7 Ways GCC Accounting and Taxation Streamlines Global Operations

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Managing finance operations across multiple countries can be one of the biggest challenges for growing businesses. From navigating complex tax laws to maintaining consistent accounting practices, global operations often result in fragmented processes, rising costs, and compliance risks.

To overcome these hurdles, many organizations are turning to GCC accounting and taxation solutions. Global Capability Centers (GCCs) act as centralized, company-owned hubs for finance functions, helping businesses consolidate operations, cut costs, and improve accuracy.

Here are seven ways GCC accounting and taxation helps streamline global operations and future-proof finance functions.

1. Centralizing Finance Operations for Consistency

Global businesses often struggle with disconnected finance teams across regions, leading to inconsistent reporting, duplicated processes, and slower decision-making.

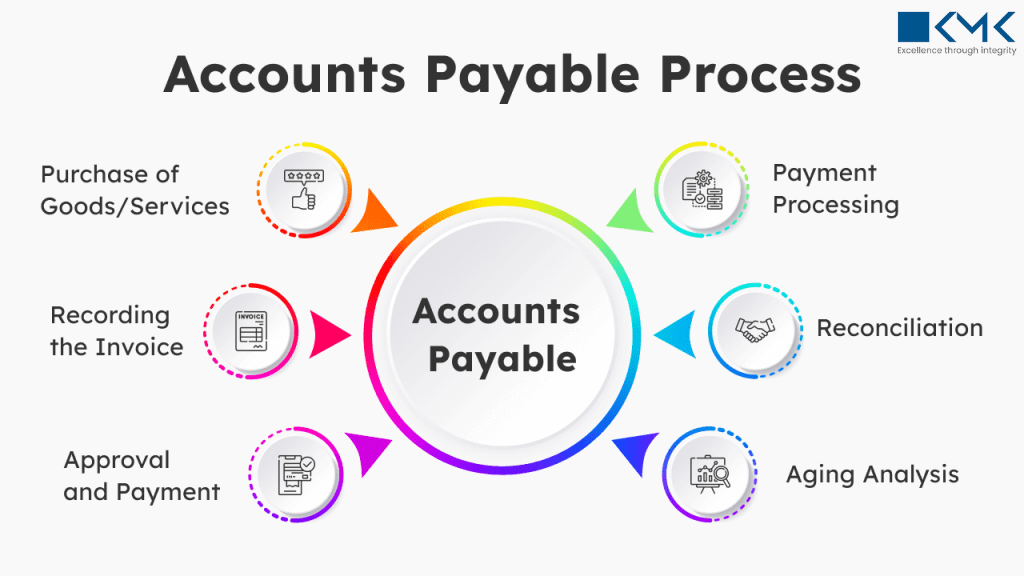

GCCs solve this by centralizing core finance functions—such as accounts payable, accounts receivable, tax filings, and reporting—into a single hub. This approach allows companies to:

- Implement standardized workflows and accounting policies.

- Reduce delays and ensure uniform financial reporting across all entities.

- Eliminate redundant processes, making operations leaner and more efficient.

Centralization ensures that every financial decision is based on accurate, consolidated data, giving leadership a clear view of global performance.

2. Strengthening Global Tax Compliance

For businesses operating across multiple jurisdictions, managing tax obligations is complex and risky. Different tax laws, filing deadlines, and reporting requirements can easily lead to penalties if not managed properly.

GCC accounting and taxation teams specialize in global and local tax regulations, ensuring:

- Timely and accurate filings for corporate tax, VAT, GST, and transfer pricing.

- Standardized reporting in line with IFRS, GAAP, and local frameworks.

- Real-time visibility into tax liabilities and deadlines across countries.

This centralized tax expertise reduces compliance risks and ensures businesses remain audit-ready year-round.

3. Leveraging Automation for Accuracy and Speed

Modern GCCs are not just about manpower—they use technology and automation to streamline finance operations. By integrating Robotic Process Automation (RPA), AI, and cloud-based ERP systems, GCCs can:

- Automate repetitive tasks like invoice processing, reconciliations, and tax computations.

- Reduce human errors that often lead to costly compliance issues.

- Speed up financial close and reporting cycles, enabling faster decision-making.

Automation frees finance teams to focus on strategic analysis and growth initiatives rather than manual processing.

4. Reducing Costs Without Losing Control

One of the biggest drivers behind GCC adoption is cost efficiency. By setting up finance hubs in cost-effective regions like India, the Philippines, or Eastern Europe, companies can:

- Tap into skilled finance and tax professionals at lower costs.

- Avoid outsourcing markups by retaining direct control over operations.

- Invest in technology and process improvements rather than overheads.

- Unlike traditional outsourcing, GCCs allow CFOs to cut costs without sacrificing control, quality, or data security.

5. Enhancing Scalability for Growth

As businesses expand into new markets or undergo mergers and acquisitions, scaling finance teams can be challenging. GCCs offer the flexibility and scalability companies need to:

- Quickly onboard new talent and expertise without disrupting operations.

- Support new jurisdictions by adding tax and accounting specialists.

- Handle seasonal or growth-driven workload fluctuations with ease.

- This agility ensures finance operations can keep pace with business expansion while staying compliant and efficient.

6. Improving Transparency and Decision-Making

Fragmented finance teams often result in delayed, inaccurate, or incomplete financial data, which can slow down decision-making.

GCC accounting and taxation teams use cloud-based systems and centralized dashboards to deliver:

- Real-time financial insights for leadership.

- Accurate tracking of cash flow, tax liabilities, and operational costs.

- Faster, more informed strategic decisions based on reliable data.

- This improved transparency allows CFOs and executives to plan effectively and respond quickly to market changes.

7. Building a Future-Ready Finance Function

Beyond operational efficiency, GCCs help businesses embrace digital transformation and prepare for the future. By centralizing accounting and taxation, companies can:

- Adopt advanced analytics, AI, and cloud technologies faster.

- Stay ahead of regulatory changes and reporting trends.

- Transition finance from a back-office function to a strategic growth driver.

In a rapidly evolving global economy, GCCs give businesses the tools and expertise to adapt, innovate, and scale with confidence.

Why GCC Accounting and Taxation Is Becoming a Standard

These seven benefits—centralization, compliance, automation, cost efficiency, scalability, transparency, and digital transformation—make GCCs more than just operational hubs. They are becoming the backbone of modern global finance strategies, enabling companies to reduce risks while driving growth.

For CFOs and finance leaders, adopting GCC accounting and taxation solutions isn’t just about saving money—it’s about creating a resilient, future-ready finance function that can scale, innovate, and support business goals worldwide.

Conclusion

As businesses continue to expand globally, managing finance operations with traditional, decentralized models will only get harder. GCC accounting and taxation offers a strategic, technology-driven way to simplify global operations, enhance compliance, reduce costs, and support long-term growth.

For companies looking to build a more efficient, accurate, and scalable finance function, investing in a GCC isn’t just an option—it’s becoming a necessity for sustainable success.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.