Why More CPA Firms Are Choosing 1120S Outsourcing: The Smart Shift to India

Let’s face it—tax season isn’t getting any easier. With shifting regulations, tight deadlines, and ever-increasing client demands, U.S.-based CPA firms are constantly juggling priorities. One major form—1120S (for S corporations)—can be especially time-consuming. That’s why an increasing number of firms are now tapping into a smarter solution: 1120S outsourcing services to India.

But why India? And why now?

Let’s dive into the real reasons this strategic move is gaining serious momentum—and why it might be time for your firm to consider it too.

The Pressure is Real: Why U.S. CPA Firms Are Re-Evaluating

CPA firms aren’t just battling deadlines—they’re battling a shortage of skilled professionals. The U.S. labor market for accounting and tax professionals is tight, making it difficult to scale quickly during busy Seasons. Meanwhile, clients still expect fast turnarounds and error-free filings.

Sound familiar?

This is where Indian outsourcing firms, like KMK & Associates LLP, come into play. They provide not just bandwidth—but deep expertise in U.S. tax codes and filing procedures, especially for specialized returns like 1120S.

Why 1120S Outsourcing to India Makes Business Sense

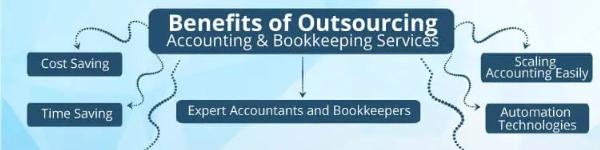

Let’s break down the benefits in plain terms:

• Cost Efficiency: Outsourcing tax preparation to India drastically cuts costs without sacrificing quality. You pay less than hiring full-time U.S. staff but still receive top-tier output.

• Expertise in U.S. Tax Forms: Leading CPA firms in India have teams trained specifically in U.S. tax law, including S corp compliance, basis calculations, shareholder allocations, and state returns.

• Time-Zone Advantage: Work can get done while your U.S. team sleeps. You wake up to progress, not delays.

• Scalability: Whether you need 10 returns or 1,000, Indian outsourcing partners offer flexibility that grows with you.

Offshore Doesn’t Mean Off-Quality

Some worry that offshore support means cutting corners. But that’s outdated thinking. Today’s top US accounting outsourcing companies in India use secure portals, standardized workflows, and even U.S.-trained managers to ensure smooth collaboration.

At KMK, for instance, data security and compliance are non-negotiable. Their quality review process and responsiveness rival that of domestic teams.

More Than Just Tax Prep: Full-Service Offshore Staffing

The value doesn’t end with 1120S forms. More firms are exploring offshore staffing for CPA firms across audit, bookkeeping, and tax departments. If you’re looking to expand capacity for engagements, streamline operations, or reduce burnout among your core staff, it’s worth considering a long-term offshore partnership.

Need help beyond tax season? Try outsourcing audit work to India to add back-up support during financial statement audits, walkthroughs, and testing.

Future-Proofing Your Firm with a Smarter Global Strategy

Imagine finishing your busiest season without the stress. No frantic last-minute hires. No overworked teams. Just efficient, accurate, and timely filings—powered by a global team of experts.

That’s the future more firms are moving toward.

And the good news? You don’t have to navigate it alone.

Ready to Get Started?

Outsourcing isn’t just about cost savings—it’s about strategy. Whether you’re testing the waters or ready to scale, contact KMK & Associates LLP to learn how your firm can benefit from their tailored 1120S outsourcing service and comprehensive offshore staffing solutions.

The bottom line: Let your U.S. team focus on growth, client relationships, and high-value advisory—while trusted experts in India handle the heavy lifting behind the scenes.

It’s not about working harder. It’s about working smarter.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.