India Loan Against Property Market Size, Share & Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

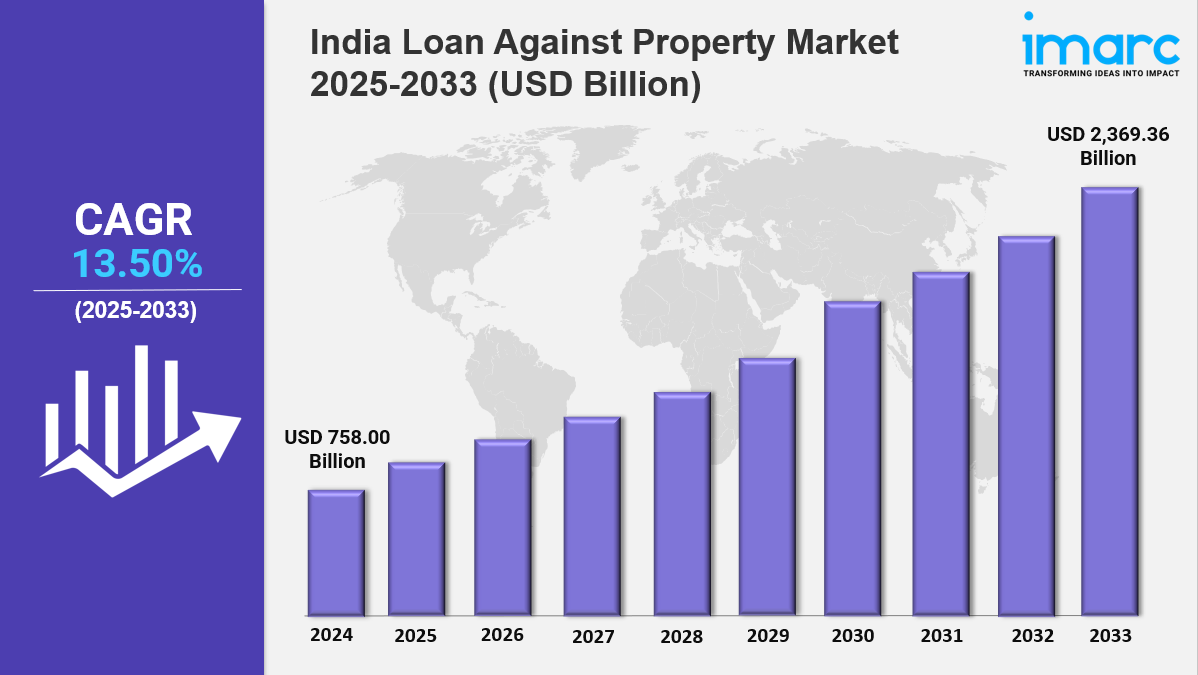

The India loan against property market size reached USD 758.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2,369.36 Billion by 2033, exhibiting a growth rate (CAGR) of 13.50% during 2025-2033. The market is expanding due to rising property ownership, growing credit demand, and digital lending platforms. Growth is driven by flexible terms, competitive interest rates, and tailored financial products. With increasing financial inclusion and urbanization, the industry is becoming more dynamic, accessible, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising demand for secured financing options among individuals and businesses

✔️ Increasing adoption of digital lending platforms for faster processing and approvals

✔️ Expanding awareness of property-based loans as a viable alternative to unsecured credit options

Request for a sample copy of the report: https://www.imarcgroup.com/india-loan-against-property-market/requestsample

India Loan Against Property Market Trends and Drivers:

The India loan against property market is witnessing robust growth, largely driven by the funding needs of small and medium enterprises (SMEs). With stricter lending conditions from banks after the pandemic, many SMEs—contributing over 30% to India’s GDP—are leveraging their residential and commercial properties to raise capital. These loans are commonly used for working capital, business expansion, and debt consolidation. In 2024, LAP disbursements rose by 22% compared to the previous year. Interest rates ranging between 8.5% and 12%, along with repayment periods extending up to 15 years, have made these loans more attractive.

Non-banking financial companies (NBFCs) and fintech lenders have gained a larger share of this market by offering faster approvals—often within 72 to 96 hours—and loan-to-value (LTV) ratios between 60% and 75%. The use of blended valuation methods that combine digital tools with manual assessments has improved property appraisal accuracy, addressing earlier concerns about undervaluation.

However, regional disparities persist. Maharashtra, Karnataka, and Tamil Nadu account for 55% of total LAP disbursals, while rural markets face challenges due to unclear land titles and limited awareness. In 2024, the Reserve Bank of India introduced new rules requiring a 20% provision for LAPs exceeding ₹5 crore and stress tests for portfolios with commercial property exposure. These steps aim to manage risk, especially after the default rate reached 4.3% in Q3 2023.

Changes to the SARFAESI Act have helped reduce average asset recovery time from 42 months to 28 months. Despite this improvement, issues like title disputes—responsible for 18% of delayed recoveries—and uneven implementation of foreclosure laws continue to affect lenders. Smaller cities are becoming more prominent, with tier-2 and tier-3 locations now contributing 38% to the LAP market, up from 24% in 2021. Cities such as Coimbatore, Indore, and Visakhapatnam have shown 15–20% annual growth in real estate, making them key markets for collateral-based lending.

Borrowers in these regions seek loans for a range of purposes, including education, healthcare, and agricultural investments. In response, lenders have introduced tailored products such as crop-season-linked repayment plans and doorstep services in semi-urban areas. Despite the rise of digital platforms, in-person consultations remain important—particularly for 65% of borrowers in tier-2 markets—prompting lenders to adopt a hybrid model of service delivery.

Ongoing infrastructure developments under initiatives like the Bharatmala Pariyojana and Smart Cities Mission are also expected to raise property values, making them more suitable as collateral. Analysts project a compound annual growth rate (CAGR) of 12–15% for tier-2 and tier-3 LAP markets through 2027. The overall market size has now crossed ₹12.4 lakh crore, with an average loan size of ₹1.8 crore for commercial assets and ₹72 lakh for residential ones—figures that reflect both inflation and higher asset prices.

While some sectors like hospitality and retail remain under stress, industrial and warehousing properties have performed well, supported by government incentives for manufacturing. Competition has intensified with the arrival of foreign banks and private equity investors, pushing down net interest margins to 3.8–4.2%, compared to 5.1% in 2022.

Borrowers increasingly use digital platforms to compare loan offers, and roughly one-third now share financial data directly with lenders through APIs. Nevertheless, long-standing operational issues remain. Manual title verification adds significant delays, and varying state and central regulations continue to limit scalability. Future developments like integration with the Open Credit Enablement Network (OCEN) and the use of blockchain for title verification may help address some of these structural challenges.

India Loan Against Property Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Property Type:

- Self-Occupied Residential Property

- Rented Residential Property

- Commercial Property

- Self-Owned Plot

Breakup by Interest Rate:

- Fixed Rate

- Floating Rate

- Breakup by Tenure:

- Up to 5 Years

- 6-10 Years

- 11-24 Years

- 25-30 Years

Breakup by Region:

- North India

- South India

- East India

- West India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.