What Are the Benefits of Offshore Accounting for Small Businesses?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Looking to save time and reduce costs? Learn how offshore accounting services help small businesses streamline finances, ensure compliance, and scale faster with expert support.

Are You Maximizing Your Accounting Budget?

If you’re running a small business, you already know how critical it is to keep your finances in order. But managing everything in-house—from bookkeeping to tax prep—can be expensive, time-consuming, and stressful. That’s where offshore accounting services come into play.

But what exactly does offshore accounting mean, and why are more and more small businesses choosing to outsource?

What Is Offshore Accounting?

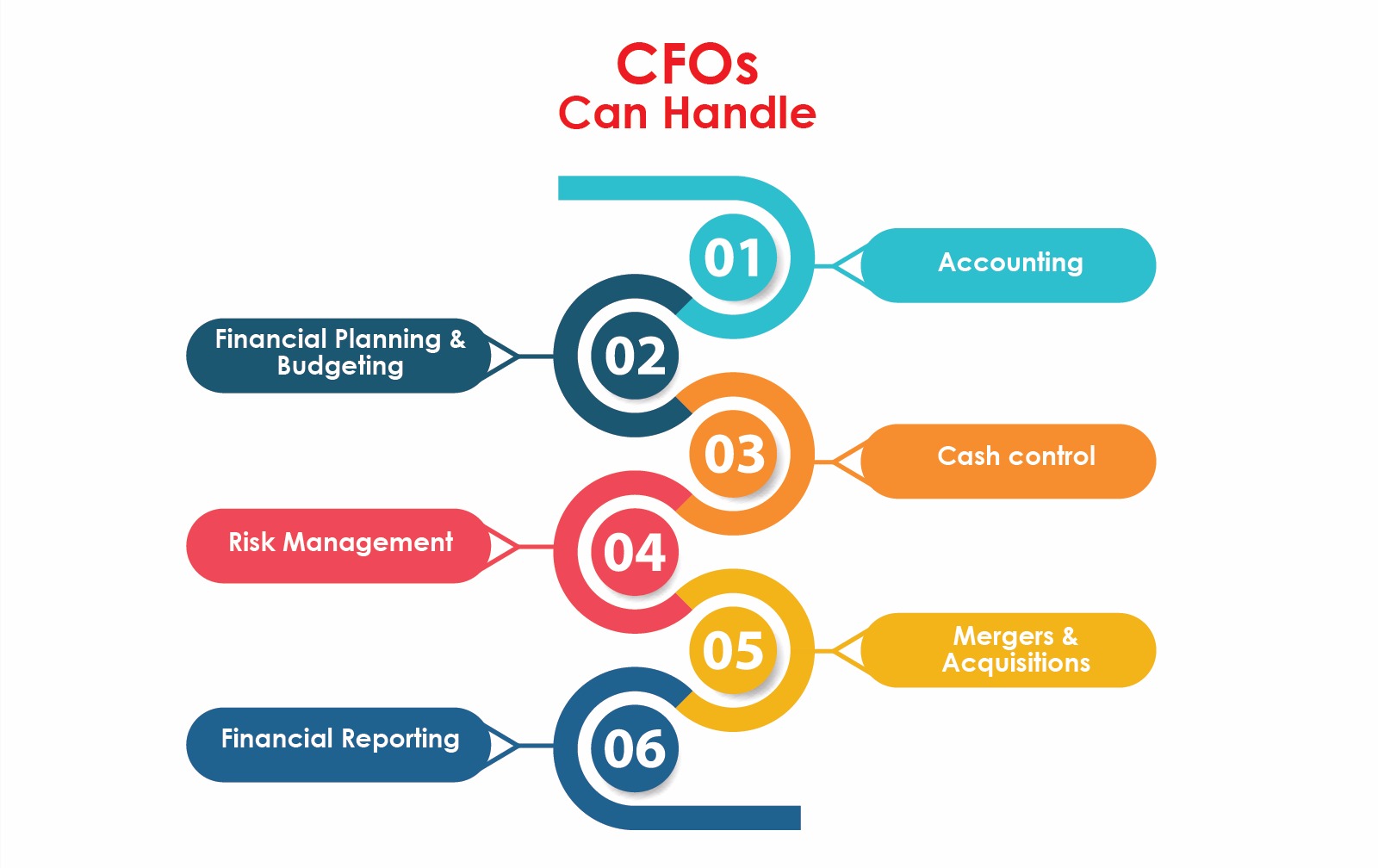

Offshore accounting involves hiring a third-party firm located outside your home country—typically in regions like India or the Philippines—to handle your accounting tasks. These services often include:

1. Bookkeeping

2. Payroll processing

3. Tax preparation

4. Financial reporting

5. Accounts payable and receivable management

These offshore teams work remotely but seamlessly integrate into your business operations using cloud-based platforms and secure file-sharing tools.

Why Are Small Businesses Outsourcing Accounting Services?

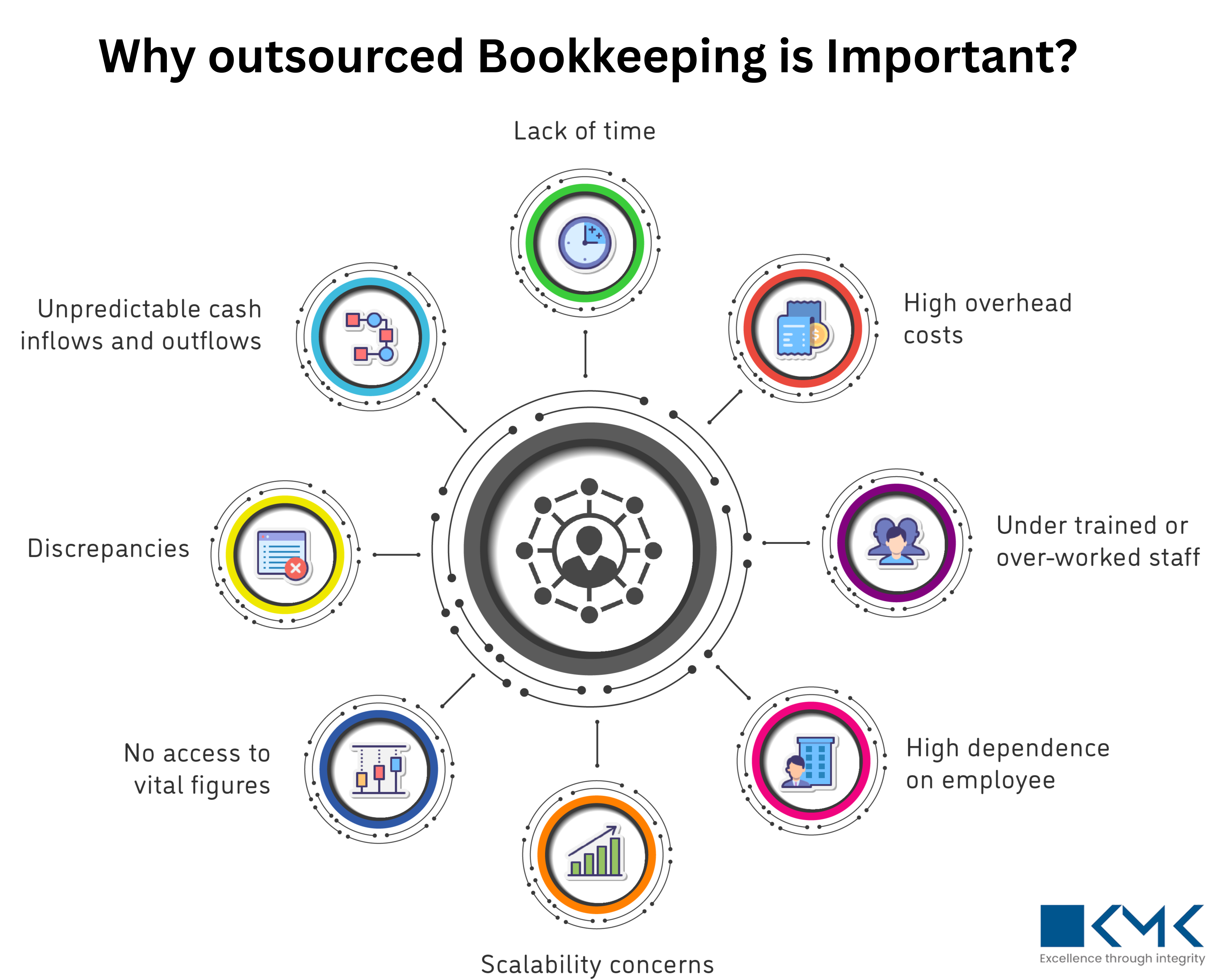

Small businesses face unique challenges: limited staff, tight budgets, and the constant pressure to grow. Outsourcing accounting services for small business operations allows owners to focus on scaling without being bogged down by back-office tasks.

Here are the key benefits:

1. Significant Cost Savings

Hiring full-time, in-house accountants comes with overhead—salaries, benefits, office space, and training. By choosing to outsource accounting for small business, you can save up to 40-60% on accounting costs while maintaining high-quality work.

2. Access to Skilled Professionals

Offshore accounting firms are staffed with qualified, English-speaking CPAs and finance experts trained in international standards like GAAP and IFRS. Many specialize in U.S. tax laws and compliance, making them ideal partners for American small businesses.

3. Focus on Core Business Activities

Let’s be honest—handling taxes and reconciliations isn’t the best use of your time as a business owner. By outsourcing, you reclaim hours each week to spend on:

• Customer service

• Product development

• Marketing and sales

• Strategic planning

4. Scalability and Flexibility

Your accounting needs evolve as your business grows. Offshore teams can quickly scale up (or down) depending on seasonality, growth phases, or market shifts—without the hassle of hiring and training new staff.

5. Better Compliance and Risk Management

When it comes to finances, mistakes can be costly. Offshore firms stay up to date on tax laws, filing deadlines, and data protection standards. This helps minimize risk and ensures you're always in compliance.

6. 24/7 Productivity and Faster Turnarounds

Thanks to time zone differences, work is often being done while you sleep. This leads to quicker turnarounds, faster report generation, and real-time financial visibility—giving you a competitive edge.

Is Offshore Accounting Right for Your Business?

• Are your current accounting costs eating into your profits

• Do you struggle to keep up with tax deadlines or financial reporting

• Would you benefit from expert guidance without hiring full-time staff

• Are you planning to scale and need flexible support

Why Choose KMK Ventures?

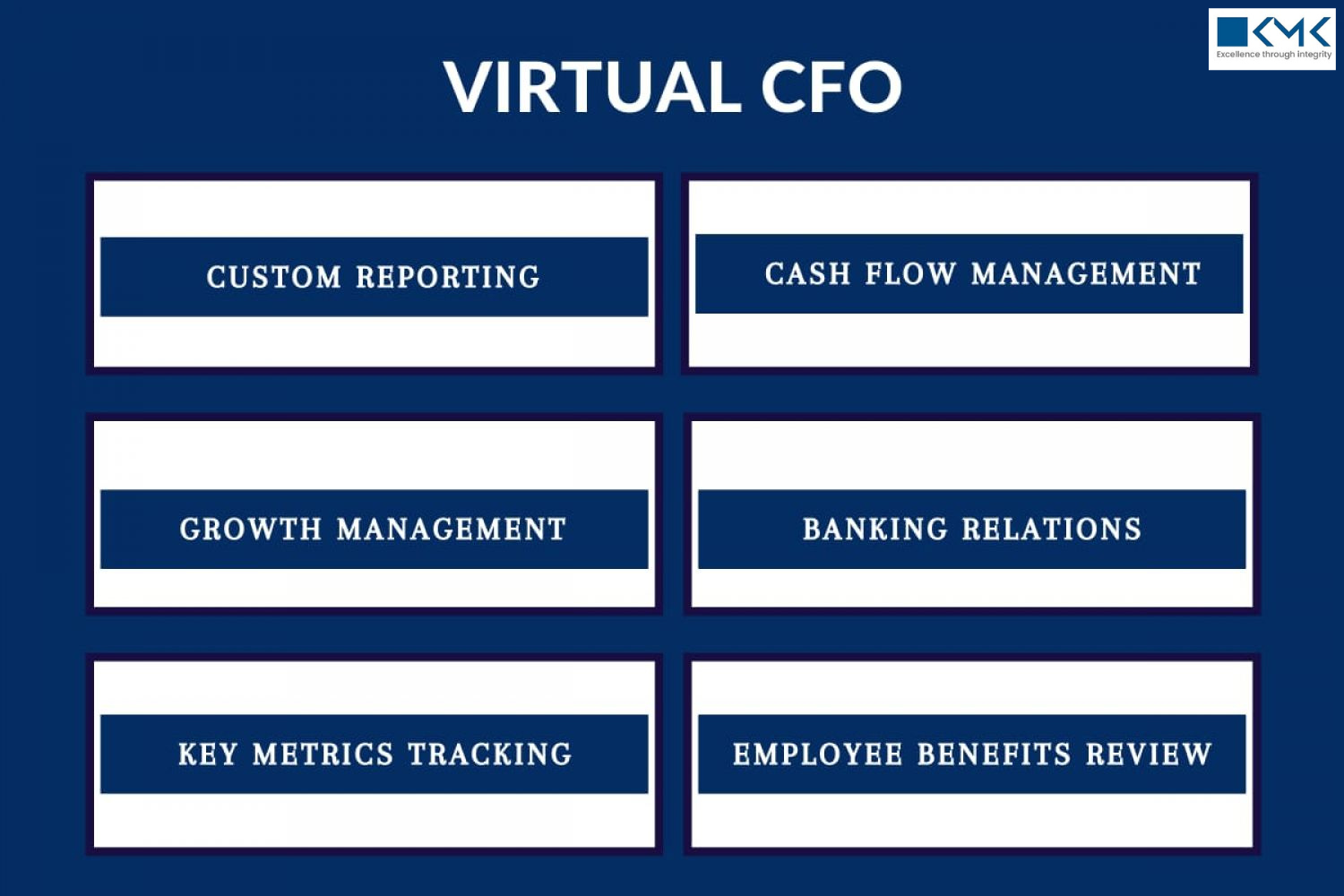

We understand that choosing the right partner is crucial. Here’s why U.S. businesses trust KMK Ventures:

U.S.-Focused Compliance and Accounting Standards

💼 Experienced Team with Industry-Specific Expertise

🔐 Secure Systems and Confidentiality Protocols

🌐 Cloud-Based Real-Time Access

📈 Scalable Services for Startups, Small Businesses, and CPA Firms

Explore how KMK Ventures can help simplify your Outsourced Services:

To learn more or discuss a customized solution for your business, connect with the KMK team today. Our experts are ready to answer your questions and guide you toward a seamless payroll experience.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.