India Data Center Server Market Size, Share, Trends, and Growth Opportunities 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

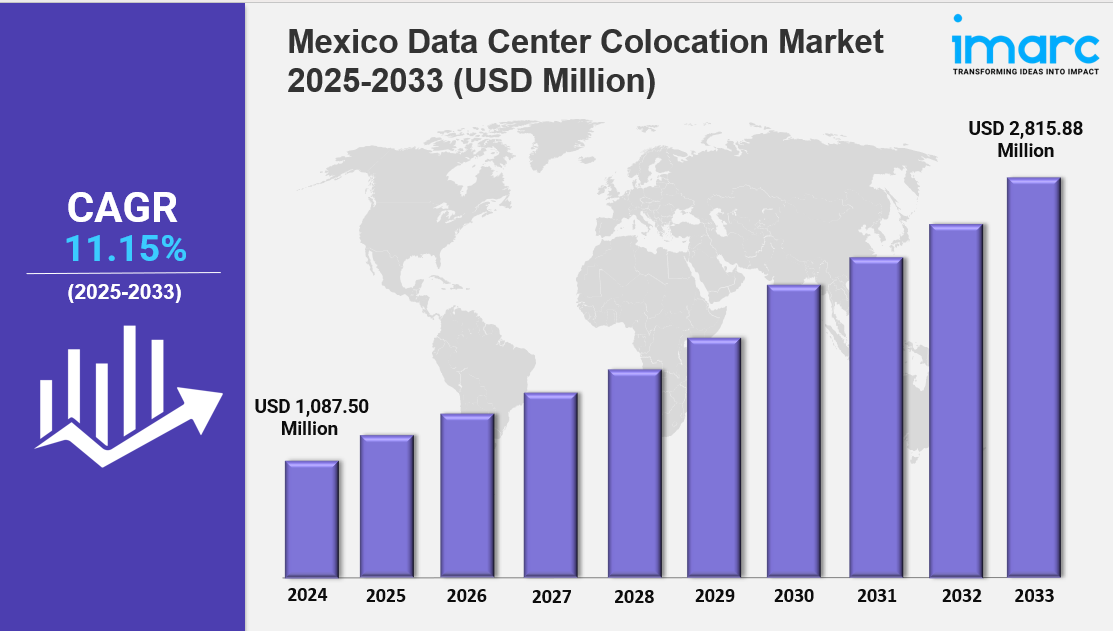

The India data center server market size reached USD 2.46 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.76 Billion by 2033, exhibiting a growth rate (CAGR) of 7.03% during 2025-2033. The market is expanding due to increasing cloud adoption, rising demand for data storage, and growing digital transformation. Technological advancements, government initiatives, and the surge in AI and IoT applications are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing demand for cloud computing and digital transformation

✔️ Rising adoption of energy-efficient and high-performance server solutions

✔️ Expanding investments in hyperscale and edge data centers across the country

Request for a sample copy of the report: https://www.imarcgroup.com/india-data-center-server-market/requestsample

India Data Center Server Market Trends and Drivers:

The India Data Center Server Market is growing fast. This growth is fueled by the rise of cloud computing and large-scale infrastructure. As banks, e-commerce, healthcare, and government move to hybrid and multi-cloud setups, the demand for high-density servers is growing. These servers need to support AI/ML workloads, real-time analytics, and virtualization. Major cloud providers, such as AWS, Microsoft Azure, and Google Cloud, plan to expand in Mumbai, Chennai, and Hyderabad. They will invest over $2.5 billion

in 2024. This trend fits with India's push for a digital economy, fueled by initiatives like Digital India and Smart Cities.

in 2024. This trend fits with India's push for a digital economy, fueled by initiatives like Digital India and Smart Cities.

These programs need scalable server architectures. Still, challenges persist. Power reliability, cooling efficiency, and supply chain delays for advanced GPUs and ASIC-based servers are ongoing issues. Consequently, operators are turning to liquid cooling solutions and modular data center designs. Sustainability is now key in India's data center server procurement. Energy costs make up about 40% of operational expenses. With strict carbon neutrality goals from state governments, operators focus on energy-efficient servers. These servers feature dynamic voltage scaling, ARM-based processors, and AI tools for optimizing workloads.

In 2024, the Bureau of Energy Efficiency (BEE) will launch a STAR rating system for data center servers. This will speed up replacing old x86 systems with greener options. For example, Yotta Infrastructure’s Navi Mumbai facility uses servers with a 94% power usage effectiveness (PUE). They utilize direct-to-chip cooling and renewable energy. At the same time, circular economy models are on the rise. Refurbished servers from global markets are being repurposed for Indian Tier-2 cities.

This approach reduces e-waste and meets cost concerns in emerging markets. The rise of edge computing, driven by 5G and IoT, is changing server designs in India. Telecom leaders like Reliance Jio and Bharti Airtel are setting up micro-data centers. These centers use rugged, compact servers that can handle high temperatures in rural and semi-urban areas. At the same time, the generative AI boom is increasing the need for GPU-accelerated servers. Companies like NVIDIA and Dell Technologies are launching server models tailored for India in 2024. These systems focus on high memory bandwidth, such as HBM3, and low-latency connections.

They aim to support real-time applications in telemedicine and autonomous logistics. However, India still faces challenges due to limited semiconductor manufacturing and reliance on imports for advanced parts. This has led to partnerships between Indian IT firms and global foundries to create local server supply chains. The India Data Center Server Market is changing rapidly with new technologies and local strategies. Hyperscale deployments still lead in metro areas. However, smaller businesses are now using colocation services and pay-per-use server models.

The government’s revised Production-Linked Incentive (PLI) scheme for IT hardware in 2024 encourages global OEMs like HPE and Lenovo to set up server assembly units in Tamil Nadu and Uttar Pradesh. This move cuts lead times by 30–40%. Sovereign cloud platforms, required by data localization laws, boost the need for servers with better encryption and local data controls. Still, the market faces challenges from fluctuating component prices and skill gaps in managing diverse server environments. Analysts expect that AI-native server stacks, open-source hardware standards, and public-private partnerships will shape the next growth phase, making India a $9.1 billion server market.

India Data Center Server Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product:

- Rack Servers

- Blade Servers

- Micro Servers

- Tower Servers

Breakup by Application:

- Industrial Servers

- Commercial Servers

Breakup by Region:

- North India

- South India

- East India

- West India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.