Explosive Keyword Research – Target Buyers, Not Just Traffic!

Explosive Keyword Research – Target Buyers, Not Just Traffic!

Financing Your Dream: A Comprehensive Guide to Business Loans for Startups

Written by Aryan Arora » Updated on: June 17th, 2025

Starting a new business venture is an exciting yet daunting experience. While you need to focus on planning and ideation, you also need to dedicate time to find the capital needed to get the business started. This is where a start-up business loan can help. A business loan for your start-up can help you secure the funds needed to transform your entrepreneurial dreams into reality. This guide on start-up business loans sums up everything you need to know about these loans in detail.

Business Loan Options For Start-Ups

Government-Backed Start-Up Loans:

The Indian government has rolled out several startup business loan schemes for MSMEs and start-ups. Here’s a list of the top two government-backed start-up loan schemes you can consider:

- Stand-Up India: The Stand-Up India scheme is designed to offer easy credit access for ST, SC, and women entrepreneurs above the age of 18 years. Launched in 2016 and headed by SIDBI, this scheme facilitates bank loans between Rs. 10 Lakhs to Rs. 1 Crore to eligible entrepreneurs. Start-ups loans are sanctioned to green field projects. Green field signifies the first-time venture of the beneficiary into trading, manufacturing, services, or agri-allied activities.

- Mudra Loan: MSME start-ups can also opt for Mudra loans to meet their funding requirements. The Pradhan Mantri Mudra Yojana was launched in 2015 to offer loans of up to Rs. 10 Lakhs to non-corporate, non-farm, small/micro enterprises. These loans are popularly known as Mudra loans and headed by the Micro Units Development and Refinance Agency (MUDRA). The loan scheme offers funding to three enterprise categories, namely, Shishu, Kishor, and Tarun. The loan amount depends on the development stage of the business. Mudra loans are collateral-free loans and carry a tenure of 1-5 years.

Apart from these start-up loan schemes, the Indian government has taken various steps to ensure easy finance access for start-ups and MSMEs. For instance, the CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) offers a guarantee cover of up to Rs. 5 Crores for unsecured business loans sanctioned to eligible MSEs from member lending institutions.

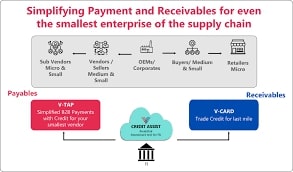

Bank and NBFC Loans:

Commercial banks and NBFCs remain major sources of start-up funding in India. These financial institutions offer loans through government schemes as well as a separate set of unique loan products dedicated to start-ups. Some banks offer lines of credit, while others also offer seed funding, equipment loans, and more. Banks and NFBCs have varied eligibility criteria and document requirements. Once the loan is approved, you receive the sanctioned amount and make repayments in EMIs over a fixed repayment tenure. The interest rate, tenure, and loan amounts differ from one lender to the next.

Eligibility Criteria

Qualifying for a start-up business loan requires you to meet certain eligibility parameters. While the specific requirements vary from one lender to the next, here’s a list of standard eligibility parameters used by most:

- Nationality: The applicant should be a citizen of India

- Age: The applicant should be at least 21 years old when applying for the loan. While the upper age cap varies, generally, the maximum age limit is set at 65 years.

- Credit score: The applicant should have a good credit score, preferable above 700.

- Business plan: Lenders require a well-structured business plan for the venture to clearly demonstrate cash flow and revenue estimates.

Documents Required

If you meet the eligibility criteria for a start-up business loan, you can apply for it by presenting the following documents:

- Identity proof: You need to submit a valid identity proof document such as your Aadhaar Card, PAN Card, Passport, or Voter’s ID.

- Address proof: Accepted address proof documents include utility bills, Aadhaar Card, Driving Licence, and Passport.

- Business registration proof: You need to submit proof of business registration like a Certificate of Incorporation, Partnership Deed, or any other relevant registration document.

- Business plan: You also need to submit a thorough business plan outlining your business model, market analysis, financial projections, and growth prospects.

- Financial statements: Proof of income include ITR and bank statements from the last 6 months.

Things to Consider Before Taking a Start-Up Business Loan

If you’re thinking of applying for a business loan for start-ups, consider these factors carefully:

- Make a crisp business plan that outlines every aspect of your business. Make sure that your business plan is detailed and research-backed to ensure that it answers any questions the lender may have about your business.

- Clearly define the purpose of the loan. Stating how you propose to use the funds is a key component of getting quick approvals.

- Determine how much funding you need for the business. Consider factors like start-up costs like legal fees, branding expenses, and inventory purchase as well as operating costs like rent, utilities, and marketing costs. Also factor in revenue projections and a buffer for unexpected costs.

- Compare interest rates and processing charges across lenders to find the most cost-effective option. Remember that even a 0.50% difference in interest rates can make a world of difference in the long run.

- Choose a loan tenure that suits your business needs. Carefully consider the projected cash flow of your business and overheads to ensure that the repayment duration aligns with your financial projections and repayment capacity.

Benefits of Availing a Start-Up Business Loan

Availing a start-up business loan offers the following benefits:

Access to Immediate Capital

A start-up business loan helps you gain access to capital immediately. In other words, you can have the necessary funds needed to start your business operations immediately.

Flexibility

Start-ups in their nascent stages can benefit from the flexible nature of such loans. Start-up business loans come with easy and flexible repayment tenures, allowing you to customise the loan terms to suit your business needs.

Multi-Purpose Loans

Budding enterprises can utilise a start-up business loan to finance various requirements of the business. From purchasing inventory to buying equipment and managing working capital, funds from a start-up loan can be utilised flexibly to fulfil different business goals.

Collateral-Free Finance

Generally, start-up business loans are collateral-free unsecured loans. This is highly beneficial for start-ups that have limited pledgeable assets.

Seize Growth Opportunities

With a start-up loan, budding enterprises can leverage growth opportunities. They can utilise the funds from the loan to optimise marketing campaigns and build a customer base to enhance sales and revenue.

Build Credit History

Securing debt finance without a credit history is extremely challenging. Start-ups can tackle this problem with a quick start-up business loan. Timely repaying this loan helps them build a positive credit history, making it simpler to access credit in the future.

Conclusion

Establishing your start-up business and affording initial business expenses requires significant capital. Availing of a start-up business loan can help you fund varied costs including equipment purchase, inventory costs, payroll expenses, rent, and other working capital needs. Depending on your requirement, eligibility, and preference, you can choose from various government schemes and bank/NBFC loan options. But before you apply for a start-up loan, remember to curate a well-structured business plan, determine the loan amount, purpose, and repayment strategy.

Frequently Asked Questions

What is the maximum tenure of a business loan for start-ups?

The maximum tenure of a start-up business loan can vary depending on the lender in question. However, most lenders offer start-up loans for a maximum of 60 months or 5 years.

Why should I take a start-up loan?

Start-up business loans can help budding entrepreneurs secure capital for starting their business venture. You can avail of a start-up loan to open an office, hire staff, purchase equipment, integrate tech tools, and capitalise on growth opportunities.

What is the eligibility for start-up business loans?

The eligibility checklist varies from lender to lender. However, most lenders offer start-up loans to applicants above 21 years of age with a good credit score of 700 or above. t terms.

Read Also: Enhancing Your Business With A Term Loan

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.