The Revolution of Fintech Applications: Reshaping Finance

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Financial technology, commonly known as fintech, has emerged as a game-changer in the financial services industry. Fintech applications encompass a wide array of digital tools and platforms that leverage technology to deliver financial services more efficiently, conveniently, and inclusively. In this article, we'll explore the transformative impact of fintech apps across various domains and discuss their role in shaping the future of finance.

The Evolution of Fintech Apps

Finance applications have evolved significantly over the years, driven by technological advancements and changing consumer preferences. Initially, fintech focused on disrupting traditional banking services, offering digital alternatives to brick-and-mortar institutions. However, the scope of fintech has expanded to include a diverse range of services, including payments, lending, wealth management, insurance, and regulatory technology (Regtech).

Empowering Consumers with Digital Banking

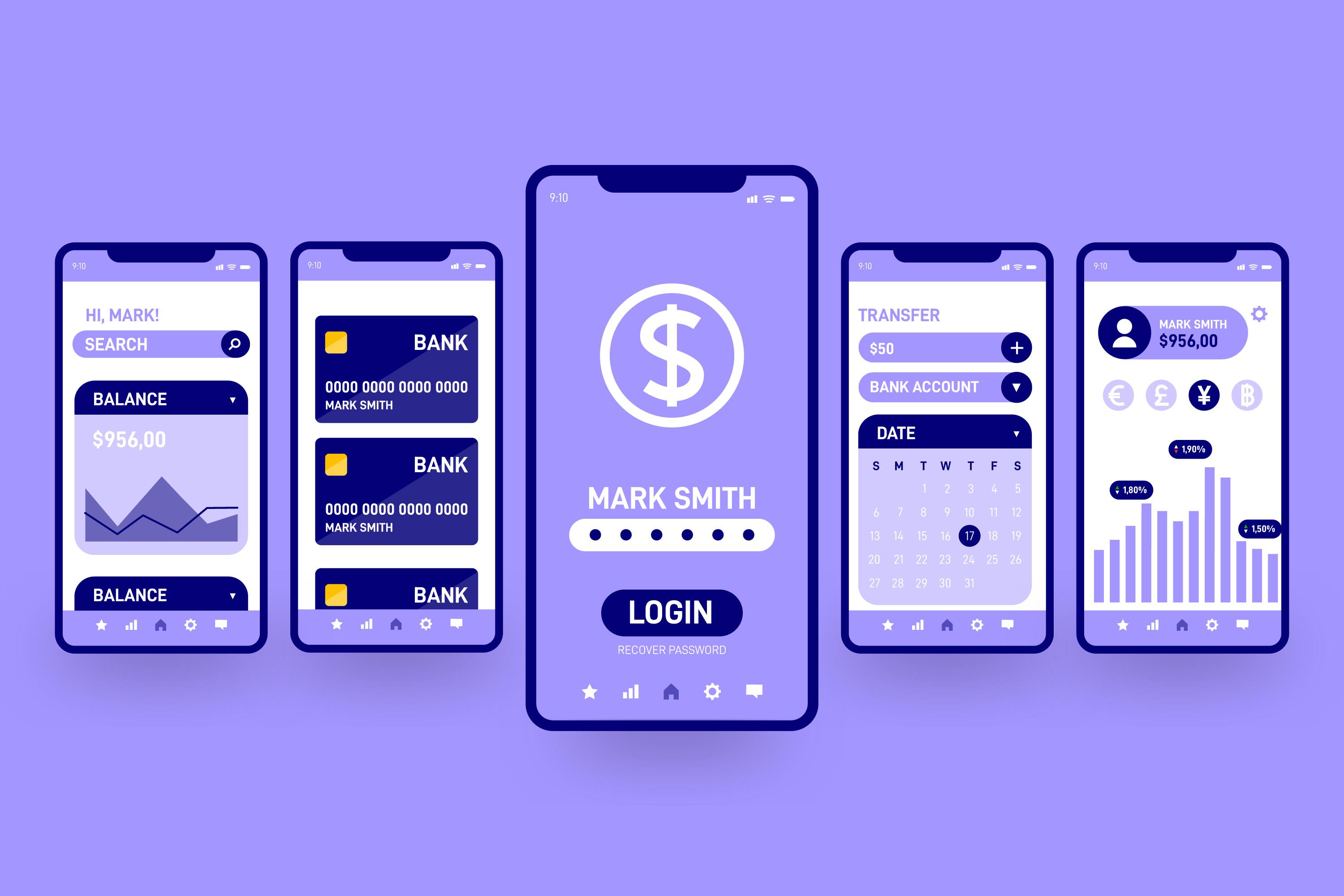

Digital banking applications have revolutionized the way consumers manage their finances. These apps provide users with convenient access to banking services, allowing them to check account balances, transfer funds, pay bills, and even apply for loans—all from their smartphones. Digital banks, often referred to as neobanks or challenger banks, operate solely online, offering competitive interest rates and low fees compared to traditional banks.

Streamlining Payments and Transactions

Fintech applications have also transformed the payment landscape, making transactions faster, more secure, and frictionless. Mobile payment platforms enable users to make purchases, send money to friends and family, and split bills with ease. With the rise of contactless payments and digital wallets, consumers are increasingly adopting cashless payment methods, driving the shift towards a cashless society.

Democratizing Investing with Robo-Advisors

Investment management has traditionally been reserved for affluent individuals and institutional investors. However, fintech has democratized investing by introducing robo-advisors—automated investment platforms that use algorithms to manage portfolios and provide personalized investment advice. Robo-advisors offer low fees, diversified investment options, and user-friendly interfaces, making investing accessible to a broader audience.

Enhancing Financial Inclusion

Fintech mobile applications play a crucial role in promoting financial inclusion by reaching underserved populations and providing them with access to essential financial services. In emerging markets, mobile money platforms enable individuals without traditional bank accounts to store, send, and receive money using their mobile phones. Similarly, microlending platforms offer small loans to individuals and businesses that lack access to traditional credit facilities.

Addressing Regulatory Challenges

Despite their transformative potential, finance apps face regulatory challenges and compliance requirements. Regulatory frameworks vary across jurisdictions, posing challenges for fintech companies operating in multiple markets. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is essential to mitigate the risk of financial crimes and ensure the security of user data.

Future Outlook: Innovations and Opportunities

Looking ahead, the future of fintech mobile applications is filled with innovations and opportunities. Emerging technologies such as artificial intelligence, machine learning, blockchain, and decentralized finance (DeFi) are expected to drive further disruption in the financial industry. These technologies promise to enhance security, improve efficiency, and unlock new business models, reshaping the future of finance in profound ways.

In conclusion, fintech applications have revolutionized the financial services industry, empowering consumers, driving financial inclusion, and challenging traditional banking norms. With their innovative solutions and user-centric approach, fintech mobile apps are poised to continue reshaping the way we manage money, paving the way for a more accessible, inclusive, and efficient financial ecosystem.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.