United States Business Jet Market Outlook, Industry Size, Growth Factors, Investment Opportunity 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

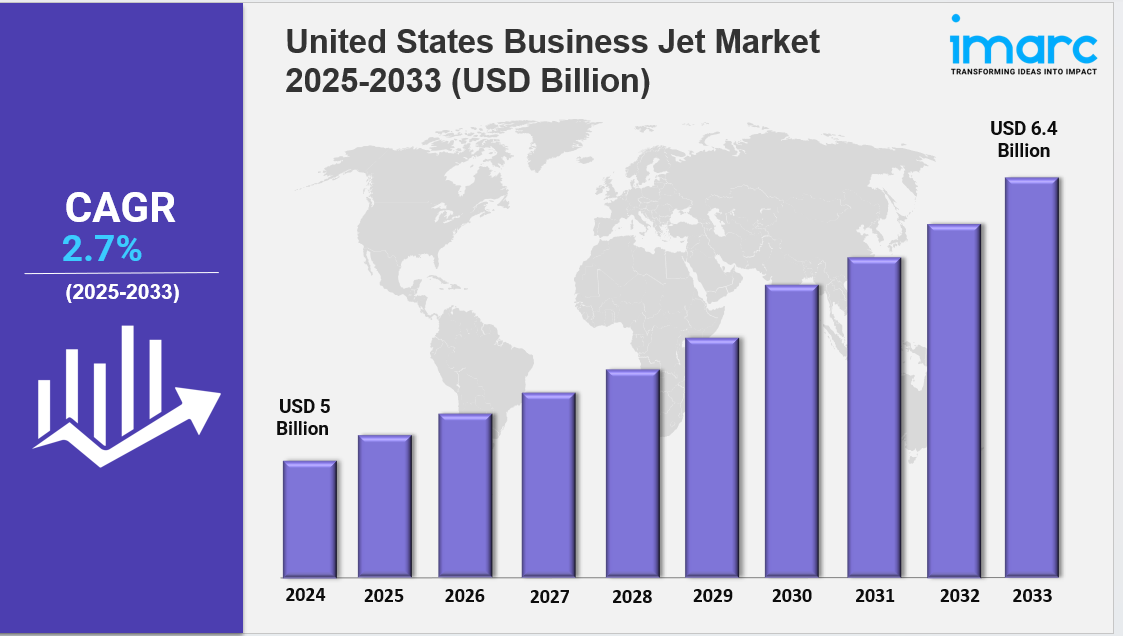

The United States business jet market size was valued at USD 5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2033, exhibiting a CAGR of 2.7% from 2025-2033. The market is expanding due to rising demand for flexible corporate travel, fleet modernization, and fractional ownership growth. Growth is driven by technological advances, sustainability initiatives, and increased high-net-worth travel preferences, making the industry more efficient, private, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising demand for private air travel and corporate mobility solutions

✔️ Increasing adoption of next-generation, fuel-efficient jets with advanced avionics and connectivity

✔️ Expanding charter services and fractional ownership models enhancing accessibility for business travelers

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-business-jet-market/requestsample

United States Business Jet Market Trends and Drivers:

The United States Business Jet Market is experiencing major changes as companies prioritize sustainability and smarter travel solutions. Manufacturers like Gulfstream and Bombardier are leading the charge by investing in engines that work with Sustainable Aviation Fuel (SAF), aiming for net-zero emissions by 2035. New FAA carbon rules introduced in 2024 have pushed operators to upgrade older jets or face higher costs. At the same time, electric vertical takeoff and landing (eVTOL) aircraft—like Joby Aviation’s S4—are gaining interest for short business trips between cities such as New York and Chicago. Hybrid aircraft, like Textron’s Cessna Denali, are also making progress with engines that cut emissions by up to 40%.

These efforts are not just about meeting regulations—corporate sustainability goals now require many businesses to report flight emissions, increasing demand for cleaner jet options, especially in the tech and healthcare industries. Despite being more expensive upfront, green-certified jets are becoming a preferred choice. The United States Business Jet Market Share is also expanding thanks to fractional ownership models, which make private jet access more affordable and flexible. Companies like NetJets and Flexjet introduced subscription packages starting at $5,000, opening up the market to entrepreneurs and professionals beyond the executive level.

Digital platforms like Jet.AI have further improved fleet efficiency, matching underused jets with last-minute travelers. New players like Volato are offering "micro-fraction" ownership models through blockchain contracts, allowing smaller groups to co-own jets. Recent changes in tax laws, such as 100% bonus depreciation on fractional shares, have also helped boost participation. This shift has prompted OEMs like Embraer to develop jets tailored to this model, such as the Phenom 300E, with features like AI-based maintenance tracking. As a result, the market saw a 19% increase in revenue and attracted over 12,000 new users in 2024 alone.

Geopolitical tensions have forced the industry to rethink its supply chains and flight routes. After the U.S.-EU titanium dispute in 2024, Bombardier opened a refinery in Oklahoma to source materials locally. Ongoing export bans from Russia further strained access to avionics, leading companies like Honeywell to shift production to Mexico and India. Flight routes have also changed, with longer travel times due to restrictions over Russian airspace. To deal with these issues, operators are using advanced tools like Satcom Direct’s Polaris to reroute flights using satellite data. Even defense contractors are getting involved—Lockheed Martin is now applying stealth tech to reduce production delays. These adjustments reflect both the challenges and the resilience of the United States Business Jet Market.

As the market adapts, a few key trends stand out. Many buyers are choosing to upgrade pre-owned jets instead of purchasing new ones, especially with rising interest in SAF-ready models. Dassault’s Falcon 10X, for example, now includes advanced features like biometric entry and engines that monitor themselves mid-flight. Urban Air Mobility (UAM) is also growing, with the Department of Transportation funding vertiports in 14 cities to support eVTOL aircraft. But challenges remain—there’s a major pilot shortage, prompting trials of remote-piloted systems like Delta’s 5G-based "Virtual Wingman."

Younger buyers are also shaping the United States Business Jet Market Size, with Gen X and millennials now accounting for over 60% of sales. These customers are more focused on practical features like telehealth support and cybersecurity than traditional luxury. Regulatory requirements are also tightening: the FAA’s "Zero-Emissions Corridor" plan will require all jets flying near major airports to be emissions-free by 2027. Despite these hurdles, the outlook remains strong. The United States Business Jet Market Size is expected to reach $48 billion by 2026, driven by demand for sustainable travel, flexible ownership models, and smarter logistics powered by technology.

United States Business Jet Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

- Base Year: 2024

- Historical Year: 2019-2024

- Forecast Year: 2025-2033

Analysis by Type:

- Light

- Medium

- Large

Analysis by Business Model:

- On-Demand Service

- Air Taxis

- Branded Charters

- Jet-Card Programs

- Ownership

- Fractional Ownership

- Full Ownership

Analysis by Range:

- 3,000 - 5,000 NM

- > 5000 NM

Analysis by Point of Sale:

- OEM

- Aftermarket

Regional Analysis:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.