Social Media Content Packs – Stay Active Without Lifting a Finger!

Social Media Content Packs – Stay Active Without Lifting a Finger!

Essential Features to Look for in a Mediclaim Insurance Policy

Written by Aakash » Updated on: June 17th, 2025

Choosing the right medical insurance plans is critical to health insurance planning. With the rising cost of healthcare, having a robust health insurance policy is more important than ever. A well-chosen plan can provide financial protection and peace of mind during medical emergencies. However, selecting the best health insurance policy can be challenging, with numerous options available. This article will guide you through the essential features to look for in a mediclaim insurance policy, ensuring you make an informed decision for your health and financial well-being.

1. Comprehensive Coverage

The most crucial feature of medical insurance plans is comprehensive coverage. This includes coverage for a wide range of medical expenses, such as:

Inpatient hospitalisation: Expenses incurred during hospital stays, including room rent, ICU charges, doctor fees, and nursing costs.

Pre and post-hospitalisation: Costs for treatments and consultations before and after hospitalisation, typically for a specified period.

Daycare procedures: Treatments that do not require a 24-hour hospital stay, such as cataract surgery, chemotherapy, and dialysis.

Domiciliary treatment: Medical treatment taken at home on a doctor's advice when hospital admission is impossible.

Ambulance charges: Coverage for expenses incurred on emergency ambulance services.

A policy offering extensive coverage ensures that most of your medical needs are taken care of without a significant out-of-pocket expense.

2. Cashless Treatment Facilities

Cashless treatment facilities are a boon during medical emergencies. With cashless hospitalisation, the insurance company directly settles the medical bills with the hospital, reducing the policyholder's financial burden. When evaluating a health insurance policy, check the network hospitals associated with the insurer. A broad network of hospitals ensures access to quality healthcare services across different locations without worrying about cash payments.

3. High Sum Insured and No Sub-limits

The sum insured is the maximum amount the insurance company will pay for the covered medical expenses. Choosing a high-sum insured policy is vital, especially considering the rising medical costs. Additionally, ensure that the policy does not have restrictive sub-limits on specific treatments or room rent. Sub-limits can significantly reduce the claim amount, leaving you to bear a substantial portion of the costs.

4. No Claim Bonus (NCB)

The No Claim Bonus is a reward insurance companies give policyholders for not making any claims during a policy year. It usually comes as an increased sum insured at the same premium or a discount on the renewal premium. Policies offering a substantial NCB can be highly beneficial, providing enhanced coverage or savings in the long run.

5. Renewability and Age Limit

Ensure that the health insurance policy offers lifelong renewability. Some policies have an upper age limit for renewal, which can be problematic as you grow older and are more likely to need medical care. Lifelong renewability guarantees you can continue your coverage without interruption, providing peace of mind and continuous protection.

6. Pre-existing Disease Coverage

Pre-existing diseases are medical conditions that existed before purchasing the health insurance policy. Most insurance companies have a waiting period for pre-existing diseases, typically 2 to 4 years. When selecting a policy, check the waiting period for pre-existing disease coverage and choose one with the shortest duration. Additionally, ensure that the policy covers pre-existing conditions after the waiting period.

7. Maternity and Newborn Cover

Maternity and newborn cover is essential for those planning to start a family. This coverage typically includes expenses related to childbirth, pre-and postnatal care, and newborn baby coverage for a specified period. Since maternity cover usually comes with a waiting period, it is advisable to plan and opt for this feature well in advance.

8. Critical Illness Cover

Critical illness insurance cover provides a lump sum payment on the diagnosis of specified critical illnesses such as cancer, heart attack, stroke, and kidney failure. This cover can be a part of the base policy or an add-on. Given the high treatment costs of critical illnesses, this feature can offer significant financial relief and support.

9. OPD (Outpatient Department) Coverage

OPD coverage includes expenses for consultations, diagnostic tests, and minor procedures that do not require hospitalisation. While most health insurance policies focus on inpatient treatment, having OPD cover can be advantageous for managing routine medical expenses and preventive care.

10. Alternative Treatment Cover

With the growing popularity of alternative treatments like Ayurveda, Homeopathy, and Unani, many insurance policies now offer coverage for these therapies. If you prefer alternative medicine, ensure that your policy includes this feature to cover expenses for non-allopathic treatments.

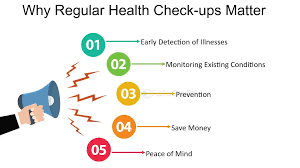

11. Health Check-ups and Wellness Benefits

Regular health check-ups are crucial for early detection and prevention of diseases. Some health insurance policies offer free annual health check-ups and wellness programmes as part of their benefits. These features encourage policyholders to maintain their health and can lead to long-term savings on healthcare costs.

12. Claim Settlement Ratio

The claim settlement ratio indicates the percentage of claims settled by the insurance company out of the total claims received. A high claim settlement ratio reflects the insurer's reliability and efficiency in handling claims. When choosing a health insurance policy, consider the insurer's claim settlement ratio to ensure a hassle-free claim process.

13. Customer Support and Services

Excellent customer support addresses queries, resolves issues, and guides you through the claim process. Evaluate the insurer's customer service quality through reviews, testimonials, and their responsiveness to policyholders. Good customer service ensures a smooth experience and timely assistance when you need it the most.

14. Affordable Premiums

While choosing a policy with comprehensive coverage is essential, it is equally important to consider the affordability of the premiums. Compare the premium rates of different policies with similar features and benefits. Ensure that the premium fits within your budget without compromising on the coverage and benefits offered.

Parting Thoughts

Selecting the best health insurance policy requires careful consideration of various features that align with your healthcare needs and financial goals. Well-rounded medical insurance plans provide financial protection during emergencies and promote preventive care and overall well-being. Focusing on comprehensive coverage, cashless facilities, lifelong renewability, and other critical features ensures that you and your family are adequately protected.

You should take the first step towards securing your health and financial future by exploring the extensive range of Niva Bupa health insurance plans today. With Niva Bupa, you can access comprehensive coverage, a vast network of hospitals, and exceptional customer service. Protect yourself and your loved ones with a reliable health insurance partner.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.