A Stepwise Guide to File W-2 Forms in QB Desktop Payroll

Strong8k brings an ultra-HD IPTV experience to your living room and your pocket.

Are you seeking a stepwise, precise manual to file the W-2 form in QuickBooks Desktop Payroll? We've got you! This blog post will help you and walk you through smoothly filing your W-2 forms.

A W-2 form, essential for filing a tax return, includes details about employee earnings. At the end of the year, sending W-2 forms to the appropriate agencies on time is a crucial payroll task. Different types of QuickBooks software products require specific steps to file these forms, so it is essential to comprehend the process for each product. To ensure accurate and timely submission, read the entire blog to learn about handling W-2 forms in QuickBooks.

Do you need prompt verbal help related to filing QuickBooks W-2 forms? Call +1(800) 780-3064 for detailed assistance from a QuickBooks expert.

Stepwise Manual to File W-2 Forms in QuickBooks

Let us learn how to systematically file your W-2 forms for QuickBooks Desktop Payroll.

Step 1. Set Up the W-2 Forms

In QuickBooks Desktop Payroll, you first need to set up the W-2 forms before filling them electronically.

- Launch QuickBooks Desktop.

- Then, navigate to the Employees option and select the Payroll Center.

- Now, click on QuickBooks Desktop Payroll Setup.

- Go to the Payroll Center option, then choose the File Forms tab.

- In the Other Activities list, select the Change Filing Method option. Thereafter, check the screen at the bottom for the list.

- After this, you need to click on the Continue button and then select the Federal Form W-2/W-3 option from the forms list.

- Then, tap on the Edit button. Choose Finish. Now, you will see the enrollment guidelines, which you can read and print.

- Now, you can close the View Enrollments window.

- At the end, hit the Finish Later option.

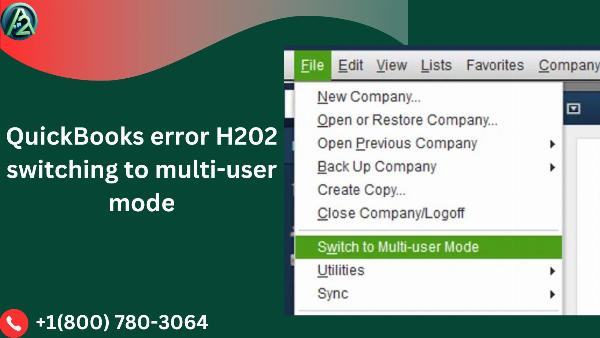

read more:- QuickBooks Error H202 – Multi-User Switching Issue

Step 2. Generate the W-2 Forms

Here is how you can generate the W-2 Forms:

- Navigate to the Employees option, then select Payroll Tax Forms and W-2s.

- After that, hit the File W-2 Forms in QuickBooks button, then choose File Forms.

- Hit the Annual Form W-2/W-3 - Wage and Tax Statement/Transmittal option.

- Finally, select Create Form.

Step 3. Transmit your W-2 Forms

Now, you can send your W-2 forms electronically by following the procedure below. After step 3, you can print your W-2s in QB Desktop Payroll.

- Go to the Process W-2s, and select All Employees from there to file as per the batch.

- Now, navigate to the Select Filing Period section and input the filing year of the form.

- Choose OK and decide on employees in the Select Employees for Form W-2/W-3 option. You may also choose Mark All to select all the employees.

- Then, click on the E-File Federal Forms. After this, you must fill in your details, such as your business mobile/contact number and email ID.

- At the end, choose File W-2 Forms in QuickBooks.

If you filed an incorrect W2 form in QuickBooks, you can take corrective actions according to your QB product. It also depends on the automated taxes and form settings.

This blog post explains all the steps users must follow to file their W-2 forms in the QuickBooks Desktop Payroll application. If you have any queries or need additional assistance, immediately dial +1(800) 780-3064 and get an instant reply from a QuickBooks expert.

get more info:- Web Connector Error QBWC1039

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.