HARO Backlinks – Get Cited Like a Pro in Top Media!

HARO Backlinks – Get Cited Like a Pro in Top Media!

Critical Illness Insurance: A Lifesaver for Unexpected Health Challenges

Written by Aakash » Updated on: June 17th, 2025

Health crises can strike at any time, often when least expected. Whether it’s a heart attack, stroke, or a serious cancer diagnosis, these sudden health events can disrupt not only your physical well-being but also your financial stability. While traditional health insurance policies help cover day-to-day medical expenses, critical illness insurance takes this support a step further, offering financial protection in the event of a life-threatening condition.

What is Critical Illness Insurance?

Critical illness insurance is designed to offer a lump sum payment if you are diagnosed with a specified critical illness. This amount can be used to cover various expenses that might arise during your treatment, recovery, or even in instances where you are unable to work due to illness. Unlike regular health insurance, which may only cover hospitalisation and medical treatments, critical illness insurance provides the financial cushion to manage broader financial obligations such as lost income, childcare, homecare, or other living expenses during a challenging period.

Why Critical Illness Insurance is Essential

The rise in life-threatening illnesses has made critical illness insurance an essential consideration for families. Conditions such as cancer, heart attack, kidney failure, or stroke can lead to long-term health complications, requiring expensive treatments and hospital stays. In these scenarios, traditional health insurance may not be enough to cover all the costs. Critical illness insurance steps in by providing a lump sum payment to the policyholder upon diagnosis of a covered illness.

Furthermore, even with the best health insurance plans for family, policyholders may still find themselves facing non-medical costs related to their illness. These could include adjustments to lifestyle, such as home modifications, or the need for ongoing treatment that might not be covered under a standard health plan. Critical illness insurance allows you to take control of these financial responsibilities while focusing on recovery.

How Does Critical Illness Insurance Work?

Once you have a critical illness insurance policy, the coverage will typically include a list of specific illnesses, such as:

- Cancer

- Stroke

- Heart attack

- Organ transplant

- Kidney failure

If you are diagnosed with one of these illnesses during the policy term, you will receive a one-time payment, which can vary depending on the policy. This payout is yours to use as needed—whether for medical treatments not covered by health insurance or to maintain your daily living expenses if you are unable to work.

For instance, after a serious diagnosis, the lump sum payment can support you in paying for expensive private treatments or cover the cost of travelling to a specialist. In the case of heart attacks or strokes, it can help with rehabilitation costs or home care.

Benefits of Critical Illness Insurance

Critical illness insurance offers several benefits beyond financial assistance:

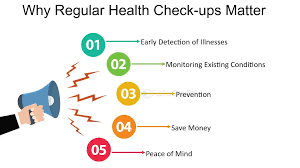

Peace of Mind: Knowing that you are protected against the financial burden of a critical illness allows you to focus on what matters most—your recovery.

Flexibility: The lump sum payout from a critical illness policy can be used as needed, giving you the freedom to prioritise what’s most important for your family.

Enhanced Family Protection: By securing critical illness cover, you help ensure that your family remains financially stable during your illness, preventing financial hardship while you recover.

How to Choose the Right Critical Illness Insurance Plan?

When choosing a critical illness policy, it is essential to consider your family’s specific needs. Here are some factors to keep in mind:

Assess Your Risk: Understanding your family’s health history and any existing risk factors can help determine the level of coverage required. For example, if heart disease or cancer runs in your family, it may make sense to choose a policy that covers these illnesses comprehensively.

Understand the Payout Terms: Different policies offer different payout structures. Some provide a lump sum, while others may pay in instalments. It's essential to understand which option works best for you and your family's financial situation.

Consider Add-ons: Some policies allow you to customise your coverage with additional benefits, such as coverage for children or a higher payout in case of specific illnesses. Customising your policy can offer better protection based on your needs.

Review the Exclusions: As with any insurance policy, it’s crucial to be aware of exclusions or limitations. Some conditions may not be covered, and understanding these exclusions can help you avoid surprises later.

Reputation of the Insurer: Choose an insurer with a good track record of claims settlement and customer service. This is vital in ensuring you receive the support you need when you are dealing with a serious health crisis.

Choosing the Best Health Insurance Plans for Family with Critical Illness Cover

When considering the best health insurance plans for family, it is important to select a policy that not only offers hospitalisation benefits but also includes critical illness cover. Many health insurance providers now offer this add-on benefit, which can be a lifeline during trying times.

Selecting the best plan for your family involves comparing features such as:

The range of critical illnesses covered

The waiting period before the payout is eligible

The payout amount

Any exclusions or limitations

Additional benefits, such as coverage for children or family members

Many families also opt for policies that cover multiple members under one plan, as it offers better value and convenience. The right health insurance plan can protect your family from financial distress if a critical illness diagnosis occurs.

One of the notable players in the critical illness insurance sector is Niva Bupa, which offers tailored health plans that include critical illness cover. Niva Bupa's health insurance products focus on providing peace of mind with a range of features, including coverage for over 20 critical illnesses. The company’s plans ensure that your family’s financial stability is safeguarded when life takes an unexpected turn.

What makes Niva Bupa stand out is its quick claims process and customer-centric approach, ensuring that policyholders receive the financial support they need when it matters most. They provide individual and family critical illness insurance policies, helping families manage the financial risks associated with major health issues. With added perks like access to top-notch medical facilities, Niva Bupa is worth considering for those who want to be prepared for life’s uncertainties.

Final Words

Critical illness insurance is an essential safeguard against the financial strain caused by unexpected health events. While the best health insurance plans for family may cover everyday medical expenses, critical illness insurance provides an extra layer of protection against serious health challenges. Whether you opt for a policy like Niva Bupa's or explore other options, the key is to ensure that your family’s health and financial future are well-protected.

By planning ahead and choosing the right critical illness cover, you are not just investing in insurance but also in your family's long-term well-being.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.