Launch apps instantly. Claim $200 credits on DigitalOcean

Launch apps instantly. Claim $200 credits on DigitalOcean

Transforming Online Shopping: The Impact of BNPL Apps

Written by Jose Alejandro » Updated on: March 11th, 2024

In the world of online shopping, a new player has entered the scene, changing the way we pay for our purchases. BNPL apps like Afterpay, Klarna, and Affirm have gained popularity, providing users with a different way to handle their payments. Let's dive into how these apps are making waves and reshaping the online shopping experience.

The Rise of BNPL

In the past, when we shopped online, we mainly relied on credit or debit cards. But now, Buy Now Pay Later apps have disrupted this routine. They allow users to split their payments into smaller, more manageable parts, often without adding extra interest. It's a fresh approach that's catching on.

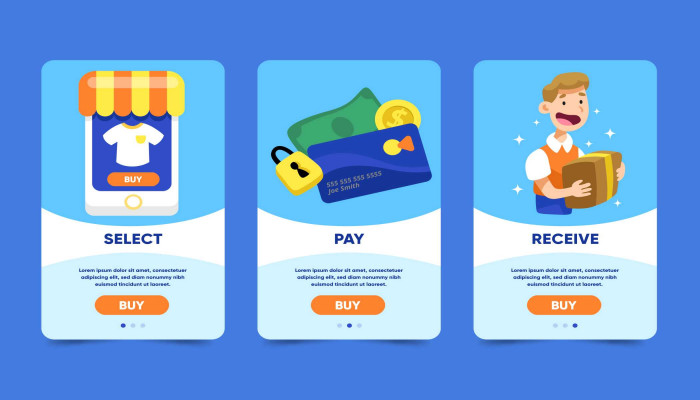

How BNPL Works

Here's the lowdown on how Buy Now Pay Later apps operate: when you make a purchase, the total cost is divided into smaller payments. At the checkout, if you choose the BNPL option, you get to decide how you want to spread these payments. The time frame usually ranges from four to eight weeks, letting you match payments with your payday.

When to Give BNPL a Go

Wondering when it's a good idea to use BNPL apps? Here are a few scenarios:

When You Need Financial Flexibility

If you find yourself needing some breathing room in your finances, BNPL can be a game-changer. Instead of using up all your savings or maxing out your credit card, you can split the cost over time.

For Big-Ticket Items

Eyeing that fancy gadget or a stylish piece of furniture? Buy Now Pay Laterapps make it easier to bring these items into your life without emptying your wallet in one go.

During Special Shopping Seasons

Whether it's holiday shopping or a seasonal sale, BNPL apps offer a way to keep up with increased spending without stressing about huge credit card bills.

Why People Love BNPL

What makes BNPL apps so appealing?

No Interest or Low Fees

Unlike credit cards, many BNPL apps either don't charge any interest or keep the fees quite low. This makes them a pocket-friendly option for many users.

Easy Approval

Getting started with BNPL is a breeze. The approval process is straightforward, often requiring minimal personal details. It's accessible, even if you don't have an extensive credit history.

Seamless Shopping

BNPL is seamlessly integrated into many online stores. When you're checking out, you can easily choose BNPL as your payment method, making the whole process smooth and hassle-free.

Benefits of BNPL

Wondering what's in it for you?

Budget-Friendly Spending

BNPL lets you budget effectively by breaking down payments over a few weeks. This helps you avoid overspending impulsively and encourages a more disciplined approach to your finances.

Better Shopping Deals

Many online retailers partnering with BNPL apps offer exclusive deals and discounts. Using BNPL not only helps you save money but also enhances your overall shopping experience.

Financial Control

With fixed installment plans, you have a clear idea of what will be deducted from your account and when. It gives you better control over your finances and helps with more organized financial planning.

In Conclusion: A Shift in the Online Shopping Landscape

To sum it up, BNPL apps are changing the way we shop online. Their flexible and user-friendly approach to payments is attracting a wide audience. As these apps continue to evolve and become more widely accepted, they are shaping the way people think about online transactions. However, as with any financial tool, it's important to use BNPL responsibly, ensuring that it aligns with your financial goals and capabilities.

Copyright © 2024 IndiBlogHub.com Hosted on Digital Ocean

Post a Comment

To leave a comment, please Login or Register