Maximize Efficiency with Professional Accounts Payable Outsourcing Services

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In the fast-paced world of business, efficiency is crucial for success. As companies grow, managing financial processes, especially accounts payable (AP), can become increasingly challenging. Many organizations are turning to professional accounts payable outsourcing services to streamline their operations and improve overall efficiency. This article explores how outsourcing AP can help businesses maximize efficiency and drive growth.

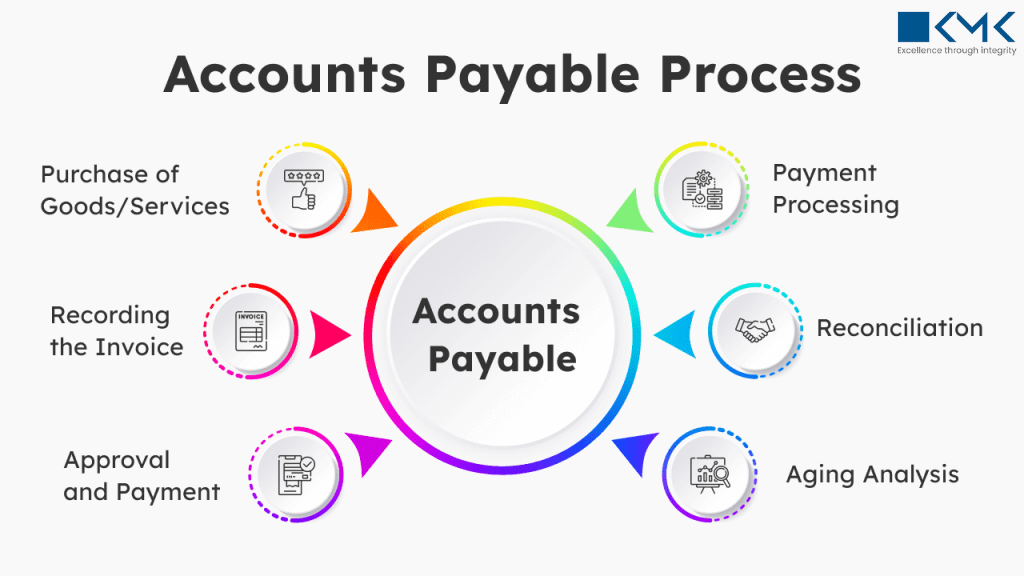

Understanding Accounts Payable

Accounts payable refers to the amounts a company owes to its suppliers for goods and services received. Efficient management of this process is essential for maintaining good relationships with vendors and ensuring that cash flow remains stable. However, as a business expands, the volume of invoices and payments increases, leading to potential bottlenecks and errors if handled in-house.

The Case for Outsourcing AP

1. Enhanced Efficiency Through Automation

One of the most significant advantages of outsourcing accounts payable is the access to advanced technology and automation. Professional outsourcing firms utilize state-of-the-art software that automates many AP processes, such as invoice processing, approval workflows, and payment scheduling. This automation reduces the need for manual data entry, minimizes errors, and accelerates processing times. As a result, businesses can ensure timely payments, which strengthens supplier relationships and enhances cash flow management.

2. Cost Reduction

Outsourcing AP can lead to substantial cost savings. Maintaining an in-house AP department requires resources, including staff salaries, training, and technology investments. By outsourcing, companies can reduce overhead costs significantly. Outsourcing firms often have established relationships with suppliers, allowing them to negotiate better payment terms and discounts, further enhancing savings for the business.

3. Access to Expertise

Outsourcing provides access to a team of financial professionals who specialize in accounts payable management. These experts are well-versed in industry regulations, compliance issues, and best practices. Their knowledge can help mitigate risks associated with errors and ensure that the company adheres to all relevant laws and standards. For growing organizations, this expertise is invaluable and allows internal teams to focus on strategic initiatives rather than day-to-day AP tasks.

4. Scalability and Flexibility

As businesses grow, their accounts payable needs may fluctuate. Outsourced AP services offer the flexibility to scale operations up or down based on current requirements. This means that businesses can easily adjust the level of service without the hassle of hiring or training new staff. This scalability is particularly beneficial for companies experiencing seasonal fluctuations or rapid growth.

5. Improved Cash Flow Management

Timely payments are crucial for maintaining healthy supplier relationships and optimizing cash flow. Outsourced AP services ensure that invoices are processed and paid on time, which can lead to better vendor relationships and potential discounts. Improved cash flow management allows businesses to allocate resources more effectively and invest in growth opportunities instead of being bogged down by operational inefficiencies.

6. Focus on Core Business Functions

When finance teams are overwhelmed with manual AP tasks, they have less time to focus on strategic initiatives that drive business growth. Outsourcing accounts payable frees up internal resources, allowing teams to concentrate on higher-value activities such as financial analysis, budgeting, and strategic planning. This shift not only enhances overall productivity but also positions the company for long-term success.

Choosing the Right Outsourcing Partner

While the benefits of professional accounts payable outsourcing services are clear, selecting the right partner is critical. Here are some factors to consider:

1. Experience and Reputation

Look for outsourcing firms with a proven track record in accounts payable management. Research their reputation, client testimonials, and case studies. A reputable partner will have experience in your industry and understand the unique challenges you face.

2. Technology and Security

Ensure that the outsourcing firm utilizes advanced technology that integrates seamlessly with your existing systems. Security is also a crucial factor; verify that the partner implements robust data protection measures to safeguard your financial information.

3. Customization and Flexibility

Choose a partner that offers customizable solutions tailored to your specific needs. Flexibility in service offerings will allow you to scale operations as your business grows.

4. Transparent Communication

Effective communication is essential for a successful outsourcing partnership. Ensure that the firm maintains open lines of communication and provides regular updates on performance metrics, enabling you to monitor the effectiveness of their services.

Conclusion

Maximizing efficiency through professional accounts payable outsourcing services is a strategic move for businesses looking to streamline operations and drive growth. By leveraging advanced technology, accessing expert knowledge, and reducing costs, companies can enhance their financial management processes significantly.

Outsourcing accounts payable allows organizations to focus on their core competencies, improve cash flow management, and maintain strong supplier relationships. As your business continues to grow, consider the transformative benefits of outsourcing AP. By making this strategic choice, you position your organization for long-term success and innovation in a competitive market. Don’t let outdated processes hold you back—embrace the advantages of professional accounts payable outsourcing services today!

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.