Guaranteed SEO Boost: Triple Your Rankings with Backlinks starting at 5$

Guaranteed SEO Boost: Triple Your Rankings with Backlinks starting at 5$

How do I allow an application to access QuickBooks?

Written by katejenifer » Updated on: October 04th, 2024

Integrating QuickBooks with other applications can bring numerous benefits to your organization. For instance, you may want to connect your CRM (Customer Relationship Management) system with QuickBooks to automatically sync customer information, invoices, and payments.

The common use case for QuickBooks integration is with inventory management systems. Connecting your inventory software with QuickBooks lets you automatically update your accounting records as products are sold or new stock is received.

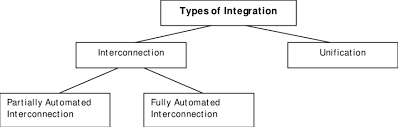

Understanding the different types of integrations

When it comes to integrating QuickBooks with other applications, there are several different approaches you can take. The most common types of integrations include:

Naive nations:

QuickBooks offers a range of native integrations with various software providers, such as Salesforce, Bill.com, and TSheets. These pre-built integrations often provide a more seamless and streamlined experience, as they are designed to work seamlessly with QuickBooks.

Custom integrations:

If the application you want to integrate with QuickBooks doesn't have a native integration, you can opt for a custom integration. This involves developing a custom connection between the two applications, typically using APIs (Application Programming Interfaces) or other integration tools. Custom integrations can be more complex, but they offer greater flexibility and control over the integration process.

Third-party integration platforms:

There are also several third-party integration platforms, such as Zapier, that can help you connect QuickBooks with a wide range of other applications. These platforms often provide a user-friendly, no-code interface for setting up integrations, making it easier for businesses to automate their workflows without the need for extensive technical expertise.

Expert Recommendation: QuickBooks Utility Application Keeps Popping Up

How to allow an application to access QuickBooks (step-by-step guide)

Now that you understand the different types of integrations, let's explore the step-by-step process of allowing an application to access QuickBooks. In this guide, we'll use the example of a CRM system, but the general steps can be applied to other types of applications as well.

Step 1:

Identify the application you want to integrate with QuickBooks The first step is to identify the specific application you want to integrate with QuickBooks. This could be a CRM system, an inventory management tool, a payroll software, or any other business application that you use regularly. Make sure to research the available integration options, both native and custom, to determine the best approach for your needs.

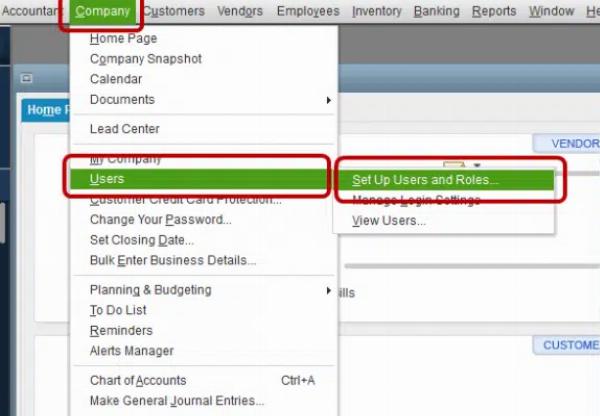

Step 2:

Obtain the necessary permissions and credentials Once you've identified the application, you'll need to obtain the necessary permissions and credentials to allow it to access your QuickBooks data. This typically involves creating a new user account in QuickBooks with the appropriate permissions, as well as obtaining any API keys or access tokens required by the integration.

Step 3:

Configure the integration in QuickBooks Next, you'll need to configure the integration in your QuickBooks account. This process will vary depending on the type of integration you're using, but generally, it involves navigating to the "Apps" or "Integrations" section of your QuickBooks account, selecting the application you want to integrate, and following the on-screen instructions to set up the connection.

Step 4:

Customize the integration settings After the initial setup, you'll likely want to customize the integration settings to ensure that the data flows between QuickBooks and the other application in the way that best suits your business needs. This may involve mapping specific fields, setting up automated workflows, or configuring data sync preferences.

Step 5:

Test the integration and troubleshoot any issues Before fully implementing the integration, it's important to thoroughly test it to ensure that everything is working as expected. Check for any data discrepancies, errors, or other issues, and work with the application provider or QuickBooks support team to troubleshoot and resolve any problems.

Step 6:

Monitor and maintain the integration Once the integration is up and running, it's important to regularly monitor it to ensure that it continues to function correctly. This may involve checking for any updates or changes to the applications involved, and making adjustments to the integration settings as needed to maintain optimal performance.

Read more:- How to create QuickBooks exclusions with Kaspersky Antivirus?

Recommended applications for QuickBooks integration

As you explore the world of QuickBooks integrations, you'll come across a wide range of applications and software solutions that can be connected to your accounting platform. Here are some of the top recommended applications for QuickBooks integration:

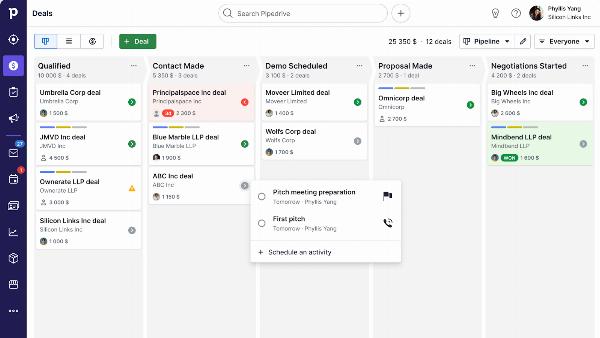

1. CRM systems (e.g., Salesforce, HubSpot, Zoho CRM)

Integrating your CRM with QuickBooks can help you streamline your sales and accounting processes, automatically syncing customer information, invoices, and payments between the two systems.

2. Inventory management tools (e.g., TradeGecko, Fishbowl, Unleashed)

By connecting your inventory management software with QuickBooks, you can ensure that your accounting records are always up-to-date with the latest stock levels, sales, and purchasing data.

3. Payroll and HR applications (e.g., Gusto, ADP, Paychex)

Integrating your payroll and HR systems with QuickBooks can simplify your employee management and compliance processes, automating tasks like payroll processing, tax filings, and employee expense reimbursements.

4. E-commerce platforms (e.g., Shopify, WooCommerce, BigCommerce)

If you have an online store, integrating your e-commerce platform with QuickBooks can help you streamline your order processing, inventory management, and financial reporting.

5. Project management tools (e.g., Asana, Trello, Basecamp)

By connecting your project management software with QuickBooks, you can better track project-related expenses, invoices, and revenue, improving your overall financial visibility and decision-making.

6. Time tracking and expense management apps (e.g., TSheets, Expensify, Concur)

Integrating your time tracking and expense management tools with QuickBooks can automate the process of capturing, categorizing, and reconciling employee hours and expenses, saving you time and reducing the risk of errors.

When evaluating and choosing the right applications to integrate with your QuickBooks software, consider factors such as ease of integration, data security, feature compatibility, and overall alignment with your business needs and workflows.

Benefits of integrating QuickBooks with other applications

Integrating QuickBooks with other business applications can provide a wide range of benefits to your organization, including:

1. Improved data accuracy and consistency

By automating the flow of data between QuickBooks and your other software systems, you can reduce the risk of manual data entry errors and ensure that your financial information is always up-to-date and accurate.

2. Enhanced productivity and efficiency

Integrations can help you streamline your workflows, eliminate time-consuming manual tasks, and free up your employees to focus on more strategic business initiatives. This can lead to significant productivity gains and cost savings for your organization.

3. Increased visibility and decision-making capabilities

By consolidating data from multiple sources into your QuickBooks platform, you can gain a more comprehensive and insightful view of your business's financial performance, enabling you to make more informed decisions and drive better outcomes.

4. Improved customer experience

Integrating your customer-facing applications, such as CRM or e-commerce platforms, with QuickBooks can help you provide a more seamless and personalized experience for your clients, leading to increased customer satisfaction and loyalty.

Conclusion

By allowing an application to access your QuickBooks data, you can unlock a world of possibilities, from streamlining your workflows and improving data accuracy to enhancing your customer experience and driving better business outcomes.

Throughout this comprehensive guide, we've explored the various steps and best practices involved in granting access to an application in QuickBooks.

Learn More:- System Requirements for QuickBooks Desktop 2024

Disclaimer:

We do not claim ownership of any content, links or images featured on this post unless explicitly stated. If you believe any content or images infringes on your copyright, please contact us immediately for removal ([email protected]). Please note that content published under our account may be sponsored or contributed by guest authors. We assume no responsibility for the accuracy or originality of such content. We hold no responsibilty of content and images published as ours is a publishers platform. Mail us for any query and we will remove that content/image immediately.

Copyright © 2024 IndiBlogHub.com. Hosted on Digital Ocean