Guaranteed SEO Boost: Triple Your Rankings with Backlinks starting at 5$

Guaranteed SEO Boost: Triple Your Rankings with Backlinks starting at 5$

Family Health Insurance: A Comprehensive Guide for Your Loved Ones

Written by Matthew Cole » Updated on: September 15th, 2024

Health insurance is a vital part of financial planning for families. It ensures that in the event of medical emergencies or unexpected health issues, you and your loved ones are covered without having to bear the full brunt of medical expenses. Family health insurance plans offer coverage for all members of the family under a single policy, making it convenient and often more affordable than individual health plans.

In this article, we will explore the importance of family health insurance, what it covers, the different types of plans available, and how to choose the right one for your family.

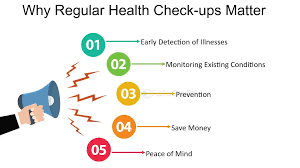

Why is Family Health Insurance Important?

Financial Security Medical treatments can be costly, and without insurance, a family might face significant financial strain. Family health insurance protects against high medical expenses, ensuring that you don’t have to deplete your savings or incur debt during medical emergencies.

Access to Quality Healthcare Health insurance enables access to a wide range of medical services, from routine check-ups to specialized treatments. With family health insurance, all members of the family can receive timely and necessary medical care without delay, improving overall health and well-being.

Comprehensive Coverage A family health insurance plan covers multiple members under one umbrella, meaning that the entire family benefits from comprehensive coverage. Whether it’s the birth of a new baby, medical care for elderly parents, or treatments for chronic conditions, the plan takes care of everyone’s needs.

Tax Benefits In many countries, premiums paid towards family health insurance policies are tax-deductible. This provides an added financial incentive to invest in a robust health insurance policy for your family.

What Does Family Health Insurance Cover?

Family health insurance policies generally provide a wide array of coverage options that can be customized based on the family’s needs. Typical coverage areas include:

Hospitalization Expenses Family health insurance policies cover the cost of hospital stays, surgeries, and treatments. This includes room rent, nursing expenses, and surgery costs. Some plans may also offer coverage for daycare treatments and procedures that do not require a full day of hospitalization.

Pre and Post-Hospitalization Many family health insurance policies also cover medical expenses incurred before and after hospitalization, such as diagnostic tests, follow-up visits, and prescribed medications. These costs can be substantial, and coverage helps reduce the financial burden.

Maternity Benefits If you’re planning to expand your family, many family health insurance policies offer maternity benefits, covering the costs of childbirth and newborn care. Some plans also cover vaccination expenses for the newborn.

Critical Illness Coverage Family health insurance can also offer coverage for critical illnesses such as cancer, heart disease, kidney failure, and more. These conditions often require extensive medical care, which can be incredibly expensive. Critical illness coverage ensures financial support during these times.

Outpatient Care (OPD) Family health insurance often includes coverage for outpatient care, such as doctor consultations, diagnostics, and minor medical procedures that do not require hospitalization. Regular check-ups and doctor visits are essential for maintaining good health, and OPD coverage can significantly reduce these costs.

Preventive Health Check-ups Many family health insurance policies encourage preventive healthcare by offering free annual health check-ups. This ensures early detection of health issues and helps in maintaining overall family well-being.

Alternative Treatments Some policies offer coverage for alternative treatments such as Ayurveda, Homeopathy, and Acupuncture, providing a holistic approach to healthcare for families who prefer these treatments.

Types of Family Health Insurance Plans

When it comes to family health insurance, there are several types of plans to choose from. It’s essential to understand each type and its benefits before making a decision.

Family Floater Plans Family floater plans are the most common type of family health insurance. Under this plan, all members of the family share a single sum insured. For example, if you purchase a plan with a coverage of $50,000, the entire family can access this amount during the policy period. This is a cost-effective solution, especially for younger families with fewer medical concerns.

Individual Plans for Each Family Member In some cases, families prefer to take individual plans for each family member. This ensures that every member has a dedicated sum insured. While this option provides more comprehensive coverage per person, it can be more expensive than a family floater plan.

Group Health Insurance Some employers offer group health insurance plans that cover employees and their families. These plans may offer limited coverage, but they can be supplemented with additional individual or floater policies to provide full protection.

Top-Up and Super Top-Up Plans Top-up and super top-up plans are designed to provide additional coverage once the basic sum insured has been exhausted. These plans are ideal for families who already have basic coverage but want to enhance their protection against large medical expenses.

How to Choose the Right Family Health Insurance Plan

Choosing the right family health insurance plan can be overwhelming, but considering a few key factors can help simplify the process.

Assess Your Family’s Health Needs Consider the current and future health needs of each family member. For example, if you have elderly parents who require frequent medical care, a plan with higher coverage and comprehensive benefits is essential. Similarly, if you’re planning a family, look for policies with maternity and newborn benefits.

Evaluate the Coverage Amount Ensure that the sum insured is sufficient to cover all family members. While a lower sum insured might be cost-effective initially, it may not be enough in the event of a medical emergency. Consider the rising cost of healthcare when selecting the coverage amount.

Check the Network Hospitals Insurance companies often have a network of hospitals where cashless treatments are available. Choose a plan with a wide network of hospitals near your residence to ensure you can access medical care easily when needed.

Review Policy Inclusions and Exclusions Go through the fine print of the policy to understand what is covered and what is not. Some plans may exclude specific treatments or have waiting periods for pre-existing conditions. Ensure that the policy covers the essential healthcare services that your family needs.

Consider Add-On Benefits Many insurance providers offer add-on benefits such as personal accident coverage, critical illness cover, and more. While these may increase the premium, they provide enhanced protection for your family’s health.

Compare Premiums While it’s tempting to choose a plan with the lowest premium, make sure it offers adequate coverage. Use online tools to compare different family health insurance plans based on coverage, premiums, and benefits.

Look for No-Claim Bonus Some family health insurance plans offer a no-claim bonus (NCB), where the sum insured increases for each claim-free year. This can significantly enhance your coverage over time, providing extra protection without increasing your premiums.

Conclusion

Family health insurance is an essential investment in your family’s future. It provides financial security, access to quality healthcare, and peace of mind knowing that your loved ones are protected during medical emergencies. With various plans and options available, it’s crucial to assess your family’s needs, compare policies, and choose one that offers comprehensive coverage at a reasonable premium.

By selecting the right family health insurance plan, you can ensure that your family receives the best possible medical care without worrying about the cost. Take the time to research, compare options, and invest in a plan that offers both financial protection and access to quality healthcare for your loved ones.

Disclaimer:

We do not claim ownership of any content, links or images featured on this post unless explicitly stated. If you believe any content or images infringes on your copyright, please contact us immediately for removal ([email protected]). Please note that content published under our account may be sponsored or contributed by guest authors. We assume no responsibility for the accuracy or originality of such content. We hold no responsibilty of content and images published as ours is a publishers platform. Mail us for any query and we will remove that content/image immediately.

Copyright © 2024 IndiBlogHub.com. Hosted on Digital Ocean