South Korea Kitchen Appliances Market Size, Growth, Demand & Report 2025-2033

Market Overview 2025-2033

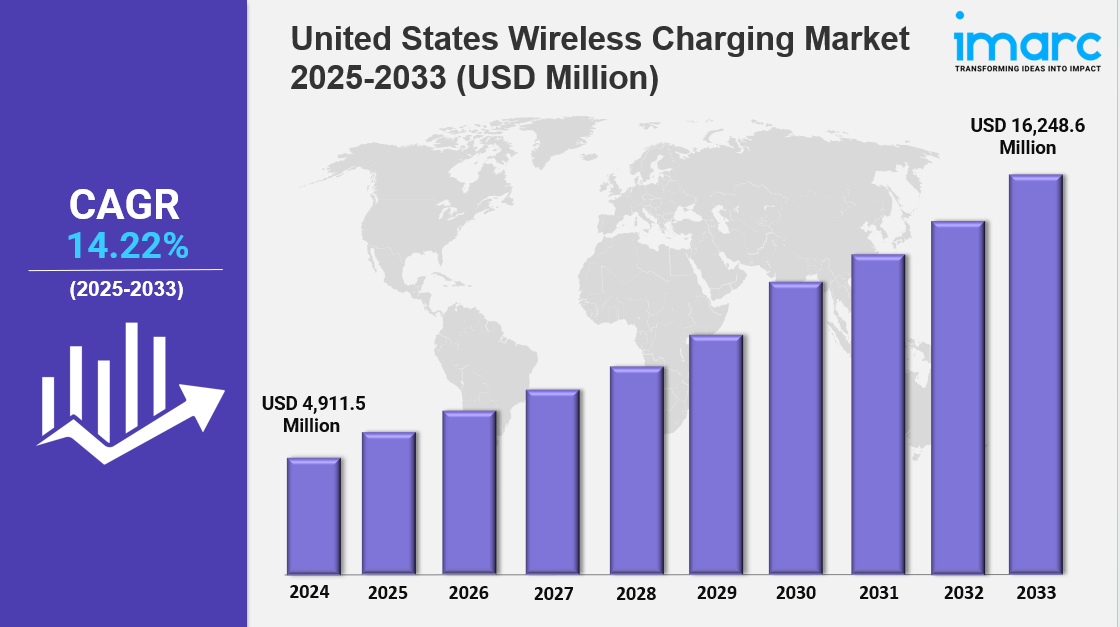

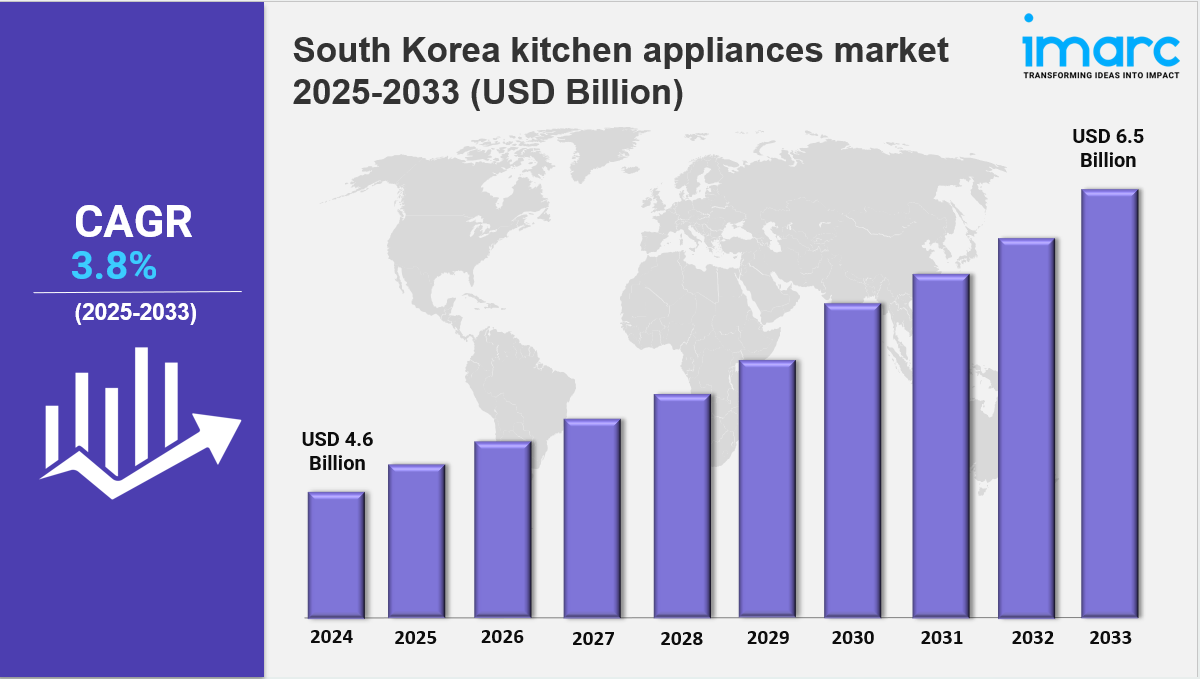

The South Korea kitchen appliances market size was valued at USD 4.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.5 Billion by 2033, exhibiting a CAGR of 3.8 % from 2025-2033. The market is expanding due to rising demand for smart, energy-efficient appliances and growing urbanization. Technological advancements, including AI integration and IoT connectivity, are driving innovation. Changing consumer lifestyles, increased disposable incomes, and a focus on convenience contribute to a dynamic and competitive industry landscape.

Key Market Highlights:

✔️ Strong market growth driven by increasing urbanization and demand for smart home solutions

✔️ Rising consumer preference for energy-efficient and multifunctional kitchen appliances

✔️ Expanding innovation in design, connectivity, and automation across product categories

Request for a sample copy of the report: https://www.imarcgroup.com/south-korea-kitchen-appliances-market/requestsample

South Korea Kitchen Appliances Market Trends and Drivers:

The South Korea kitchen appliances market is going through a noticeable transformation as modern lifestyles and sustainability become more important to everyday consumers. Households across the country are leaning toward smart, energy-efficient, and stylish kitchen solutions that fit both fast-paced routines and environmental concerns. In today’s homes, it’s common to see appliances like refrigerators with built-in cameras, app-controlled ovens, or dishwashers that run on custom schedules—features that blend convenience with the country's high-tech lifestyle.

In 2024, leading brands such as Samsung and LG introduced more user-focused innovations. Their latest kitchen appliances are designed to save time, cut energy bills, and even help with grocery planning. Features like voice control and personalized settings are now standard in many mid-to-high-end models, showing just how quickly user expectations are shifting. This push toward convenience and connectivity reflects broader South Korea kitchen appliances market trends, where people value function just as much as form.

Sustainability is another big force behind the changing South Korea kitchen appliances market outlook. More shoppers are looking for eco-friendly products that use less power and water. Appliances with energy-efficiency certifications are not only good for the planet but also qualify for government incentives, making them even more appealing. In fact, sales of green options like induction cooktops and energy-saving dryers rose sharply—up 22% in 2024 alone.

Manufacturers are also making changes behind the scenes. Many are adopting greener production methods, from using recycled materials to cutting down on wasteful packaging. And in cities like Seoul and Busan, style is just as important as sustainability. Young professionals and design-savvy homeowners are choosing modular kitchens, customizable colors, and sleek built-ins that match open-plan living. High-end appliances like built-in espresso machines or dual-zone refrigerators are becoming common, especially in smaller homes where every square meter counts.

Brands like Winia and Cuchen have responded to this trend by offering customization options that allow customers to choose appliance colors and finishes. This personalization push helped boost premium product sales by 18% in 2024, proving that design matters just as much as tech features.

The South Korea kitchen appliances market has also been shaped by post-pandemic lifestyle shifts. With more people working and cooking from home, compact and multifunctional gadgets—like air fryers and countertop meal-prep helpers—have become kitchen staples. Aging households are influencing design too, with manufacturers now building appliances that are easier to use, like voice-assisted microwaves or large-button cooktops.

Government policy has played a helpful role in this evolution. Since 2022, the “Digital New Deal” initiative has encouraged smart home adoption. By 2024, kitchen appliances made up 40% of smart home device sales, showing just how central the kitchen has become in connected living.

Urbanization is also changing the game. As apartments get smaller, appliance makers are coming up with clever space-saving ideas—like slimline dishwashers or stacked laundry units that fit into tight layouts. Looking ahead, the South Korea kitchen appliances market forecast suggests steady growth fueled by innovation, eco-conscious living, and demand for personalized solutions.

South Korea Kitchen Appliances Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Product:

- Refrigerators and Freezers

- Dishwashers

- Food Processors

- Mixers and Grinders

- Microwave Ovens

- Grills and Roasters

- Water Purifiers

- Others

Analysis by Distribution Channel:

- Multi-Brand Stores

- Exclusive Stores

- Online

- Others

Analysis by End User:

- Residential

- Commercial

Regional Analysis:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.