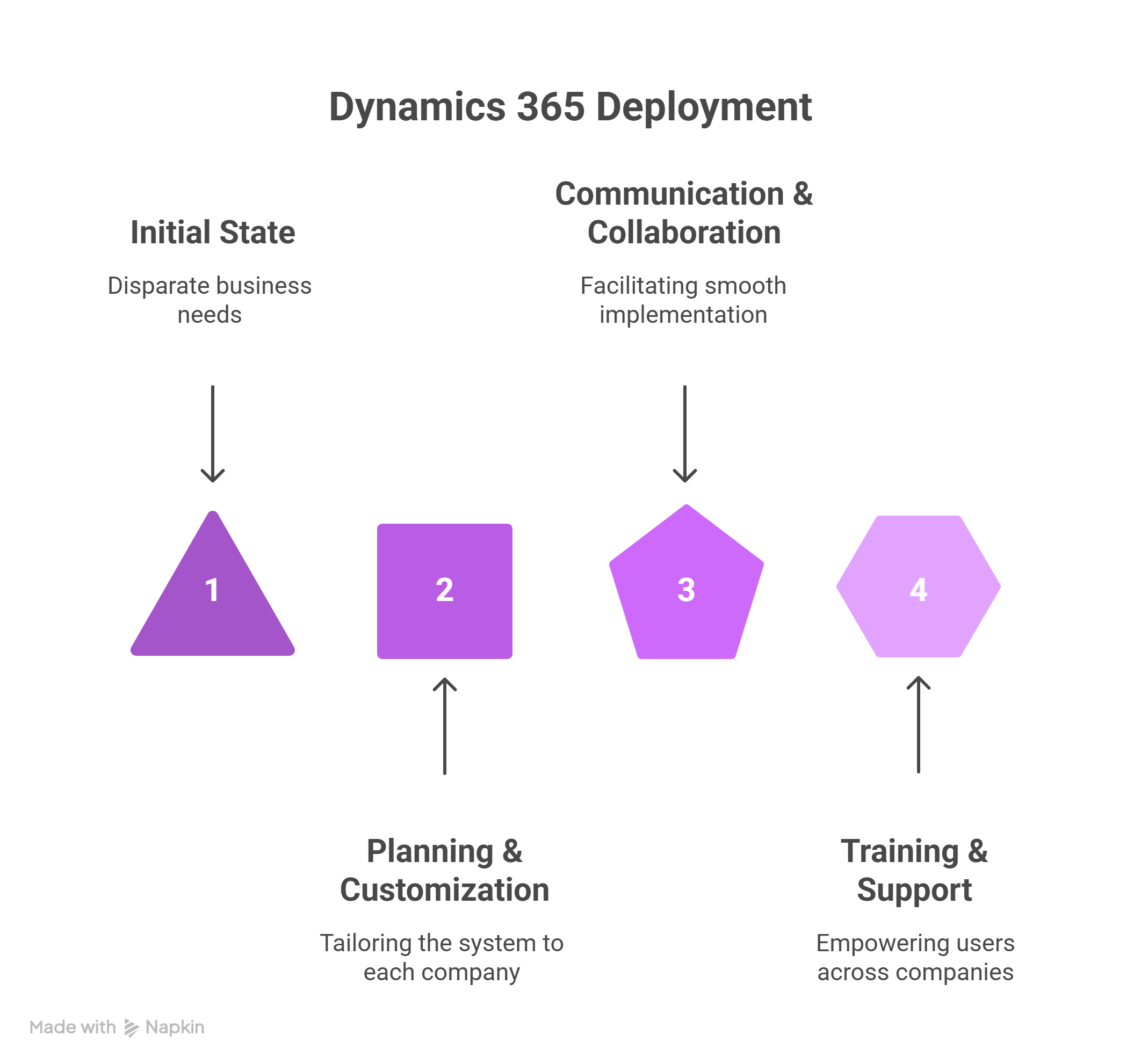

Microsoft Dynamics 365 Finance – Ideal for enterprises needing advanced financial control

Xero – User-friendly cloud-based software with strong reporting features

FreshBooks – Known for easy invoicing and time tracking

Final Thoughts

Financial management software is no longer a luxury, it’s a necessity for modern businesses. It helps you stay organized, compliant, and financially healthy, all while saving valuable time and reducing errors.

If you’re just getting started, take the time to evaluate your specific needs and test out a few tools. The right solution will empower you to make smarter financial decisions and focus more on growing your business.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

![What’s New in Dynamics 365 Implementation? [2025 Update Overview]](https://indibloghub.com/public/images/courses/686d1a9112af2552_1751980689.jpg)