How Do Offshore Bookkeeping Services Compare to Local Providers?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In today’s fast-paced business world, bookkeeping is more than just crunching numbers — it's the key to smart decision-making and healthy cash flow. As businesses grow and evolve, many are starting to weigh their options between traditional local bookkeeping model and the increasingly popular offshore bookkeeping Services.

So, how do these two compare? Let’s break it down across key factors like cost, communication, expertise, scalability, and more.

1. Cost: Offshore Services Are More Budget-Friendly

One of the biggest advantages of offshore bookkeeping is the cost savings. Offshore providers, often based in countries like India or the Philippines, operate at significantly lower hourly or monthly rates compared to local professionals.

* Offshore bookkeeping: Rates can start around $8–$15 per hour.

* Local providers: Often charge between $30–$80 per hour.

This pricing difference comes from lower labor costs in offshore regions — not necessarily lower quality. For small businesses and startups especially, offshore services can offer professional support without draining the budget.

2. Communication: Local Providers Have the Home-Field Advantage

One of the concerns with offshore services is the time zone gap and potential communication delays. If your business needs real-time updates or frequent meetings during U.S. or UK business hours, local providers might offer smoother coordination.

That said, many offshore firms now assign dedicated account managers, offer flexible hours, and use platforms like Slack, Zoom, and email to bridge the time gap. The difference is shrinking — but for some businesses, that local availability still matters.

3. Expertise: Offshore Teams Are More Skilled Than Ever

There’s a common misconception that offshore bookkeepers lack the same level of expertise as local ones. In reality, many offshore professionals are highly trained in U.S. GAAP, international accounting standards, and popular software like QuickBooks, Xero, and Zoho Books.

* Offshore teams are often certified and experienced in handling global clients.

* Local bookkeepers may be more familiar with regional tax codes or niche industries.

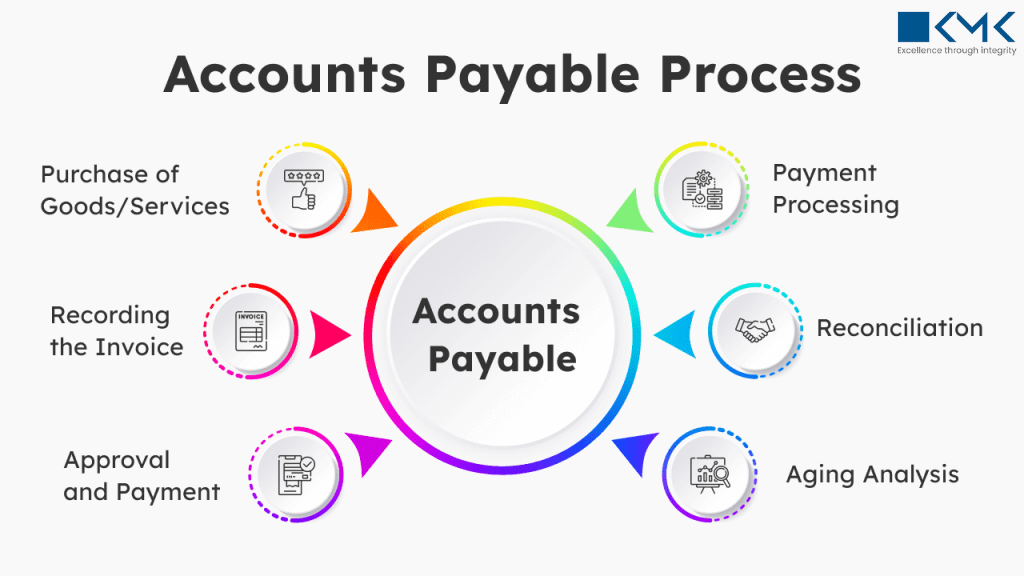

If your business deals with complex, location-specific regulations, a local provider might have the upper hand. But for general bookkeeping tasks — such as reconciliation, AR/AP, or reporting — offshore teams perform exceptionally well.

4. Scalability and Flexibility: Offshore Services Offer More Bandwidth

One major benefit of offshore bookkeeping is scalability. Offshore providers typically work with teams, not just individuals — meaning they can easily handle more work as your business grows.

* Need extra help during tax season?

* Want to add payroll or invoicing to your service plan?

Offshore firms can expand services quickly without you needing to hire or train new staff. Local providers, especially freelancers or small firms, may not have the same capacity or flexibility.

5. Technology and Tools: No Major Difference

Both local and offshore bookkeeping providers now use the same leading accounting platforms, including:

* QuickBooks Online

* Xero

* FreshBooks

* NetSuite

* Sage

Cloud-based systems allow real-time access, secure file sharing, and automated updates — regardless of location. Offshore teams are also tech-savvy and often integrate tools like Dext, Bill.com, and Gusto to streamline your bookkeeping processes.

6. Data Security and Compliance: Both Are Catching Up

Security is a top concern for any business sharing financial data. While local providers may offer peace of mind due to proximity and easier accountability, reputable offshore firms follow strict data protection standards:

* ISO-certified systems

* GDPR compliance

* Encrypted communication tools

Most offshore providers also sign NDAs and have clear privacy policies to protect your business data. Still, it’s important to vet offshore providers thoroughly before handing over sensitive financial information.

7. Relationship Building: Local Feels More Personal, But Offshore Can Adapt

Local bookkeepers can offer face-to-face meetings, in-person reviews, and a more personal relationship. For some business owners, that’s a key part of the trust equation.

Offshore services, however, are adapting. Many now offer weekly virtual check-ins, proactive updates, and consistent communication through project management tools. While the connection is virtual, many businesses build strong and lasting relationships with their offshore teams.

Final Thoughts

Both offshore and local bookkeeping providers have their strengths. Offshore services win when it comes to affordability, scalability, and access to global talent. Local providers shine in real-time communication, regional knowledge, and personal interaction.

Ultimately, the best choice depends on your business needs, budget, and working style. If you're open to virtual collaboration and looking to save on costs while maintaining quality, offshore bookkeeping could be the perfect fit. If you prefer in-person support and need detailed local expertise, a local provider might be better.

Either way, modern bookkeeping is about finding the right partner who understands your business and helps keep your financials strong — whether they’re across the street or across the ocean.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.