Core Web Vitals Boost – Speed Up Your Site & Your SEO!

Core Web Vitals Boost – Speed Up Your Site & Your SEO!

How GST Business Loans Are Empowering Small and Medium Enterprises (SMEs) ?

Written by Aryan Arora » Updated on: June 17th, 2025

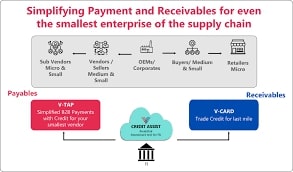

Small and medium enterprises (SMEs) have proven to be the backbone of India’s economy. The government has also taken all possible steps to empower these enterprises, including various types of loans and subsidies. One such loan is the GST business loan, which was introduced to promise financial aid for businesses running on profit and diligently paying their goods and services tax.

Did You Know the current production value of SMEs in India is approximately ₹ 816,000 crores?

Owning SMEs and running them on profit can now help get business loans easily. Let’s learn more about GST business loan and their role in empowering SMEs.

What is a GST Business Loan ?

As the name suggests, a GST business loan helps get loans based on the GST returns filed by MSMEs. These business loans are available for these enterprises for various purposes. Whether they want to purchase equipment, establish a new factory or implement expansion strategies, a GST business loan comes in as financial backing.

Empowering SMEs through GST Business Loans

Let’s understand how GST business loans are empowering SMEs:

- Unsecured Loan

One of the biggest challenges faced by small and medium enterprises while applying for a business loan was pledging securities that often took control out of the business owner’s hands. However, with schemes like GST business loans, SMEs can apply for business loans without pledging security. This type of loan is also known as an unsecured loan. - Minimal Interest Rates

A key aspect while applying for any type of business loan is the interest rate the borrower is being charged. Through the GST business loan scheme, SME business owners are offered minimal interest rates that reduce the cost of borrowing. - Loan Amount for Varying Needs

One loan scheme doesn’t suit all. This is true particularly for SME business owners therefore under this type of loan, borrowers are provided a chance to choose the loan amount that best suits their requirements. Whether it is for machinery or marketing strategies, GST business loans can be tailored. - Flexible Loan Tenure

While applying for a business loan, it is crucial for borrowers to pick a loan tenure smartly as it impacts their financial planning. With schemes like these, borrowers get to choose the loan tenure that best suits them without creating a rigid repayment burden.

Understanding the GST Business Loan Application Process

- A business loan can be complex especially with lenders having a tedious application and approval process. However, to ensure that SMEs are offered quick and hassle-free financial aid, the application process for GST business loans is kept simple. Here’s how a SME business owner can apply for a loan:

- Offline Application

You can visit the nearest branch of any lender authorised to provide a loan under this scheme. Make sure to understand the document requirements and approval process thoroughly for a quick sanction. - Online Application

You can apply for a GST business loan through the official website of lenders authorised to offer this type of loan. The online application process does not require you to visit the lender’s branch thus promising you financial aid while you sit in the comfort of your home.

To Conclude

SMEs have been boosting the country’s economy for decades and with the government providing financial support, they are set to take the economy to new levels. GST business loan for SMEs is organised and promises a hassle-free loan application and approval process. This type of business loan also helps the economy as SMEs are encouraged to diligently pay GST to enjoy the benefits of financial support. At Lendingkart, business loans for SMEs are promised with minimal documentation and fast approval.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.